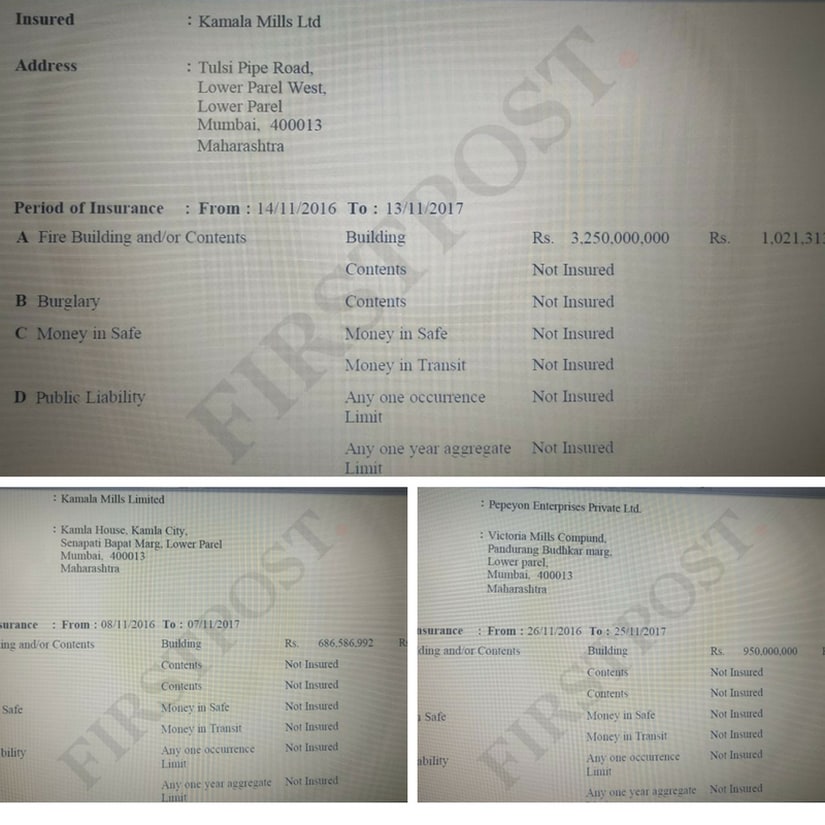

The Kamala Mills fire tragedy in Mumbai, which claimed the lives of 14 people two weeks earlier, has spurred the Brihanmumbai Municipal Corporation (BMC) into action. Following the incident, the civic body has carried out inspections and demolitions, while the police have arrested the owners who are illegally running pubs and bars in the Kamala Mills premises. The Lower Parel area in south central Mumbai was once a mill district—with the Kamala, Victoria, Todi and Raghuwanshi Mills located there. Over the years, the mill areas have given way to other commercial establishments like pubs, bars, party halls and (illegally) hookah parlours. Astoundingly, Ramesh G Gowani, who owns the two-storeyed building where both 1Above and Mojo’s Bistro are located, did not have valid fire insurance for the structure when the fire took place, sources told Firstpost. The Gowani family owns three properties in the Kamala Mill and Victoria Mill compounds, and the family holds the majority stakes in the company Kamala Mills Limited. [caption id=“attachment_4298801” align=“alignnone” width=“825”]  Images procured by Sanjay Sawant/Firstpost[/caption] Records show that the fire insurance policy of the building expired on 13 November 2017 and was renewed only on 4 January 2018. Thus, when the fire took place in the compound, the building had no fire insurance. This is not all. The old policy which expired on 13 November covered only the building, but did not cover burglary, money in safe (including money in transit), and public liability. The insurance amount was Rs 10,21,313 for 2017. As per documents with Firstpost, the proprietors of Kamala Mills bought fire insurance amount from Tata AIG for Rs 12.5 lakh plus GST on 4 January, 2018. Gowani’s family also owns two other properties—Kamala House and Pepeyon Enterprises Private Limited in Kamala and Victoria Mills respectively. But in both these properties, fire insurance had lapsed, and insurance for all three properties (including Kamala Mills Limited) was renewed on 4 January, 2018, one week after the fire. Speaking to Firstpost, a senior official from TATA AIG confirmed that when the fire took place, the property was not covered by fire insurance. “The insurance policy expired in the month of November but they (Gowani family) did not update the policy. On 4 January, we insured the property under our company as they paid the insurance policy amount,” she added. She further stated that the company was not liable for any claim related to the fire as it was not insured at the time. The senior official added, “The building in which the fire took place was worth Rs 325 crore. The premises in the building have been rented out to private banks, media houses, hotels, cafés and bars. Despite this, they did not pay the insurance amount,” he claimed. BMC commissioner Ajoy Mehta said, “This kind of accident can occur anywhere in Mumbai. The majority of pubs and hotels have constructed illegal encroachments, and they run illegal activities. Rules and regulations to prevent fires and other accidents are blatantly flouted. Not adhering to safety norms is criminal and those culpable must be punished.” He further stated that in the past week, the civic body has demolished more than 700 premises which have built illegal encroachments. These include hotels, cafes, pubs and other commercial establishments. Action will continue in the future too," said Mehta. The civic chief further stated, “Proper implementation of regulations is important to avoid unnecessary accidents and losses. Owners of hotels, as well as trade associations need to understand and appreciate this. The Kamala Mills compound tragedy is what happens when safety regulations and building codes are disregarded and flagrantly flouted. Local authorities need to step up efforts to ensure strict implementation of rules and hold establishments accountable. No less important is the need for a responsible citizenry that understands the importance of hoteliers following rules and regulations.” Sohini Ramesh Gowani, Mitesh Ramesh Gowani, Nikhil Ramesh Gowani, Rishabh Ramesh Gowani and Nirmala K Gowani are the majority stakeholders of the company Kamala Mills Limited. The interesting thing is that not a single share is in the name of Ramesh Ghamendiram Gowani, who heads the company.Firstpost repeatedly attempted to contact Ramesh Gowani’s son Mitesh and director of the company Shashikant Jadhav through calls, text messages and messages on Whatsapp. We sought to know why the premium for fire insurance was not paid until seven days after the fire at Kamala Mills. However, we did not receive any response. With inputs from Kishor Kadam

Ramesh G Gowani, who owns the two-storeyed building in Kamala Mills where both 1Above and Mojo’s Bistro are located, did not have valid fire insurance when the blaze took place.

Advertisement

End of Article

)

)

)

)

)

)

)

)

)