Latest update, 12.30 pm: According to media reports, the finance ministry is planning to seek Banks Board Bureau’s inputs to see if a reshuffling of PNB’s top management is possible. A special CBI court in Mumbai on Wednesday sent to police custody, till 5 March, five senior executives of the Nirav Modi and Mehul Choksi Group of Companies, including Vipul Ambani, who were arrested on Tuesday in conection with the Rs 11,400 crore Punjab National Bank fraud. The Central Bureau of Investigation had nabbed Vipul Ambani, Firestar International’s president (Finance), and four other high-ranking executives belonging to the group companies of absconding billionaire diamond trader Nirav Modi and his maternal uncle Choksi. [caption id=“attachment_4361797” align=“alignleft” width=“380”] Vipul Ambani taken to be produced at special CBI court for his alleged connection with Nirav Modi-PNB scam in Mumbai on Wednesday. PTI[/caption] They also include Kavita Mankikar, an executive assistant and authorised signatory with three firms of the Firestar group, and Firestar’s senior executive Arjun Patil - who were both named in the original FIR lodged by the Central Bureau of Investigation (CBI) after the scam was reported by PNB. There is also Nakshatra Group and Gitanjali Group’s CFO Kapil Khandelwal and Gitanjali Group’s manager Niten Shahi - both group companies owned by Choksi. “Ambani was fully aware of the fraudulent and illegal LoUs issued by Shetty who was a deputy manager at PNB’s Brady House branch in Mumbai. (This was being done) in conspiracy and (under the) guidance of Nirav Modi and other employees of his firm,” a senior CBI official told IANS in New Delhi. The CBI official said the agency during its probe found that Ambani not only visited and met PNB’s officials at the Brady House branch but also met other bank officials in Mumbai and New Delhi. The official also said that they have seized documents during searches at the office of Firestar at Peninsula Business Park in Mumbai’s Lower Parel that “prove” that Ambani knew what was being done. The arrests and remand came in the CBI’s ongoing investigations into the alleged fraudulent transactions perpetrated through 150 Letters of Undertaking (LoU) and other acts committed by them in the PNB fraud unearthed at the Brady House Branch in south Mumbai last week. Earlier, the CBI had arrested Bechhu Tiwari, the PNB’s chief manager who was in-charge of Forex Department, Yashwant Joshi, a Scale II Manager in the same department and Praful Sawant, a Scale I Officer in Exports section. Last Saturday the CBI had arrested three persons, including two retired PNB officials - former DGM Gokulnath Shetty and Single Window Operator Manoj Kharat, besides Hemant Bhat, the authorised signatory for Nirav Modi Group. All the six above have been sent to police custody till 5 March. With inputs from IANS

Vipul Ambani taken to be produced at special CBI court for his alleged connection with Nirav Modi-PNB scam in Mumbai on Wednesday. PTI[/caption] They also include Kavita Mankikar, an executive assistant and authorised signatory with three firms of the Firestar group, and Firestar’s senior executive Arjun Patil - who were both named in the original FIR lodged by the Central Bureau of Investigation (CBI) after the scam was reported by PNB. There is also Nakshatra Group and Gitanjali Group’s CFO Kapil Khandelwal and Gitanjali Group’s manager Niten Shahi - both group companies owned by Choksi. “Ambani was fully aware of the fraudulent and illegal LoUs issued by Shetty who was a deputy manager at PNB’s Brady House branch in Mumbai. (This was being done) in conspiracy and (under the) guidance of Nirav Modi and other employees of his firm,” a senior CBI official told IANS in New Delhi. The CBI official said the agency during its probe found that Ambani not only visited and met PNB’s officials at the Brady House branch but also met other bank officials in Mumbai and New Delhi. The official also said that they have seized documents during searches at the office of Firestar at Peninsula Business Park in Mumbai’s Lower Parel that “prove” that Ambani knew what was being done. The arrests and remand came in the CBI’s ongoing investigations into the alleged fraudulent transactions perpetrated through 150 Letters of Undertaking (LoU) and other acts committed by them in the PNB fraud unearthed at the Brady House Branch in south Mumbai last week. Earlier, the CBI had arrested Bechhu Tiwari, the PNB’s chief manager who was in-charge of Forex Department, Yashwant Joshi, a Scale II Manager in the same department and Praful Sawant, a Scale I Officer in Exports section. Last Saturday the CBI had arrested three persons, including two retired PNB officials - former DGM Gokulnath Shetty and Single Window Operator Manoj Kharat, besides Hemant Bhat, the authorised signatory for Nirav Modi Group. All the six above have been sent to police custody till 5 March. With inputs from IANS

