New Delhi: The fugitive diamond merchant Mehul Choksi had done his homework before fleeing the country along with a huge sum of money skimmed from public and private sector banks. He pledged the same brands and same flats as collateral to various banks in his meticulous con job. According to officials probing the Punjab National Bank (PNB) fraud case, Nirav Modi’s uncle had pledged his Sangini brand of diamonds — that was endorsed by top Bollywood stars — as collateral while collecting loans for his two different companies — Gili India Limited and Gitanjali Gems Limited. Exclusive details accessed by Firstpost reveal that the Sangini brand was pledged to ICICI Bank as collateral for the two companies. Additionally, Choksi had also pledged the Asmi and Gili brands as collateral to ICICI Bank while raising a loan on behalf of Gitanjali Gems Limited. “Brand value becomes zero the moment an account is declared fraud. We have seen that in the case of Vijay Mallya. He had pledged the Kingfisher trademarks as collateral with banks, and they found them impossible to sell after he defaulted,” officials in the investigating agencies said. [caption id=“attachment_4379537” align=“alignleft” width=“380”] File images of Nirav Modi and Mehul Choksi. Facebook and Youtube screengrab.[/caption] Choksi also conned AllBank Finance Limited by pledging the same flat for two different sets of loans he managed to procure for Gili India Limited and Gitanjali Gems Limited. AllBank Finance Limited, a wholly-owned subsidiary of Allahabad Bank, that began to give loans to Choksi-owned Gili India Limited in March 2013 and subsequently modified the loan in March 2016, has an exposure of Rs 375 crore. AllBank Finance Limited gave another Rs 750 crore to Choksi-owned flagship Gitanjali Gems Limited. For a total of Rs 1,125 crore, the government-owned bank in return has received the same property — a 7,510-square foot residential flat in Kalina, Mumbai comprising flats numbered 101, 201, 203, 301 and 303 — as collateral for two companies, Gili India Limited and Gitanjali Gems. [caption id=“attachment_4380003” align=“alignnone” width=“585”]

Flat 101. Firstpost/Yatish Yadav[/caption] [caption id=“attachment_4380007” align=“alignnone” width=“585”]

