Putting an end to years of litigation—and at the same time, possibly laying the groundwork for a fresh batch of court petitions on the **Aadhaar project** , the Indian Supreme Court delivered its verdict in the **Aadhaar case** on Wednesday. The court split 4-1 — Justice Sikri authored the majority’s opinion, while Justice DY Chandrachud was the sole dissenter. The majority held most of the Aadhaar Act to be constitutionally valid, but have found some of its uses to be unconstitutional. What does this translate to in practice? [caption id=“attachment_4645531” align=“alignnone” width=“1024”]  Woman using an iris scanner for UIDAI Aadhaar registration. Image: Reuters[/caption] Aadhaar is compulsory to avail government subsidies An Aadhaar number or proof of enrolment is compulsory for individuals to avail certain government benefits, services, or subsidies being given by either the Centre or any of the states. The court has clarified that ‘benefits’ and ‘services’ are those involving the grant of a benefit by the government to a ‘particular deprived class’. Put differently, this means subsidies and welfare schemes, the expenditure of which comes from the Consolidated Fund of India. This means that individuals will only receive government subsidies/welfare program benefits such as ration, fertiliser subsidies, old-age/disability pension, among others after their identity has been successfully authenticated by the **UIDAI** . The agency supplying the benefit must generate an authentication request after collecting the target individual’s biometric information and Aadhaar/enrolment number.

However, the court has further explained that the CBSE, NEET, JEE and the UGC could not make Aadhaar compulsory as the law in its current form did not support this compulsion. Aadhaar is compulsory for PAN and income tax purposes The court upheld the constitutional validity of Section 139AA of the Income Tax Act, 1961. This means that it will continue to be compulsory to provide an Aadhaar/enrolment number while applying for a Permanent Account Number, and while filing income tax returns. Mobile and bank account linking is unconstitutional The court found both, Rule 9 of the Prevention of Money Laundering (Maintenance of Records) Rules, 2005 and notifications issued under it, and the Department of Telecommunications’ 23 March 2017 circular, mandating the linking of Aadhaar to an individual’s bank accounts and mobile numbers, respectively, to be unconstitutional. Therefore, banks and telecom operators can no longer insist that bank accounts and mobile numbers be linked with Aadhaar. Similarly, they cannot deny services to individuals who refuse to provide Aadhaar numbers. What happens to existing accounts and mobile numbers linked with Aadhaar, is unclear.

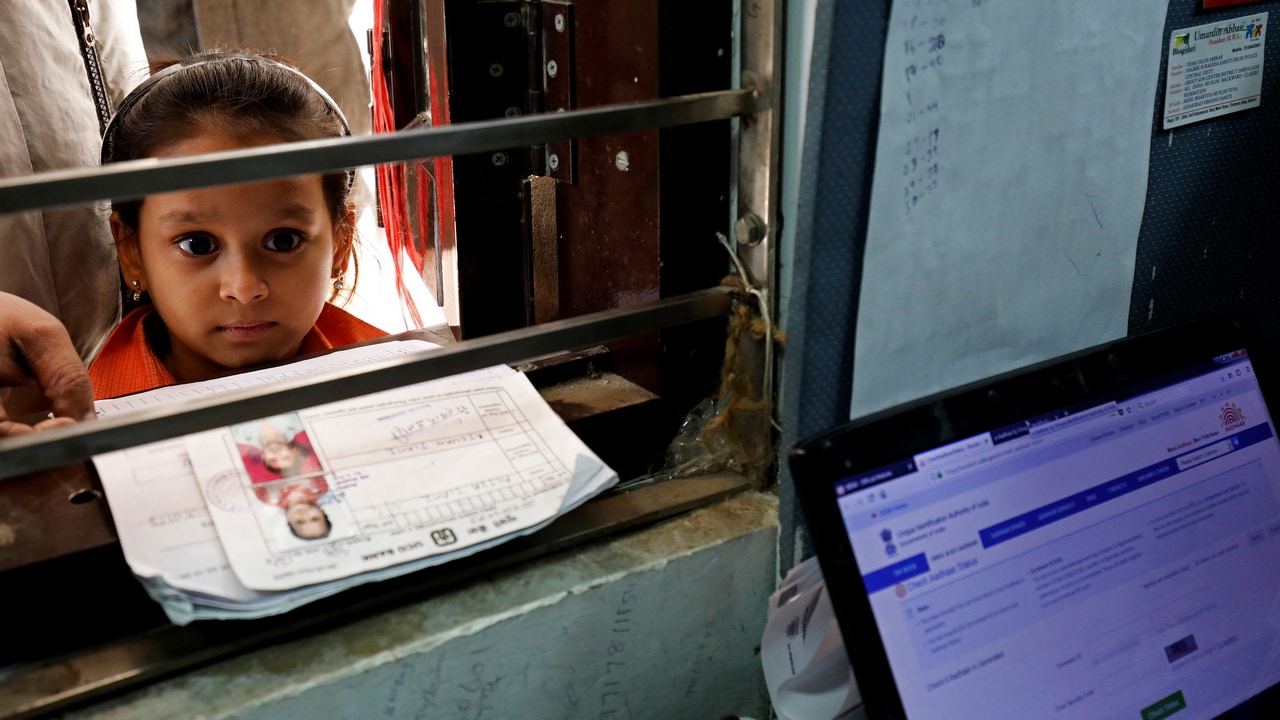

Time limits on storing authentication records Authentication records may only be stored for a period of six months. The court found unconstitutional the part of the Aadhaar Act that allowed the storage of records for up to five years. Aadhaar for children The court held that parental consent/guardian consent was mandatory to enrol children under the Aadhaar Act. In addition, children so enrolled, who do not want to avail any benefits that Aadhaar is needed for, will have the option to opt-out of the Aadhaar project once they attain the age of majority, which is currently 18 years in India. [caption id=“attachment_4364413” align=“alignnone” width=“1280”]  A girl waits for her turn to enrol for the Unique Identification (UID) database system, Aadhaar, at a registration centre. Image: Reuters[/caption] The court found that school admissions were neither a service nor a subsidy. In fact, the court noted that the right to education was a fundamental right for children aged 6 to 14. As such, Aadhaar cannot be made compulsory for admitting children into schools. Further, benefits under the Sarv Shikha Abhiyan are also not contingent on Aadhaar enrolment. For other benefits like the ones discussed above — which fall under Section 7 of the Aadhaar Act — Aadhaar number/enrolment number could be made compulsory, and this would be subject to parental/guardian consent. However, the court clarifies that children will not be denied benefits of any schemes for not being able to produce an Aadhaar number and that the benefits will instead be granted after verifying their identity from other documents. Nehaa Chaudhari heads the public policy practice at Ikigai Law, an India based policy and law firm focused on emerging technologies. Nehaa studied law at Harvard Law School, USA, and NALSAR University of Law, India. Find her on Twitter @nehaachaudhari.

)

)

)

)

)

)

)

)

)