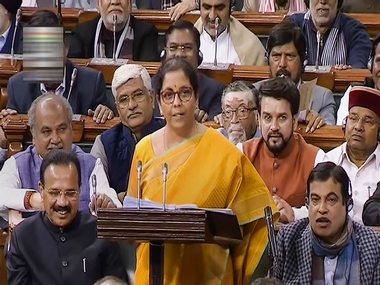

New Delhi: A large number of items including cigarettes, chewing tobacco along with imported products, like edible oils, fans, table, footwear, electric vehicles, tableware, kitchenware, toys and furniture are set to become more expensive due to hike in taxes proposed in the Union Budget for 2020-21. On the other hand, newsprint, sports goods, microphone will become cheaper as Finance Minister Nirmala Sitharaman proposed reduction in duties on these items in the Budget for 2020-21.

Custom duty hike on electrical appliances 👇👇 pic.twitter.com/u66453NNjD

— CNBC-TV18 (@CNBCTV18Live) February 1, 2020

Following is a list of imported items that will become costlier following the announcements in the Budget:

- Butter ghee, butter oil, edible oils, peanut butter

- Whey, meslin, maize, sugar beet seeds, preserved potato

- Chewing gum, dietary soya fibre, isolated soya protein

- Walnuts (shelled)

- Footwear, shavers, hair clippers, hair-removing appliances

- Tableware, kitchenware, water filters, glassware

- Household articles of porcelain or china

- Rubies, emeralds, sapphires, rough coloured gemstones

- Padlocks

- Hand sieves and hand riddles

- Combs, hairpins, curling pins, curling grips, hair curlers

- Table fans, ceiling fans and pedestal fans

- Portable blowers

- Water heaters and immersion heaters

- Hair dryers, hand drying apparatus and electric irons

- Food grinders, ovens, cookers, cooking plates, boiling rings, grillers and roasters

- Coffee and tea makers and toasters

- Electro-thermic fluid heaters, devices for repelling insects and electric heating resistors

- Furniture, lamps and lighting fittings

- Toys, stationery item, artificial flowers, bells, gongs, statuettes, trophies

- Printed Circuit Board Assembly (PCBA) of cellular mobile phones, display panel and touch assembly, fingerprint readers for use in cellular mobile phones

The government has proposed to hike the Excise duty on cigarettes, Hookah, Chewing tobacco, Jarda scented tobacco and Tobacco extracts and essence. The government has proposed to reduce the custom duty on the import of the following item:

- Pure-bred breeding horses

- Newsprint

- Sports goods

- Microphone

- Electric vehicles.

Follow full coverage of Union Budget 2020-21 here

)

)

)

)

)

)

)

)

)