RBI governor Urjit Patel versus Centre LATEST updates: As expected, the government has rightly chosen not to escalate the matters further. A statement from the government clarifying on the issue clearly acknowledges the need for RBI autonomy within the framework of RBI Act, by calling it is essential and accepted in an economy. But at the same time, there is an unmistakable sense of displeasure and warning from the government when it says that it frequently consults with RBI on important matters but never goes public with these matters. According to latest reports, Ministry of Finance released a statement which said, “Both the government and the Central Bank, in their functioning, have to be guided by public interest and the requirements of the Indian economy. For the purpose of extensive consultations on several issues take place between the government and the RBI from time to time.” The Narendra Modi government is reportedly readying to issue a statement soon to clarify its position on the matter. Regardless of the speculations in media, there are reasons to believe that government is very unlikely to go for the extreme step of invoking Section 7, which would add to its headaches in the financial markets. Former finance minister Yashwant Sinha said RBI governor must resign if govt has issued directives to central bank. “If indeed govt has issued directives to the RBI then its governor should resign forthwith.” According to reports, sources said that Letters of Consultation under Section 7 of the RBI Act were invoked 3 times. First letter under Section 7 followed Allahabad court’s verdict in RBI versus Power companies. The letter wanted RBI to carve out exemption for power companies under 12 February circular. Second letter was on using RBI’s capital reserves and the third letter was on relaxing constraints on PCA banks for loans to SMEs. In the world of financial markets, sentiments come at play first, then facts. Speculations can have major ramifications and destablise markets, at least, in the short-term, particularly equities. Mere speculation of contagion of IL&FS crisis sent stocks of other well-run housing finance companies to multi-year lows. BJP slammed Rahul Gandhi for his criticism against Prime Minister Narendra Modi over the RBI-Centre rift, and said that it reflects Congress party’s grounding, “which is fast eroding in national politics.” Rahul on Monday said it was nice to see RBI Governor Urjit Patel “finally defending” the central bank from Modi. [caption id=“attachment_3938005” align=“alignleft” width=“380”] File image of RBI Governor Urjit Patel. AFP[/caption] Even thought the controversy around spat between the government and the RBI has been doing rounds for a couple of days now, speculations over RBI governor Urjit Patel’s resignations hit the headlines on Wednesday morning. Experts and observers noted that before Patel, others, including Raghuram Rajan, Arvind Panagaria and Viral Acharya pointed at serious problems with the way this government approached economic policies and implementation. Government officials believe that RBI Governor Urjit Patel has some responsibility for the controversy, and he cannot expect an extension of his current three-year term — which ends next September — “as his right”, one of the officials added. Sources in the ministry of finance told Firstpost that Section 7 of the RBI Act has not been invoked. However, two letters were sent to RBI last month in which “Section 7 was quoted”, highlighting the existence of powers under the Act that allows the government to issue directions to the central bank on “matters of public interest”. Government officials were “very upset” with the RBI for publicly talking about a rift with the government, fearing it could tarnish the country’s image among investors, Reuters reported. On Friday night, the RBI Deputy Governor Viral Acharya warned that undermining a central bank’s independence could be “potentially catastrophic”, in an indication that it is pushing back hard against government pressure to relax its policies and reduce its powers. Sources reported that RBI governor Urjit Patel may tender his resignation willingly if government invokes Section 7 of RBI Act. The report, which has not received any by official confirmation, said that the government is keen on a bureaucrat as the next governor if Patel resigns. Patel had come under increasing criticism from the banking industry as well as the government over his handling of non-performing assets (NPAs) and his stance on the autonomy of the RBI. There is also a rumoured rift with finance minister Arun Jaitley. According to ET Now, Patel had told government not to ‘raid RBI reserves’, as government was keen on the transfer of reserves to fill up its fiscal deficit amid NPA stress.

