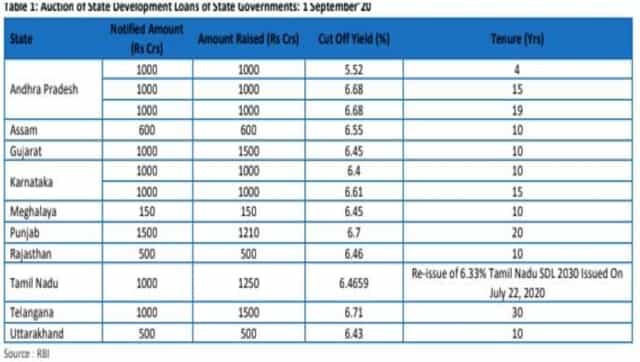

Numbers are not the most friendly way to wade into a discussion. But, instead of reeling off opinions, it is better to let data do the talking since in the topic of Centre-state spat on GST there is more opinion than data floating around. So, here it goes although I promise to keep numbers to a minimum. It is not even halfway for the Indian financial year (April onwards) yet states have already borrowed 48 percent more from the markets than what they did last year. Also, of every Rs 100 spent by the Central government, states spend Rs 64. The Centre spends Rs 34 and the local bodies, about Rs 6. When the Centre, therefore, advises them to borrow more to make up the shortfall in the Goods and Services tax this year, they have good reasons to baulk. To put these numbers in perspective, there is a little bit more of numbers. States finance 44 percent of their budget from taxes. From 2017 this includes GST plus other taxes that states raise like professional tax, stamp duty, luxury tax and so on. Obviously the biggest chunk is the GST or state GST. Essentially the states have argued that since they have written away a substantial share of their right to raise taxes to a common pool — the GST — any shortfall there must be made good by the Centre. It is a plausible argument. They have two clinching ones to add on. The Centre had committed itself to make good any shortfall. In the GST law, the Centre has agreed to a constitutional provision that state revenues must grow at 14 percent per annum, else the Centre will make good the difference. Next, since the states spend more than the Centre, (as we saw above) their needs are more. Unspoken by the states is the fear with which we started off. Since taxes and transfer of resources from the Centre (another 35 percent) do not fill up their purse they have to borrow. They have already borrowed a lot more – almost 50 percent more than last year and banks will demand a higher rate of interest to offer more loans. But why have the states borrowed a lot more? One could be because of the shortfall in receipts because of COVID-19. But the bill for the pandemic is just beginning to come in. Tamil Nadu, for instance, has said it has spent Rs 7,612 crore on it till the end of August. Using the same metric the largest 14 states have spent about Rs 51,400 crore so far. But till the end of June, the Centre has shared almost half of its tax receipts with the states. This is most unusual. The Centre is supposed to give 42 percent of its tax collection to the states. In the last fiscal ie FY20, it had run up arrears. The Centre despite collecting 32 percent less in April to June 2020, has made good the arrears. Essentially then the states should have been a bit more solvent now than they seem to be, yet they have borrowed more! Also, the borrowing figures are an under statement. Almost all the states borrow some more off-budget, through state-run companies. The chairman of the Fourteenth Finance Commission, Dr YV Reddy tried to estimate it but gave up. “Such disclosures are not available for the States as a whole. We recommend that in the interest of transparency, both the Union and the States need to make full disclosure of extra-budgetary borrowings,” his report notes. From Budget 20-21, the Centre has moved to show the extent of these off-budget borrowings on its shoulders. It is not a pretty picture at Rs 1.86 trillion. But the states are yet to show their hand. As the Commission added: “Such outstanding extra-budgetary liabilities need to be clearly identified and eliminated in a time-bound manner, with transparent reporting of deficit and debt.” The reasons why the states are in a soup is that they have overcommitted to spend on welfare measures far more than their finances permit. Chief among these are farm loan waivers (Rs 2.63 trillion), power sector losses (Rs 2.1 trillion) and assorted income support schemes. Some of these also include government-run insurance schemes, the move to switch to a trust model instead to pay for crop failures. Or the Kalia, Rythu Bandhu and Krishak Bandhu schemes of Odisha, Telangana and West Bengal respectively for instance. Each of these cost upwards of a few thousand crore rupees, going by just respective budget estimates. Once the claims emerge they shall draw in much more funds. This is where the off-budget borrowings come in useful. Despite reminders by the RBI, no state government has shown its hand. Uttar Pradesh has financed its four power sector distribution companies to the tune of Rs 1,18,027.57 crore in almost two decades since 2000-01. The net present value of these equity and long term loan is calculated at Rs 1,90,696.62 crore. The sum is about 14 percent of the state GDP as on 2017-18. The combined net worth of these companies