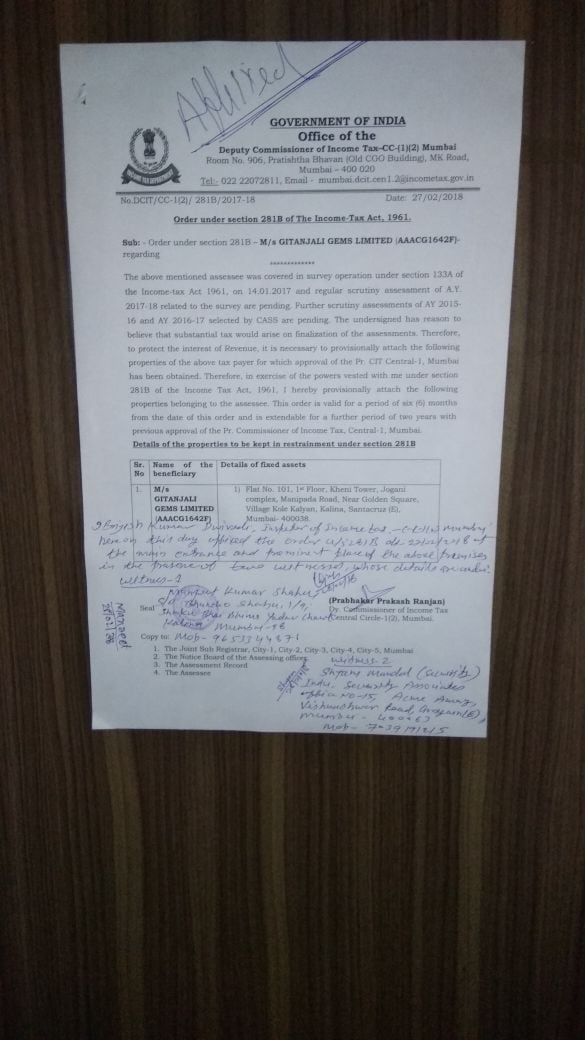

Flat 101. Firstpost/Yatish Yadav[/caption] [caption id=“attachment_4380007” align=“alignnone” width=“585”] Government of India notice outside Flat 101. Firstpost/Yatish Yadav[/caption] The investigators found this collateral bizarre since it appeared to be premeditated and not seen as a larger part of continuing security, a tradition prevalent with many banks. “Both companies applied for the loan on the very same day in 2013 and the file was moved for modification on the same day in 2016. This kind of collateral has no meaning and is in fact, a violation of the continuing security norm. We don’t know the value of the property yet, but it is peanuts against the loan amount. It’s like like pledging your motorcycle against a brand new imported car,” the investigators further added. [caption id=“attachment_4380011” align=“alignnone” width=“585”]

Government of India notice outside Flat 101. Firstpost/Yatish Yadav[/caption] The investigators found this collateral bizarre since it appeared to be premeditated and not seen as a larger part of continuing security, a tradition prevalent with many banks. “Both companies applied for the loan on the very same day in 2013 and the file was moved for modification on the same day in 2016. This kind of collateral has no meaning and is in fact, a violation of the continuing security norm. We don’t know the value of the property yet, but it is peanuts against the loan amount. It’s like like pledging your motorcycle against a brand new imported car,” the investigators further added. [caption id=“attachment_4380011” align=“alignnone” width=“585”] Jigani Complex in Kalina. Firstpost/Yatish Yadav[/caption] Interestingly, flat number 203 measuring 940 square feet that has been pledged to AllBank Finance Limited has been pledged to two other banks — PNB and Axis Bank. PNB — involved in loans worth over Rs 12,000 crore in the Nirav Modi case — gave around Rs 175 crore to Choksi-owned Gitanjali Gems while considering flat number 203 at Kalina as collateral. This flat was already pledged to the subsidiary of Allahabad Bank. Moreover, the same flat (number 203) has been pledged to Axis Bank by Gitanjali Gems. PNB gave Rs 75 crore to Gili India Limited on 12 December, 2012. [caption id=“attachment_4380013” align=“alignnone” width=“585”]

Jigani Complex in Kalina. Firstpost/Yatish Yadav[/caption] Interestingly, flat number 203 measuring 940 square feet that has been pledged to AllBank Finance Limited has been pledged to two other banks — PNB and Axis Bank. PNB — involved in loans worth over Rs 12,000 crore in the Nirav Modi case — gave around Rs 175 crore to Choksi-owned Gitanjali Gems while considering flat number 203 at Kalina as collateral. This flat was already pledged to the subsidiary of Allahabad Bank. Moreover, the same flat (number 203) has been pledged to Axis Bank by Gitanjali Gems. PNB gave Rs 75 crore to Gili India Limited on 12 December, 2012. [caption id=“attachment_4380013” align=“alignnone” width=“585”] Outside Flat 303. Firstpost/Yatish Yadav[/caption] It accepted the same flat (number 203) as collateral security. This loan was approved by the same Brady House branch of PNB that is under the scanner for issuing fake Letters of Undertaking (LoUs) and Foreign Letters of Credit (FLCs). The approval was given despite the fact that the PNB-led consortium already had an exposure of Rs 225 crore against Gili India Limited and the company had defaulted in repayment in May 2011. The story doesn’t end here. Choksi also pledged flat number 201 at Kalina to PNB and Axis Bank on behalf of Gitanjali Gems. This flat was already pledged to AllBank Finance Limited. He did the same with flat number 303 and it was pledged to three banks — PNB, Axis and AllBank Finance Limited. However, Choksi pledged flat number 101 as collateral on behalf of Gitanjali Gems to only two banks — Axis and AllBank Finance Limited in his well-planned loan scam. While securing loans from AllBank Finance Limited, Choksi also pledged the entire current assets of Gili India Limited, a personal guarantee from himself and a corporate guarantee from Gitanjali Gems Limited. Another collateral to the bank was described as “all present and future of the movable fixed assets including plant and machinery, furniture, computer hardware and software, machinery spares, tools and accessories and other movables”. For other loans of Gitanjali Gems, Choksi pledged stocks (inventory) as collateral and in another case it was receivables — roughly means proceeds from the business. As far as his nephew Nirav Modi is concerned, surprisingly, PNB did not receive any collateral, investigators said. Nirav’s Firestar International Limited in August 2012 had secured a Rs 2,480-crore loan from PNB Investment Services Limited, a wholly owned subsidiary of Punjab National Bank. The loan was modified on 11 December, 2017, less than a month before he fled India. In February 2015, Firestar International Limited secured another loan amounting to Rs 846 crore from PNB Investment Services Limited without pledging any collateral. Seven months later, PNB’s Brady House branch approved another loan amounting to Rs 400 crore on 11 September, 2015 to Nirav’s company. The Choksi-owned Nakshtra World Limited too secured over Rs 440 crore from various public and private sector banks without pledging any collateral. Some top Bollywood stars, who had endorsed the Nakshtra brand of jewellery had recently accused Choksi of not paying dues, alleging breach of contract. The Enforcement Directorate (ED) recently attached 41 properties owned by Choksi worth Rs 1,217 and companies controlled by him. The assets includes 15 flats and 17 office premises in Mumbai, Hyderabad Gems SEZ in Andhra Pradesh, a shopping mall in Kolkata, farmhouse in Alibaug and 231 acres of land in Maharashtra and Tamil Nadu.