File image of RBI Governor Urjit Patel. AFP[/caption] Even thought the controversy around spat between the government and the RBI has been doing rounds for a couple of days now, speculations over RBI governor Urjit Patel’s resignations hit the headlines on Wednesday morning. Experts and observers noted that before Patel, others, including Raghuram Rajan, Arvind Panagaria and Viral Acharya pointed at serious problems with the way this government approached economic policies and implementation. Government officials believe that RBI Governor Urjit Patel has some responsibility for the controversy, and he cannot expect an extension of his current three-year term — which ends next September — “as his right”, one of the officials added. Sources in the ministry of finance told Firstpost that Section 7 of the RBI Act has not been invoked. However, two letters were sent to RBI last month in which “Section 7 was quoted”, highlighting the existence of powers under the Act that allows the government to issue directions to the central bank on “matters of public interest”. Government officials were “very upset” with the RBI for publicly talking about a rift with the government, fearing it could tarnish the country’s image among investors, Reuters reported. On Friday night, the RBI Deputy Governor Viral Acharya warned that undermining a central bank’s independence could be “potentially catastrophic”, in an indication that it is pushing back hard against government pressure to relax its policies and reduce its powers. Sources reported that RBI governor Urjit Patel may tender his resignation willingly if government invokes Section 7 of RBI Act. The report, which has not received any by official confirmation, said that the government is keen on a bureaucrat as the next governor if Patel resigns. Patel had come under increasing criticism from the banking industry as well as the government over his handling of non-performing assets (NPAs) and his stance on the autonomy of the RBI. There is also a rumoured rift with finance minister Arun Jaitley. According to ET Now, Patel had told government not to ‘raid RBI reserves’, as government was keen on the transfer of reserves to fill up its fiscal deficit amid NPA stress.

Urjit Patel vs Centre updates: Finance Ministry declares truce, but signals displeasure at RBI's behaviour

Urjit Patel versus Centre LIVE updates: Ministry of Finance statement on RBI autonomy has an unmistakable sense of displeasure and warning from the government when it says that it frequently consults with RBI on important matters but never goes public with these matters.

)

Govt cited never-before-used power of issuing directions to RBI Governor to seek a resolution to differences

The government has cited the never-before-used power of issuing directions to RBI Governor to seek a resolution to differences with the central bank, sources with knowledge of the development said.

The government has sent at least three letters on different issues under Section 7 (1) of the Reserve Bank of India Act that gives it powers to issue any direction to the central bank governor on matters of public interest.

Sources, however, insisted that the government has not taken any action of issuing any specific direction and has only initiated consultations with the central bank on unresolved issues.

Government offers truce; over to RBI now

As expected, the government has rightly chosen not to escalate the matters further. A statement from the government clarifying on the issue clearly acknowledges the need for RBI autonomy within the framework of RBI Act,by calling it is essential and accepted in an economy. But at the same time, there is an unmistakable sense of displeasure and warning from the government when it says that it frequently consults with RBI on important matters but never goes public with these matters.

This is a clear message to the RBI, particularly in the backdrop of deputy governor, Viral Acharya’s public outburst on RBI autonomy, that don’t go to public on differences with the government. The truce from the government has come. This, indeed, will be welcomed by the financial markets. But, the public dissent is out in the open now. Over to RBI now.

First reaction from Centre: Finance ministry says autonomy for Central Bank, within the framework of the RBI Act, is an essential and accepted governance requirement

“The autonomy for the Central Bank, within the framework of the RBI Act, is an essential and accepted governance requirement. Governments in India have nurtured and respected this. Both the Government and the Central Bank, in their functioning, have to be guided by public interest and the requirements of the Indian economy. For the purpose, extensive consultations on several issues take place between the Government and the RBI from time to time. This is equally true of all other regulators. Government of India has never made public the subject matter of those consultations. Only the final decisions taken are communicated. The Government, through these consultations, places its assessment on issues and suggests possible solutions. The Government will continue to do so.”

Finance Ministry releases statement, says both govt and RBI have to be guided by public interest

An NDTV report released a statement by the Ministry of Finance which said, “Both the government and the Central Bank, in their functioning, have to be guided by public interest and the requirements of the Indian economy. For the purpose of extensive consultations on several issues take place between the government and the RBI from time to time.”

RBI member Gurumurthy complains to Urjit Patel over Acharya’s speech

RBI board member S Gurumurthy has reportedly complained to governor Urjit Patel about comments made by Viral Acharya last week regarding the need to maintain regulatory autonomy, adding another dimension to the conflict between the government and the central bank.