PNB fraud case updates: Finance ministry might seek Banks Board Bureau's inputs to see if a PNB top brass rejig is possible

In the PNB scam case, a special CBI court sent to police custody, till 5 March, five senior executives of the Nirav Modi and Mehul Choksi Group of Companies, including Vipul Ambani

)

Have followed lawful avenues available to recover dues from Nirav Modi, says PNB

Vipul Ambani was director of 8 shell firms

Vipul Ambani, Firestar International’s president (Finance), was director of eight shell companies, India Today TV reported quoting unnamed sources. It also added that Ambani is singing while in CBI custody.

A special CBI court in Mumbai on Wednesday sent to police custody, till 5 March, five senior executives of the Nirav Modi and Mehul Choksi Group of Companies, including Vipul Ambani, who were arrested on Tuesday in conection with the Rs 11,400 crore Punjab National Bank fraud.

How Nirav Modi’s employees colluded with bank officials to create fake LoUs

For hours on Wednesday, sleuths from the Central Bureau of Investigation (CBI) were frustrated as they were trying to find out how fake Letter of Undertakings (LoUs) and Foreign Letter of Credits (FLCs) running into thousands of crores was drafted and subsequently sanctioned by the Punjab National Bank (PNB) officials. The two executives of Nirav Modi admitted to preparing and signing the applications made to PNB but they refused to disclose details how and where such applications were finalised.

In its note, the agency has made a startling revelation that even top officials of the PNB beginning with the zonal to head office was aware of the business dealing with Nirav Modi’s companies and the assertion that top officials were ignorant has been neutralised by the probe agency.

Read full article hereFinance ministry to seek BBB’s input to see if PNB top management reshuffle is possible

According to Moneycontrol , a finance ministry official told CNBC-TV18 that the ministry was planning to seek Banks Board Bureau’s (BBB) inputs on whether a PNB top management reshuffle is possible.

ED seizes Nirav Modi’s assets worth 94 crore

The ED on Thursday said it has frozen mutual funds and shares worth Rs 94.52 crore of the Nirav Modi and Mehul Choksi groups in connection with a money laundering probe against them in the Rs 11,400-crore alleged fraud at the Punjab National Bank (PNB).

Nirav Modi scams shows its time Parliament reexamined banking laws

Various process failures of public sector banks in India are not new. What is new in the PNB fraud is that, for the first time, questions are being raised about the supervisory capacity and systems in Reserve Bank of India (RBI). The government has written to the RBI asking for why the scam was not detected in its systems. Concerned citizens have asked for similar information in the past and disclosures by RBI have not been adequate.

Laws which govern the functioning of RBI need to be changed to bring about transparency and accountability. This has to then be supported by scrutiny into the functioning of the institution. A tragedy is a terrible thing to waste. The legislature should take a relook at the legislative framework of transparency, accountability and governance of RBI. The Draft Indian Financial Code addresses many of these concerns and there is need to incorporate its principles in primary legislation.

Read full article hereVisuals of Nirav Modi’s cars seized by ED

ED freezes Nirav Modi’s mutual funds and shares worth Rs 7.8 crore

ED seizes nine luxury cars of Nirav Modi including Rolls Royce, Mercedes

Meanwhile, Bipasha Basu, Kangana Ranaut accuse Gitanjali Gems of non-payment of dues, breach of contract

According to News18 , the actresses have accused Mehul Choksi-owned Gitanjali Gems of non payment of dues and breach of contract. A spokesperson for Ranaut said, “There are outstandings due on Kangana’s Nakshatra endorsement, beyond the stipulated contract.” She was the company’s brand ambassador since 2016 and claims she has not been paid her dues fully for endorsing the jewellery brand.

On the other hand, Bipasha Basu, who endorsed Gili, accused the Gitanjali Gems group of using her photographs even after her contract expired.

Visuals of CBI raiding Nirav Modi’s Alibaug farmhouse earlier

Nirav Modi holds two passports: Indian and Belgian

According to CNN-News18, investigative agencies could not trace absconding billionnaire Nirav Modi as he used his Belgian passport to fly out of Davos.

Nirav Modi holed up in Antwerp, Belgium

According to CNN-News18, jeweller Nirav Modi is holed up at friend Rashmi Mehta’s house 27, Berkenlaan, in Antwerp, Belgium, reported CNN-News18.

