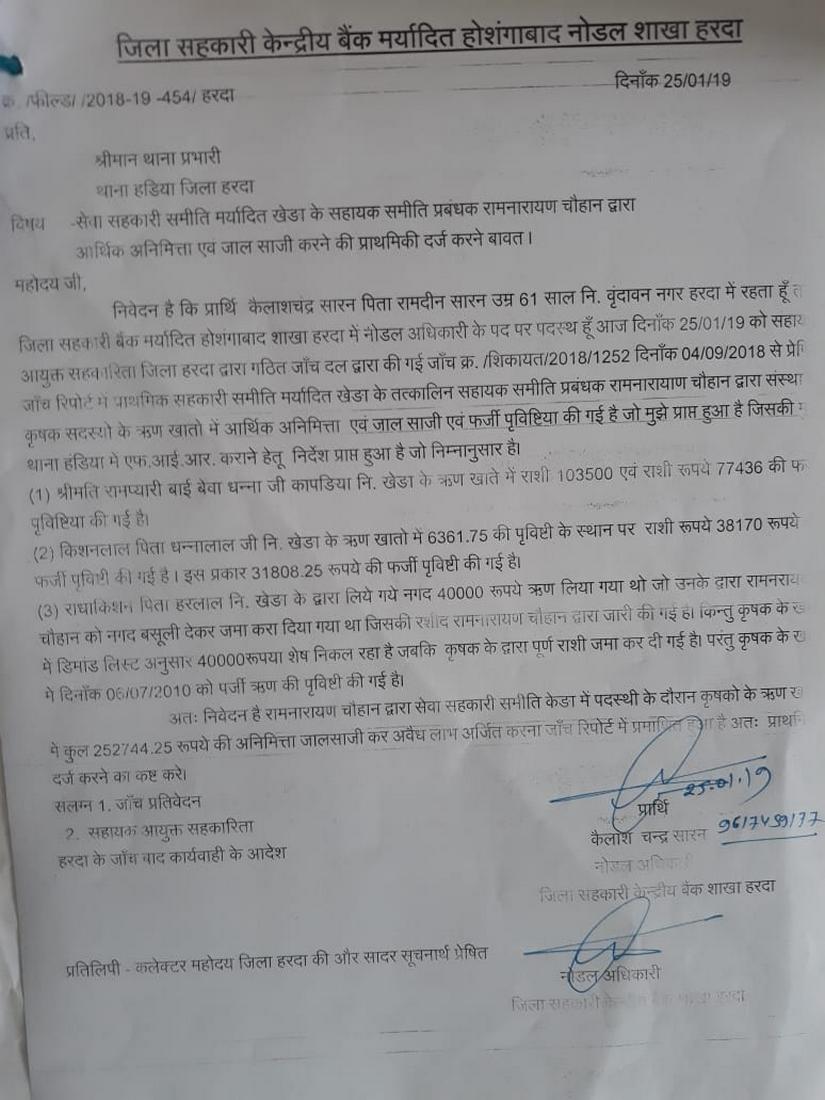

Editor’s Note: The Congress rode to power in Madhya Pradesh and Rajasthan by promising to rid the state of farmers’ issues. However, after securing a huge victory, the Congress’ farm loan waiver schemes have thrown up several discrepancies, exposing a few major irregularities in previous BJP governments’ agriculture debt adjustments. In this four-part series, we analyse the different problems related to the loan waiver schemes in the two states. Bhopal/Harda: Every village in Madhya Pradesh is buzzing — the common talking point: the farm loan waiver scheme. Panchayat offices are seeing action like never before, with hordes of farmers gathered outside to scan the lists of waiver beneficiaries. The scheme’s calculation is simple: any loan up to Rs 2 lakh taken before 31 March, 2018, is eligible for the waiver. So, for example, if a farmer has taken a loan of Rs 5 lakh, the state government will pay off Rs 2 lakh to the bank concerned, while the rest will have to be cleared by the farmer. However, alleged corruption has made the scheme’s implementation a mess, and not a single farmer has been able to get a waiver so far. And so, something that should have brought them relief is actually giving them sleepless nights. Dubious calculations by cooperative banks and societies have led to inflated outstanding loan amounts for many, and waivers as low as a paltry Rs 5 for several. And then there are those who never opted for any loan and yet are on the list. [caption id=“attachment_6065811” align=“alignnone” width=“825”]  Farmers during a meeting to solve problems related to the farm loan waiver in Neemganw village of Harda district. Manish Chandra Mishra/101Reporters[/caption] When thousands became lakhs Here’s a case in point of Ganesh Lal, a farmer from Kheda village in Harda district. Ganesh had taken a loan of Rs 64,261 in 2015 from the Kheda cooperative society. Imagine his shock on finding out that not only has the society listed him as a “defaulter”, but it has also put his outstanding amount at Rs 5.82 lakh. “The whole village is talking about my loan, but I’m not even the only one suffering as a result of some shady calculation. There are 450 others… The society is operating two different loan accounts in my name. I smell a scam and have approached the local authority,” he said, adding that he has submitted applications to MLAs and ministers as well. The contentious calculation Neemgaon farmer Ajay Vishnoi said, “I had taken a loan of Rs 2 lakh from a cooperative society. After my crop was damaged, I got Rs 1.2 lakh as insurance claim, which I adjusted with the loan. Later, I sold wheat for Rs 70,000 and deposited that amount against my loan as well. And yet I’m on the list with an outstanding amount of Rs 1.61 lakh. Isn’t it obvious that someone in the bank pocketed my money and failed to make entries of all my payments?” Sethi Patel, a farmer leader from Harda, seconded Vishnoi. He said he’s got many farmers coming to him complaining about similar issues. Another Harda-based farmer leader, Ram Hinaiya, said, “You can imagine the extent of the scam if those who’ve never taken a loan are finding themselves on these lists — Satpal Vishnoi and Reva Patel are among the scores of farmers facing this problem.” Devendra Mishra, an educated farmer from Chhatarpur’s Sarwai village, explained what is causing the chaos. “The government is waiving off loans taken before 31 March, 2018. This has led to this mess. Those who weren’t aware about the waiver scheme cleared their own loans shortly