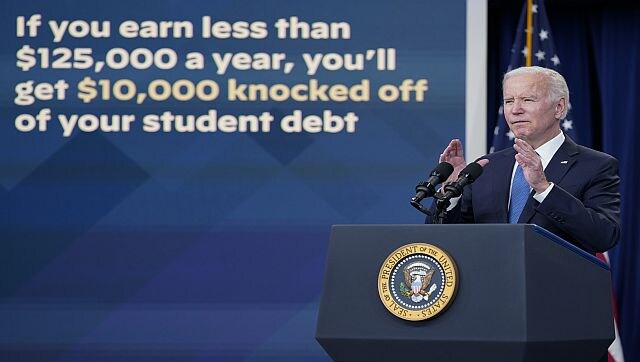

Washington: The Supreme Court is about to hear arguments over President Joe Biden’s student debt relief plan, which impacts millions of borrowers who could see their loans wiped away or reduced. So far, Republican-appointed judges have kept the Democratic president’s plan from going into effect, and it remains to be seen how the court, dominated 6-3 by conservatives, will respond. The justices have scheduled two hours of arguments in the case today, though it will probably go longer. The public can listen in on the court’s website beginning at 10 am EST (8.30 pm IST). Where things stand ahead of the hearing as well as what to expect: How does the forgiveness plan work? The debt forgiveness plan announced in August would cancel $10,000 (Rs 8.27 lakh) in federal student loan debt for those making less than $125,000 (Rs 1.03 crore) or households with less than $250,000 (Rs 2.06 crore) in income per year. Pell Grant recipients, who typically demonstrate more financial need, would get an additional $10,000 in debt forgiven. [caption id=“attachment_12217492” align=“alignnone” width=“640”] The Supreme Court is about to hear arguments over President Joe Biden’s student debt relief plan. AP[/caption] College students qualify if their loans were disbursed before 1 July. The plan makes 43 million borrowers eligible for some debt forgiveness, with 20 million who could have their debt erased entirely, according to the Biden administration. The White House says 26 million people have applied for debt relief, and 16 million people had already had their relief approved. The Congressional Budget Office has said the program will cost about $400 billion over the next three decades. How did the issue wind up at the supreme court? The Supreme Court is hearing two challenges to the plan. One involves six Republican-led states that sued. The other involves a lawsuit filed by two students. A lower court dismissed the lawsuit involving the following states: Arkansas, Iowa, Kansas, Missouri, Nebraska and South Carolina. The court said the states could not challenge the program because they weren’t harmed by it. But a panel of three federal appeals court judges on the US Court of Appeals for the 8th Circuit — all of them appointed by Republican presidents — put the program on hold during an appeal. The Supreme Court then agreed to weigh in. The students’ case involves Myra Brown, who is ineligible for debt relief because her loans are commercially held, and Alexander Taylor, who is eligible for just $10,000 and not the full $20,000 because he didn’t receive a Pell grant. They say that the Biden administration didn’t go through the proper process in enacting the plan, among other things. Texas-based US District Judge Mark Pittman, an appointee of President Donald Trump, sided with the students and ruled to block the program. Pittman ruled that the Biden administration did not have clear authorisation from Congress to implement the program. A federal appeals court left Pittman’s ruling in place, and the Supreme Court agreed to take up the case along with the states’ challenge. How did Biden get to cancel the debt? To cancel student loan debt, the Biden administration relied on the Higher Education Relief Opportunities for Students Act, commonly known as the HEROES Act. Originally enacted after the 11 September, 2001, terror attack, the law was initially intended to keep service members from being worse off financially while they fought in wars in Afghanistan and Iraq. [caption id=“attachment_12217482” align=“alignnone” width=“640”]

To cancel student loan debt, the Joe Biden administration relied on the Higher Education Relief Opportunities for Students Act, commonly known as the HEROES Act. AP[/caption] Now extended, it allows the secretary of education to waive or modify the terms of federal student loans as necessary in connection with a national emergency. Trump, a Republican, declared the COVID-19 pandemic a national emergency in March 2020, but Biden recently announced that designation will end 11 May. The Biden administration has said that the end to the national emergency doesn’t change the legal argument for student loan debt cancellation because the pandemic affected millions of student borrowers who might have fallen behind on their loans during the emergency. What are the justices likely to ask about? Expect the justices to be focused on several big issues. The first one is whether the states and the two borrowers have the right to sue over the plan in the first place, a legal concept called “standing.” If they don’t, that clears the way for the Biden administration to go ahead with it. To prove they have standing, the states and borrowers will have to show in part that they’re financially harmed by the plan. Beyond standing, the justices will also be asking whether the HEROES Act gives the Biden administration the power to enact the plan and how it went about doing so. When will borrowers know the outcome? It will likely be months before borrowers learn the outcome of the case, but there’s a deadline of sorts. The court generally issues all of its decisions by the end of June before going on a summer break. Whether or not the debt gets cancelled, the case’s resolution will bring changes. While federal student loan payments are currently paused, that will end 60 days after the case is resolved. And if the case hasn’t been resolved by 30 June, payments will start 60 days after that. Read all the Latest News , Trending News , Cricket News , Bollywood News , India News and Entertainment News here. Follow us on

Facebook,

Twitter and

Instagram.

To cancel student loan debt, the Joe Biden administration relied on the Higher Education Relief Opportunities for Students Act, commonly known as the HEROES Act. AP[/caption] Now extended, it allows the secretary of education to waive or modify the terms of federal student loans as necessary in connection with a national emergency. Trump, a Republican, declared the COVID-19 pandemic a national emergency in March 2020, but Biden recently announced that designation will end 11 May. The Biden administration has said that the end to the national emergency doesn’t change the legal argument for student loan debt cancellation because the pandemic affected millions of student borrowers who might have fallen behind on their loans during the emergency. What are the justices likely to ask about? Expect the justices to be focused on several big issues. The first one is whether the states and the two borrowers have the right to sue over the plan in the first place, a legal concept called “standing.” If they don’t, that clears the way for the Biden administration to go ahead with it. To prove they have standing, the states and borrowers will have to show in part that they’re financially harmed by the plan. Beyond standing, the justices will also be asking whether the HEROES Act gives the Biden administration the power to enact the plan and how it went about doing so. When will borrowers know the outcome? It will likely be months before borrowers learn the outcome of the case, but there’s a deadline of sorts. The court generally issues all of its decisions by the end of June before going on a summer break. Whether or not the debt gets cancelled, the case’s resolution will bring changes. While federal student loan payments are currently paused, that will end 60 days after the case is resolved. And if the case hasn’t been resolved by 30 June, payments will start 60 days after that. Read all the Latest News , Trending News , Cricket News , Bollywood News , India News and Entertainment News here. Follow us on

Facebook,

Twitter and

Instagram.

The Supreme Court is set to hear arguments on President Joe Biden’s student debt relief plan. The plan makes 43 million borrowers eligible for some debt forgiveness, with 20 million who could have their debt erased entirely

Advertisement

End of Article

)

)

)

)

)

)

)

)

)