Mehul Choksi’s Gitanjali Gems plunges over 56% in six days

Within a week of surfacing of Rs 11,400 Punjab National Bank (PNB) fraud, Gitanjali Gems’ stock has nosedived over 56 percent.

It fell for sixth consecutive session on Wednesday. The stocks of the jewellery company plunged by 9.85 percent to close at the lower circuit of Rs 27.45 per share on Wednesday. Market capitalisation of the company stood at Rs 325.60 crore, down from Rs 695.08 crore.

– IANS

RECAP: ED raids shell firms; I-T attaches Rs 145 cr assets of Nirav Modi group

The Enforcement Directorate (ED) on Wednesday continued raids for the seventh day as it visited 17 locations across the country, including four shell companies in Mumbai, even as the I-T department attached assets worth Rs 145 crore in the alleged Rs 11,400-crore Punjab National Bank (PNB) fraud.

While the ED seized assets worth Rs 10 crore on Wenesday, the tax department said it has attached a total of 141 bank accounts and fixed deposits worth Rs 145.74 crore of the Nirav Modi group. The department said it has attached these assets to realise outstanding tax demands.

With Wednesday’s seizure, the total value of gems and gold jewellery seized by the ED stands at Rs 5,736 crore. The agency has said it is carrying out an “independent valuation” of these seized assets.

–PTI

PNB, Nirav Modi, aren’t the first; India’s PSBs have long been beaten by frauds

The instances of fraudulent transactions and loan scams involving bank officials continued. This included both and big and small frauds — Citibank fraud, Bank of Baroda forex scam, Syndicate Bank fraud and several other lesser-known scams. In most instances, the victims were public sector banks and culprits their own officials. Most cash-for-loan scams happened through middlemen.

Looking at PNB-like frauds, if someone thinks that there are no checks in place in the system, they are wrong. “There are checks but no one really cares,” said another banker who too requested anonymity. He takes the example of the LoU (Letters of Undertakings) fraud in PNB. If a branch-level official does a transaction of this manner for a period of seven years, it can get caught at different levels if any of the checks in place triggered this illegal activity.

Read full article hereHigh net-worth clients of Nirav Modi’s get I-T notices

I-T notice served to Congress leader Singhvi for making payments to Nirav Modi

The I-T department issued notices to several clients, including Congress leader Singhvi, of Nirav Modi for making large payments to him in cash, reports CNN-News18.

PNB adopts strict SWIFT controls after Rs 11,400 crore fraud case

India’s state-run Punjab National Bank has stepped up its controls on the use of global payments network SWIFT following an alleged $1.77 billion fraud, according to memos issued this month and seen by Reuters.

The new measures mean only PNB officers will be able to initiate messages on SWIFT, taking away the authority of clerks to do so. Several new limits have been placed on the amount that officers can generate depending on their seniority in the bank hierarchy.

The note sent by the bank’s head office in New Delhi to all regional offices on 17 February also stated any SWIFT message will have to be created, verified and authorised by three different officers, starting Thursday. Previously only two individuals were needed for the process.

– Reuters

ED identifies 50 Bihar jewellers with Gitanjali stocks

The Enforcement Directorate on Wednesday said it has identified 50 jewellers across Bihar with suspected stocks of the Geetanjali Group, which is under the scanner in the aftermath of the Punjab National Bank scam.

The jewellers, spread across towns like Patna, Bhagalpur, Muzaffarpur and Gaya, have been asked to surrender their stocks at the agency’s zonal office in Patna, failing which they may have to face legal action, an ED official said.

The ED, in the past few days, has raided showrooms of the Gitanjali Group at a number of locations in Patna, Muzaffarpur and Kishanganj and seized valuables worth crores of rupees.

–PTI

RECAP: Karnataka CM Siddaramaiah takes a dig at BJP and Narendra Modi

Nirav Modi’s aide Vipul Ambani was aware of fraudulent LoUs: CBI

Vipul Ambani, an arrested aide of fugitive billionaire Nirav Modi, knew about the fraudulent and illegal Letters of Undertaking (LoUs) issued by the Punjab National Bank in the Rs 11,400 crore fraud, CBI officials said on Wednesday.

Ambani was arrested on Tuesday and is being continuously grilled by the Central Bureau of Investigation (CBI) officials in Mumbai.