Gurumurthy, who was recently nominated to the RBI board by the government, told Economic Times that he had written to Patel but said he wouldn’t divulge the contents of his letter.

Acharya had said undermining RBI’s independence can trigger a crisis of confidence in capital markets and that “attrition of central bank powers results in attrition of its human capital and deterioration of its efficiency and expertise over time”. He was speaking at a lecture in Mumbai on 26 October.

Viral Acharya met PMO officials over his speech in New Delhi

Channels reporting on the alleged spat ongoing between the RBI and the Centre reported that highest authorities were very upset With RBI deputy governor Viral Acharya’s speech last week. According to the reports, Acharya met with officials from the PMO on Tuesday in New Delhi.

Govt unlikely to go for extreme steps

The Narendra Modi government is reportedly readying to issue a statement soon to clarify its position on the matter. Regardless of the speculations in media, there are reasons to believe that government is very unlikely to go for the extreme step of invoking Section 7, which would add to its headaches in the financial markets.

Nevertheless, the government is likely to come with a strong-worded statement on issues where it has differences with the RBI and end the matter there, for now. That would send the message to the central bank and one needs to wait and watch for the response of the RBI governor. Remember, technically, the government is the boss of the RBI and the governor is a government appointee.

Markets may take a major hit if RBI governor is changed at this juncture, say reports

At this crucial juncture, when markets are recovering from the NBFC shake-up and harping on global cues, the resignation of the RBI Governor Urjit Patel will rattle the investor sentiment, said a Business Standard report .

Yashwant Sinha slams Centre

Former finance minister Yashwant Sinha said RBI governor must resign if govt has issued directives to central bank.

Recap: All India Reserve Bank Association had asked ‘all right-minded people’ to speak out and persuade the govt to amend

The All India Reserve Bank Association’s letter said the hiatus has widened now and the deputy governor has spoken more “in disgust and despondency” due to continuous nibbling by the government and the finance ministry.

“Even the RBI board is being sought to be stuffed in a particular direction which would prompt the discerning people to look askance, and make it difficult for RBI to frame policies,” the union said in the letter. “We appeal to all right-minded people and experts to speak out and persuade the government to amend, and let RBI do its jobs in an unfettered was as per statutes, mandates, practices,” the letter said.

Recap: RBI and Centre’s rift came out in the open after Viral Acharya’s remarks

The tension between the RBI and the government had escalated after deputy governor Viral Acharya said last week that undermining the central bank’s independence could be “potentially catastrophic” as he raised concerns over it’s autonomy.

The All India Reserve Bank Association had then written a letter saying “We firmly hold that undermining the central bank is a recipe for disaster and the government must desist.” “This is, however, not a sudden outburst, but was waiting to happen due to long-simmering discontent,” the association added.