Outside Flat 303. Firstpost/Yatish Yadav[/caption] It accepted the same flat (number 203) as collateral security. This loan was approved by the same Brady House branch of PNB that is under the scanner for issuing fake Letters of Undertaking (LoUs) and Foreign Letters of Credit (FLCs). The approval was given despite the fact that the PNB-led consortium already had an exposure of Rs 225 crore against Gili India Limited and the company had defaulted in repayment in May 2011. The story doesn’t end here. Choksi also pledged flat number 201 at Kalina to PNB and Axis Bank on behalf of Gitanjali Gems. This flat was already pledged to AllBank Finance Limited. He did the same with flat number 303 and it was pledged to three banks — PNB, Axis and AllBank Finance Limited. However, Choksi pledged flat number 101 as collateral on behalf of Gitanjali Gems to only two banks — Axis and AllBank Finance Limited in his well-planned loan scam. While securing loans from AllBank Finance Limited, Choksi also pledged the entire current assets of Gili India Limited, a personal guarantee from himself and a corporate guarantee from Gitanjali Gems Limited. Another collateral to the bank was described as “all present and future of the movable fixed assets including plant and machinery, furniture, computer hardware and software, machinery spares, tools and accessories and other movables”. For other loans of Gitanjali Gems, Choksi pledged stocks (inventory) as collateral and in another case it was receivables — roughly means proceeds from the business. As far as his nephew Nirav Modi is concerned, surprisingly, PNB did not receive any collateral, investigators said. Nirav’s Firestar International Limited in August 2012 had secured a Rs 2,480-crore loan from PNB Investment Services Limited, a wholly owned subsidiary of Punjab National Bank. The loan was modified on 11 December, 2017, less than a month before he fled India. In February 2015, Firestar International Limited secured another loan amounting to Rs 846 crore from PNB Investment Services Limited without pledging any collateral. Seven months later, PNB’s Brady House branch approved another loan amounting to Rs 400 crore on 11 September, 2015 to Nirav’s company. The Choksi-owned Nakshtra World Limited too secured over Rs 440 crore from various public and private sector banks without pledging any collateral. Some top Bollywood stars, who had endorsed the Nakshtra brand of jewellery had recently accused Choksi of not paying dues, alleging breach of contract. The Enforcement Directorate (ED) recently attached 41 properties owned by Choksi worth Rs 1,217 and companies controlled by him. The assets includes 15 flats and 17 office premises in Mumbai, Hyderabad Gems SEZ in Andhra Pradesh, a shopping mall in Kolkata, farmhouse in Alibaug and 231 acres of land in Maharashtra and Tamil Nadu.

According to officials probing the Punjab National Bank (PNB) fraud case, Nirav Modi’s uncle Mehul Choksi had pledged his Sangini brand of diamonds — that was endorsed by top Bollywood stars — as collateral while collecting loans for his two different companies

Advertisement

End of Article

)

)

)

)

)

)

)

)

)