“Ambani was fully aware of the fraudulent and illegal LoUs issued by Shetty who was a deputy manager at PNB’s Brady House branch in Mumbai. (This was being done) in conspiracy and (under the) guidance of Nirav Modi and other employees of his firm,” a senior CBI official told IANS in New Delhi.

The CBI official said the agency during its probe found that Ambani not only visited and met PNB’s officials at the Brady House branch but also met other bank officials in Mumbai and New Delhi.

The official also said that they have seized documents during searches at the office of Firestar at Peninsula Business Park in Mumbai’s Lower Parel that “prove” that Ambani knew what was being done.

IANS

CBI seals Nirav Modi’s farmhouse in Mumbai’s Alibaug

The CBI on Wednesday sealed a luxury property of billionaire Nirav Modi in Alibaug area near Mumbai, officials said.

The 1.5 acre farm house in the uber rich neighbourhood at a stone’s throw distance from Arabian sea was purchased by Modi in 2004 for Rs 32 crore for hosting special parties for his clientele to show case his precious jewellery collection, they said.

Read more hereRECAP: Nirav Modi is in Belgium, say reports

Court remands Vipul Ambani. and five others arrested. to CBI custody till 5 March

A special court in Mumbai on Wednesday remanded Vipul Ambani, the president (finance) of Nirav Modi’s Fire Star Diamond, and five others in CBI custody till 5 March in connection with the Rs 11,400 crore alleged fraud in Punjab National Bank (PNB).

The six were arrested on Tuesday in connection with two FIRs registered by the CBI involving Modi and his uncle Mehul Choksi, the owner of Gitanjali Gems.

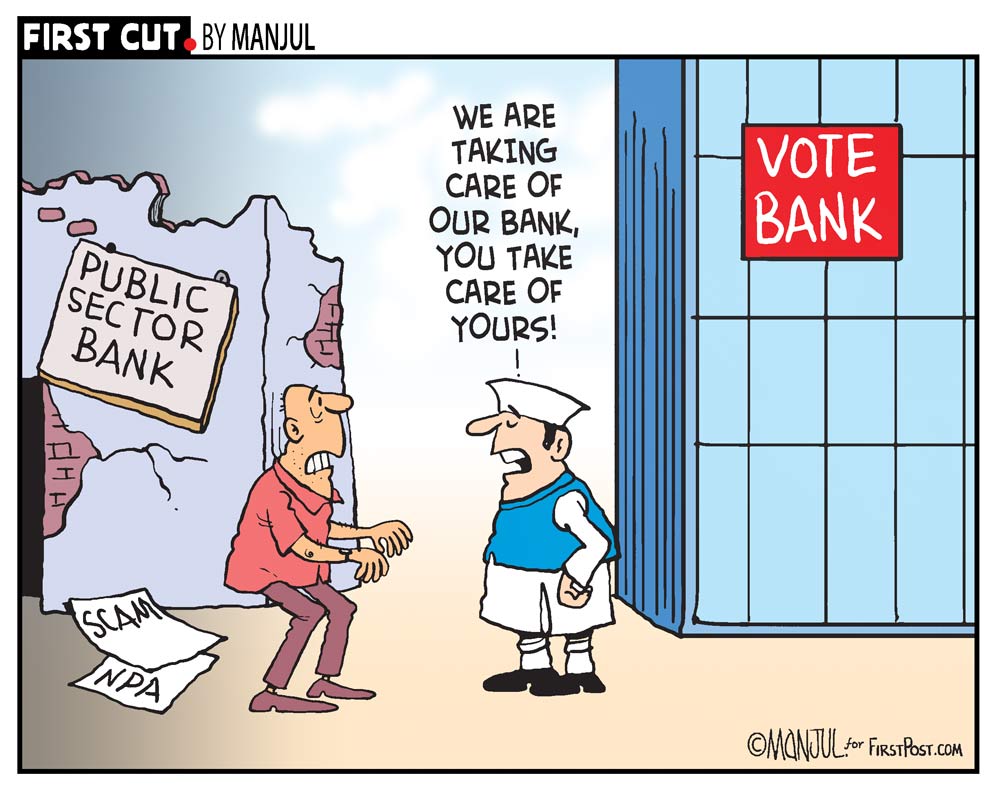

Read more hereFirst Cut by Manjul

Bank workers’ body claims close to 18,000 PNB employees transferred following alleged scam

Looking at PNB-like frauds, if someone thinks that there are no checks in place in the system, they are wrong. “There are checks but no one really cares,” said a banker who requested anonymity. He takes the example of the LoU (Letters of Undertakings) fraud in PNB. If a branch-level official does a transaction of this manner for a period of seven years, it can get caught at different levels if any of the checks in place triggered this illegal activity.