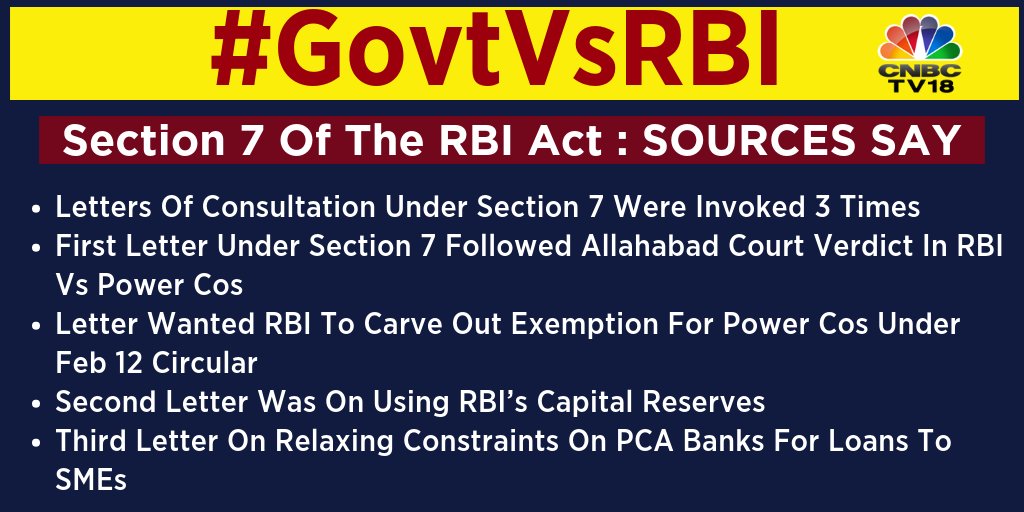

Letters of consultation under Section 7 were invoked 3 times: Sources

According to reports , sources said that Letters of Consultation under Section 7 of the RBI Act were invoked 3 times. First letter under Section 7 followed Allahabad court’s verdict in RBI versus Power companies.

The letter wanted RBI to carve out exemption for power companies under 12 February circular.

Second letter was on using RBI’s capital reserves and the third letter was on relaxing constraints on PCA banks for loans to SMEs.

Graphic by CNBC-TV18

Government and RBI must clarify on Section 7

In the world of financial markets, sentiments come at play first, then facts. Speculations can have major ramifications and destablise markets, at least, in the short-term, particularly equities.

Mere speculation of contagion of IL&FS crisis sent stocks of other well-run housing finance companies to multi-year lows. Again, it was speculations that RBI won’t support Rupee, which sent the currency to all time lows. Now that talk of Section 7 is dominating the headlines. Both the government and RBI have so far refrained from commenting on the facts of the matter. They should, in the interest of financial markets.

BJP slams Rahul Gandhi for attack on Modi on RBI-Centre rift

BJP spokesperson Sudhanshu Trivedi Tuesday said Rahul Gandhi’s criticism against Prime Minister Narendra Modi over an apparent RBI-Centre rift, reflects Congress party’s grounding, “which is fast eroding in national politics.” Rahul on Monday said it was nice to see RBI Governor Urjit Patel “finally defending” the central bank from Modi.

“Since the Congress is not getting any chance to expose Modi government on corruption issues, it is picking up subjects concerning government agencies. This shows Congress’ grounding, which is fast eroding in national politics,” Trivedi told reporters.

Journalists weigh in on RBI versus Centre spat even as no official confirmed Urjit Patel’s resignation

Urjit Patel’s resignation speculations make it to the headlines the day Narendra Modi unveils Sardar Patel’s statue in Gujarat

Even thought the controversy around spat between the government and the RBI has been doing rounds for a couple of days now, speculations over RBI governor Urjit Patel’s resignations hit the headlines on Wednesday morning. Senior journalist Rajdeep Sardesai commented on the situation: “‘Political’ India (read netas) are battling over Sardar Patel legacy but ‘real’ India (read economy) is more worried about Urjit Patel future! One Patel may get you votes, the other Patel hits your notes!!”

India shouldn’t escalate the RBI issue

Friction between the ruling political dispensations and the central banks is not uncommon in large economies. Typically, governments have a short-term view on policy matters while central banks take a long-term approach. But, Indian economy is already facing a crisis situation on account of an NPA-ridden banking sector and seer liquidity crisis in the non-banking finance companies.

There is a crisis of confidence in financial markets. In such a scenario, it is a no-brainer that if the government Invokes Section 7 can have serious ramifications in the economy and the immediate message that will go out to the world that the government has taken another step to undermine the central bank’s independence. That’s not a desirable situation.

Jaitley had blamed RBI for failing to stop lending spree between 2008-2014

Jaitley, had on Tuesday, blamed the RBI for failing to stop a lending spree between 2008-2014 that left banks with huge bad debts, inflaming a row that recently erupted between the government and the central bank.

On Friday, RBI deputy governor Viral Acharya warned that undermining a central bank’s independence could be “potentially catastrophic”, in an indication that it is pushing back hard against government pressure to relax its policies and reduce its powers ahead of a general election due by next May.

RBI employees association seek central bank’s autonomy

All India Reserve Bank Employees Association (AIRBEA) expressed concern over the recent statements made by deputy governor Viral Acharya and sought autonomy of the apex bank. The association in a statement said on Monday that “Undermining the country’s central bank was a recipe for disaster which the government must desist. Let the two talk and sort out the issues instead of the government trying to ride roughshod over the RBI, what they are trying at the expense of the nation”. Pitching for “effective independence”, RBI Deputy Governor Viral Acharya said governments that do not respect central bank’s independence would sooner or later incur the wrath of the financial markets.

