This is a welcome Budget for individual taxpayers and in fact, one could call it a PoE-Perfect for the Economy, the Infra sector, and the MSME sector. This is the first of the Amrit Kal budget which is a templated action for the next 25 years, leading to policy stability. Relief under personal Income Tax The exemption limit on individual income tax has been raised from 5 lakhs to 7 lakhs. This will save close to Rs 20,000 at a 10 percent tax under the new tax slab. Every individual will, therefore, have more money to spend. The GDP impact per person will be an increase in GDP by approximately Rs 80,000. The exemption limits have also been raised to 3 lakhs. GIFT City gets a big boost The fund manager is the regulated entity now. For a long time, the issue of single window applications in GIFT IFSC be it the SEZ or IFSCA, or others have been in discussion. This has now been enabled with powers of SEZ being delegated to the IFSCA. The GSTN registration functions will also be delegated to IFSCA. This will vastly improve the ease of doing business and avoid dual regulation. The announcements concerning GIFT City have been carefully considered. The EXIM Banks subsidiary will be set up, since this is outside the FEMA zone, import and export financing and lines of credit will become much easier. Also, the acquisition financing through GIFT City units will now be enhanced because ECB deals done abroad will now be structured in GIFT city and financed from here. An announcement has been made to recognize offshore derivatives in GIFT however, we await the details for the full text of the scheme. The Budget has introduced the concept of a Data Embassy which is unique to India. This will act as a data backup. Such data embassies will not be subject to the Data Export Laws of India. In a way, this will move GIFT IFSC to be a pure service centre for service that will not relate to India and GIFT IFSC will end up being India’s defacto commercial capital for International financial services and transactions. Cash reward for not taking leave from work The slab for applicability of tax on leave encashment for retirees has been enhanced to 10 lakhs. The highest tax rate of tax for individuals that are high earners has also been reduced from 42.74 percent to 39 percent. In general, today I-T returns are processed in 16 days as against 90 days earlier and refunds are processed under a day. This will put a whole lot of money in the hands of individuals which will then spur either savings or consumption. Opportunity for MSMEs A very important proposal for the MSME is that those who take services and goods from an MSME unit will not be able to claim expenditure on such purchases of goods or services unless they pay the MSME. This will result in faster payments to MSMEs thus improving their cash flows and therefore survival. Another important proposal for the sector is the reduction in the number of compliances. The Union Budget 2023 has promised a lot of changes and laid emphasis on innovation. While it has promoted several sectors its effective implementation will remain a key monitorable factor. The writer is the Founder and Managing Director of Basiz Fund Service Private Limited–a global fund administrator. He tweets @CA_AdityaSesh @Basizofficial. Views expressed are personal. Read all the Latest News , Trending News , Cricket News , Bollywood News , India News and Entertainment News here. Follow us on Facebook , Twitter and Instagram .

Budget 2023: Amrit Kaal budget, a templated action for next 25 years, will lead to policy stability

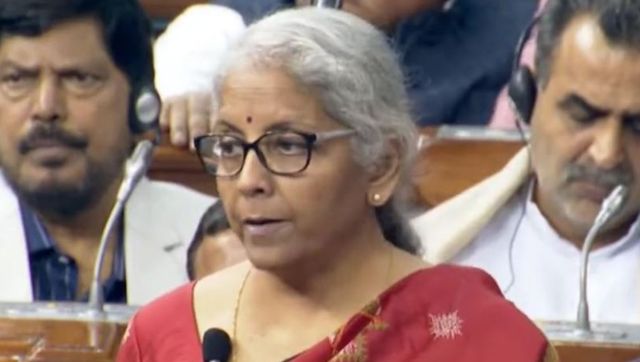

CA Aditya Sesh

• February 6, 2023, 19:22:10 IST

Government has introduced the concept of a Data Embassy which is unique to India

Advertisement

)

End of Article