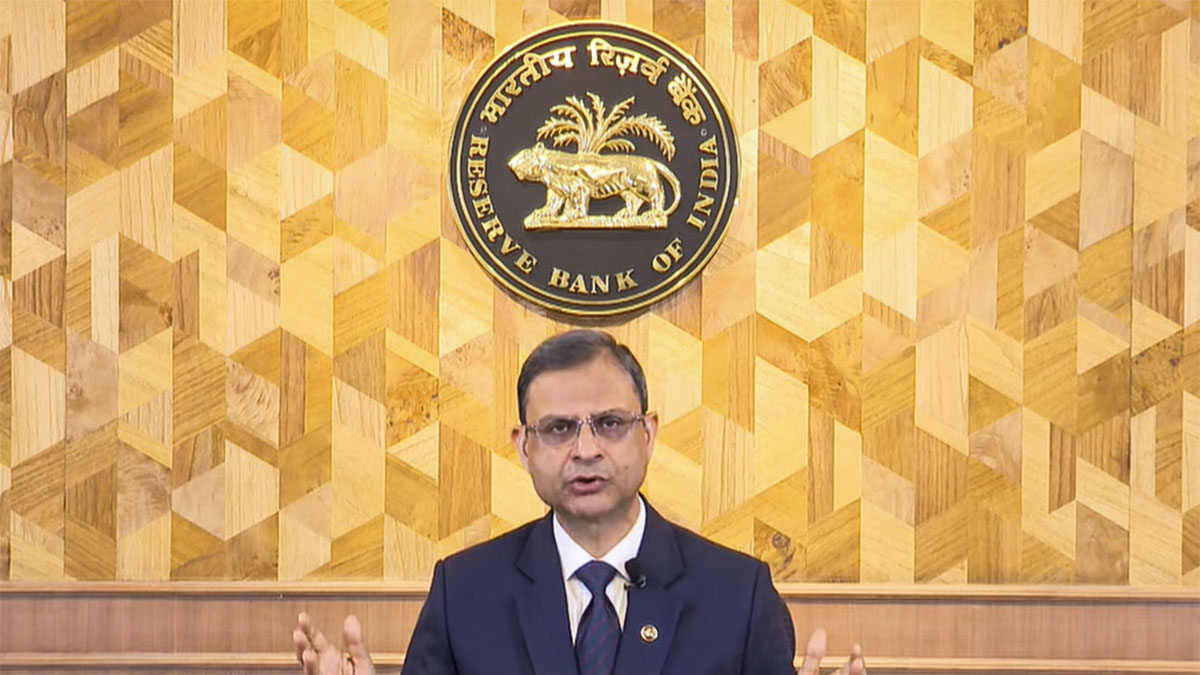

RBI Governor Sanjay Malhotra on Wednesday said that the repo rate will remain unchanged at 5.5 per cent.

The Monetary Policy Committee (MPC) held its meeting on August 4-6 and decided to keep the repo rate unchanged on account of the evolving macroeconomic and financial developments and outlook, Malhotra said.

The repo rate is the rate at which the Reserve Bank of India (RBI) lends money to commercial banks. Central banks use the repo rate and other monetary policy tools like the reverse repo rates and cash reserve ratio (CRR) to tackle inflation. Lower rates encourage borrowing to promote spending and investment to improve growth and higher rates checks inflation by discouraging borrowing.

Malhotra said that the RBI’s stance remains neutral, which means that economic metrics like inflation and growth are stable and do not need urgent intervention either with immediate rate cuts or hikes.

Malhotra said that core inflation has remained steady at 4 per cent.

Even as US President Donald Trump has slapped 25 per cent tariff on India, which may dent India’s economic growth, Malhotra has kept the country’s GDP growth projection unchanged at 6.5 per cent for 2025-26.

The MPC has six members, three from the RBI —the RBI Governor, Deputy Governor in charge of monetary policy, and an RBI officer nominated by RBI Central Board— and three nominated by the Union government. The main objective of the MPC is to set the monetary policy to keep inflation under the target of 4 per cent with a 2 per cent tolerance band in either direction.

‘Indian economy holds bright prospects’: RBI Governor

In the wake of Trump’s “dead economy” swipe on India, Malhotra said that the Indian economy holds bright prospects over the medium term.

In the changing world order, drawing on its inherent strength, robust fundamentals, and comfortable buffers, the Indian economy holds brights prospects and there are opportunities for the taking, said Malhotra.

Impact Shorts

More Shorts“The domestic growth is holding up and is broadly revolving around the lines of our assessment. Even though there were some high-frequency indicators that showed missed signals in May this year. Rural consumption remains resilient while urban consumption revives. Fixed investment supported by buoyant government capex continues to support economic activity,” Malhotra further said.

)