according to a CAG audit is a negative Rs 60,606.46 crore. In Kerala the government guarantee for state owned companies was 7.13 percent of the state GDP. Why did the states resort to off-budget borrowings? One was, of course, to generate money to finance capital expenditure despite the handouts. Over the years most states have missed their capital outlay targets—on an average 14 percent underspending as compared to revenue expenditure (7 percent) to maintain their budget discipline. Finance Commissions encourage budget discipline. The Fourteenth Finance Commission, for instance, had carved out a strategy for the states to offer them room for additional borrowing. The strategy was they should show zero revenue deficit, a fiscal deficit to GSDP ratio of 3 percent, public debt to GSDP ratio of not more than 25 percent and finally an interest payments to revenue receipts ratio of 10 percent. It was a wise basket to pursue but states also figured out they could game the system. An off-budget borrowing platform was a smart choice in this context. This is the circumstance in which the present dispute is rooted. One can now move on to argue if states should, in any case, borrow for a deficit in the GDP pool. It is clearly a matter of opinion. If one agrees that the hole in the tax receipts is the Centre’s responsibility then obviously Finance Minister Nirmala Sitharaman has to repair it. However, if one argues that the deficit is a cumulative result of the weakness in the economy then the argument is not so clear. This is where the the GDP data released on Monday will come in useful. The Centre can now argue that the cataclysmic dip in the performance of the economy is the clinching evidence to prove that tax collections are going to undershoot every budget target, with or without cess. In the circumstances whatever the centre can muster is about the best the states should expect to make do with. The Centre has offered two alternatives. Those are either to meet the shortfall arising out of GST implementation (calculated at Rs 97,000 crores approximately) to be borrowed by the states through a concessional issue of debt under a special window to be steered by the Union finance ministry or fund the entire shortfall of Rs 2,35,000 crores (including the COVID-hit portion) through market borrowings by the states at whatever rates they can manage without any support from the Centre. A final word on the borrowing. Additional state borrowings do not scare the bond markets much. The buyers of their debt—the domestic and foreign banks and financial institutions do not link their offerings to the pricing of corporate debt. For instance, as the following table shows while the yields on their papers went up, it has eased up of late. In other words, there shall be no impact from plentiful state papers that those of the corporate sector should also be priced cheap. The state papers are not yet traded heavily (but it could happen in future) Meanwhile if the Centre were to borrow the additional sum on its own balance sheet to compensate the states, it will certainly have a strong adverse impact on the debt market. The implication is that the price of the GOI papers would drop (more borrowing means cheaper papers) which would in turn seriously hurt the pricing of papers of companies too, both private and public. That would create even more strain for the economy to sustain. [caption id=“attachment_8784641” align=“alignnone” width=“640”]  Source: Care Ratings and RBI[/caption] The final alternative is for the RBI to directly finance the states. It would mean more or less a variant of the Central government’s borrowings, which is why the chairman of the fifteenth Finance Commission, NK Singh too has weighed against it. Those who have argued that it was the bait of a 14 percent assured compensation that made the states agree to a deal with the Centre to roll out GST, miss the wood for the trees. The compensation was too generous, certainly. But there was no better option to improve the tax-GDP ratio of the economy and yet make it simpler. That it should be made simpler is intuitively obvious. But even assuming so would that have made the receipts better? Since most of the demand from industry associations has been to eliminate invoice matching, which actually is the reason for GST to be introduced, one suspects the simplicity argument is an alias for exemptions. The author is Consulting Editor, Business Standard and Senior Adjunct Fellow, Research and Information System for Developing Countries.

Sops like farm loan waivers, cushioning power sector losses and assorted income support schemes have started haunting state exchequers as many punched way above their financial might before the devastating strike of COVID-19.

Advertisement

End of Article

)

)

)

)

)

)

)

)

)