Judiciary, Parliament, CBI… and now RBI. Modi govt has tried to damage every single institution: Sitaram Yechury

After Congress leader P Chidambaram, CPM’s Sitaram Yechury also tweeted out slamming Prime Minister Narendra Modi and how the government has tried to damage “every single institution.”

Urjit Patel was responsible for controversy around Viral Acharya’s speech, feel finance ministry’s sources

The officials in New Delhi were particularly angry that Viral Acharya launched the attack while Narendra Modi was about to head to Japan for talks with Prime Minister Shinzo Abe, government official told Reuters. Finance ministry officials remained largely silent in response to the speech at the weekend, as they didn’t want to aggravate the issue when Modi and top officials were in Japan, this official said.

Government officials believe that RBI Governor Urjit Patel has some responsibility for the controversy, and he cannot expect an extension of his current three-year term — which ends next September — “as his right”, one of the officials added.

Section 7 of RBI Act has not been invoked: Sources

Sources in the ministry of finance told Firstpost that Section 7 of the RBI Act has not been invoked. However, two letters were sent to RBI last month in which “Section 7 was quoted”, highlighting the existence of powers under the Act that allows the government to issue directions to the central bank on “matters of public interest”.

More bad news today, says P Chidambaram

CNBC-TV18 also quoted sources as saying that the government has initiated consultations with RBI under Section 7 of the RBI Act. The provision reportedly allowed the government to issue directions to the RBI “on matters of public interest”.

Warning of more “bad news”, former finance minister and senior Congress leader P Chidambaram said, “If, as reported, Government has invoked Section 7 of the RBI Act and issued unprecedented ‘directions’ to the RBI, I am afraid there will be more bad news today,” he said.

List of stocks to watch for the day in view of RBI developments

Govt had recently called for RBI to relax lending restrictions on some banks

Government officials have recently called for the RBI to relax its lending restrictions on some banks, and New Delhi has also been trying to trim the RBI’s regulatory powers by setting up a new regulator for the country’s payments system.

The Modi administration has also been pushing the central bank to part with some of its Rs 3.6 trillion rupees ($49 billion) surplus to help bridge the fiscal deficit and finance its welfare programmes.

‘Govt respects RBI’s autonomy but they should be more responsible’

The government officials Monday declined to be identified because of the sensitivity of the subject. One said that it was vital that what happened between the government in New Delhi and the RBI in Mumbai was kept confidential. “The government respects the autonomy and independence of the RBI but they must understand their responsibility,” the government official said.

A second official, based in Prime Minister Narendra Modi’s office, said it was “very unfortunate” that the RBI took the matters public. “The government is very upset. It was not expected from the RBI,” the official added. An RBI spokesman was not immediately available for comments after business hours.

Very upset with RBI publicly talking about a rift with govt: Sources

Government officials were “very upset” with the RBI for publicly talking about a rift with the government, fearing it could tarnish the country’s image among investors, Reuters reported .

On Friday night, the RBI Deputy Governor Viral Acharya warned that undermining a central bank’s independence could be “potentially catastrophic”, in an indication that it is pushing back hard against government pressure to relax its policies and reduce its powers.

Irreversible breakdown between RBI governor and govt

Reports about Urjit Patel stepping down as the RBI governor started floating following Finance Minister Arun Jaitley’s scathing criticism of the central bank’s “lending spree”, reports quoted sources as saying on Wednesday.

“RBI governor may even consider resigning. All options on the table,” a CNBC-TV18 report quoted a source familiar with the matter as saying. It quoted another source as saying that there is “irreversible breakdown between RBI governor and the government”.

Urjit Patel may resign today, say sources

Sources reported that RBI governor Urjit Patel may tender his resignation willingly if government invokes Section 7 of RBI Act. The report, which has not received any by official confirmation, said that the government is keen on a bureaucrat as the next governor if Patel resigns.