after 31 March. Yet, banks in my district have put their names in the beneficiary lists. This means banks will claim those amounts again, this time from the government, under the scheme,” he alleged. “Those who have caught on that it’s a scam are raising questions and complaining to the administration, but there are several who don’t understand or are unaware about it.” However, a senior bank manager, on condition of anonymity, said, “Banks are calculating the outstanding amounts before 31 March and waiving only those off. Hence the confusion. And that’s also why some farmers have got waivers of Rs 10 to Rs 50 despite taking a larger loan.” But Shivlal Kataria from Nipania Baijnath village of Agar-Malwa district is in no mood to accept the waiver of Rs 13 that he has got. Insisting that it should have been Rs 24,000, he has complained to the authorities. The first police complaint lodged The Kheda cooperative bank itself has lodged a complaint against its former manager Ramnarayan Chauhan for allegedly misappropriating loan money. Bank manager Kailash Chandra Saran said this is probably the first complaint in the scheme. [caption id=“attachment_6065821” align=“alignnone” width=“825”]  A copy of the first complaint pertaining to the loan waiver. Manish Chandra Mishra/101Reporters[/caption] Saran said the bank found three cases of incorrect entries in loan accounts — two fake outstanding amounts of Rs 1,00,500 and Rs 77,436 against Ram Pyari Bai’s account; dues of Rs 38,170 instead of Rs 6,361.75 against Kishan Lal’s account; and failure to record repayment of Rs 40,000 made by Radha Kishan to the bank. Mishra reiterated that the rot in cooperative banks goes deep as members of the same family have been dominating the district’s banking system. Congress’ defence Gopal Bhargava, Leader of Opposition and BJP leader, said Congress has failed farmers. “The (state) government is looking for excuses. If it really wanted to waive off loans, it would have done it, and properly. Instead, it is simply confusing farmers by making them fill out all sorts of forms.” [caption id=“attachment_6065831” align=“alignnone” width=“825”]  Farmers expressing their concern to authorities in Harda. Manish Chandra Mishra/101Reporters[/caption] Minister for Farmers’ Welfare Sachin Yadav, however, slammed the previous (BJP) government for this mess. “It’s a Rs 1,000-crore scam, but one that has been perpetrated by the previous government. Our scheme has merely exposed it. We are committed to the scheme and are making all necessary arrangements for farmers’ convenience. We have even set up a helpline for them to call on with their grievances; they can approach their nearest bank for the number, as there is a dedicated helpline for each district. Our government will also lodge police complaints and get justice for the aggrieved,” he said. When asked about the meagre waivers some farmers have got, Yadav added that it was a case of human error and would be rectified by the banks. The scheme is costing the state exchequer over Rs 50,000 crore, which, government officials suspect, is an inflated amount due to corruption in banks. According to government data, there are 53.3 lakh beneficiaries in different panchayats, who had taken loans from 25 national and cooperative banks. (Manish Chandra Mishra is a Bhopal- based freelance writer and a member of 101Reporters.com)

Dubious calculations by cooperative banks and societies have led to inflated outstanding farm loan amounts for many in Madhya Pradesh.

Advertisement

End of Article

)

)

)

)

)

)

)

)

)