For instance, the SWIFT messaging platform that was used by the perpetrators in the PNB case is subjected to a daily check by the branch manager, which is compulsory in any bank. Even if one imagines that this part failed, the branch manager has to do a daily tally of income and expenditure in the branch while one of the officers (not involved in the transactions) combs through the books to look for suspicious transactions, the official said.

This apart, there are RBI and government representatives on the boards of large banks who are supposed to keep an eye on all transactions and ensure that nothing goes amiss.

“But, it appears that all of them were sleeping when a fraud was developing,” said the banker. That apart, given the tremendous pressure on bankers to generate business, top-level officers often turn a blind eye to illegal business activities.

Click here to read moreHave strong sovereign backing, adequate capital, PNB assures customers

Scam-hit PNB has assured investors and customers that it has a strong sovereign backing and adequate capital to deal with the situation in the aftermath of the Rs 11,400 crore fraud. “We assure you that in your bank, it is business as usual,” state-owned Punjab National Bank said in a tweet.

The country’s second largest lender has also dismissed media reports that it has imposed restrictions on withdrawals.

“Be rest assured we have a strong sovereign backing. The core strengths of the bank is the brand image with rich 123 years of existence, strong CASA base, stable asset quality and increased pace of digitisation,” PNB said.

Earlier in February, the bank said that it has been hit by a fraud amounting to about $1.77 billion. The alleged fraud was affected by fraudulent Letter of Undertakings (LOUs) issued to firms of diamantaire Nirav Modi and Mehul Choksi.

“We have adequate capital coupled with strong non core asset base,” said the PNB tweet as multi-agency probe widened into the fraud. PNB also said that it has the capacity and capability to “handle the situation” and protect the interest of the institution.

PTI

Visuals from Youth Congress protest against PNB scam

CBI calls around ten PNB officials for questioning in Mumbai

Rahul targets Narendra Modi for silence on PNB scam

Congress president Rahul Gandhi attacked Prime Minister Narendra Modi over his silence on the PNB bank fraud and the Rafale deal, saying sarcastically that he looked forward to his “sermon” on the issues in his “Mann ki Baat” programme.

Rahul also labelled the prime minister’s programme aired on All India Radio a monologue and said the country wants to hear him speak on billionaire diamond jeweller Nirav Modi and the Rafale “scam”.

In response to the prime minister’s suggestion for ideas for his 28 January ‘Mann ki Baat’ programme, Rahul had urged him to tell the country about India’s plans on stopping rapes, getting the Chinese out of Doklam and jobs for the youth.

PTI

Congress brings back ‘Chhota Modi’ jibe to slam Modi govt over Nirav Modi fraud case

Centre opposes plea for SIT probe

The Centre on Wednesday opposed in the Supreme Court a PIL seeking an independent probe and deportation of billionaire jeweller Nirav Modi in the over Rs 11,000 crore PNB fraud case, saying an FIR has been lodged and a probe was on.

A bench comprising Chief Justice Dipak Misra and Justices AM Khanwilkar and DY Chandrachud said it would not say anything on the matter now and listed the PIL filed by lawyer Vineet Dhanda for further hearing on 16 March.

Attorney General KK Venugopal, appearing for the Centre, said he was opposing the PIL on various grounds, including that an inquiry has started after the FIR was registered.

The PIL has made Punjab National Bank, Reserve Bank of India and the ministries of finance and law and justice as parties. It has sought a direction for initiation of deportation proceedings against Nirav Modi and others allegedly involved in the banking fraud, preferably within two months.

The plea has asked for a special investigation team (SIT) to probe the banking fraud, allegedly involving billionaire jewellers Nirav Modi and Mehul Choksi. It has also sought a probe into the role of the top management of the Punjab National Bank (PNB).

PTI

On what basis is Nirav Modi branded a fugitive, lawyer asks media

Rebel Congress MP Shehzad Poonawalla questions Rahul Gandhi over PNB scam

RBI sets up committee to preempt and prevent scams in future

The Reserve Bank of India (RBI), on quick action mode, has rolled out some strict measures in the aftermath of the Rs 11,400 crore Punjab National Bank scam. An expert committee will be formed, while the central bank has also issued guidelines and safeguards that banks are meant to implement.

Read the full report here

)

)