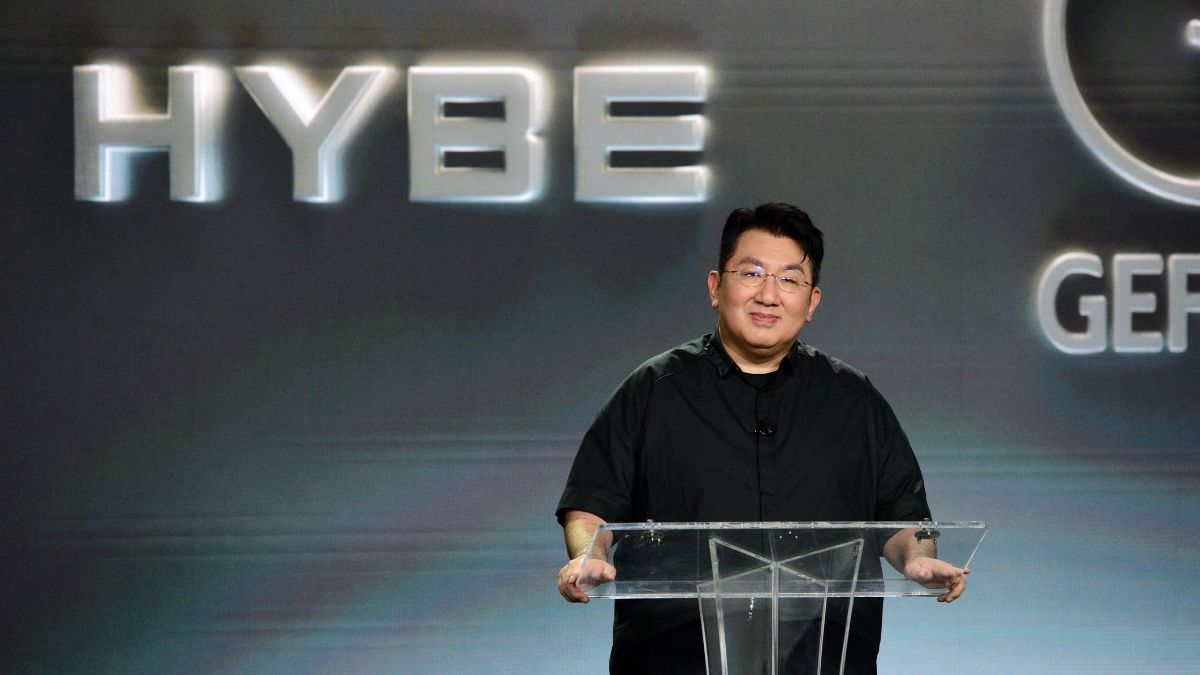

Bang Si-hyuk, founder and chairman of Hybe – the South Korean entertainment giant behind the K-pop sensation BTS, has found himself in a soup. The country’s top financial watchdog has decided to refer Bang to the prosecution for alleged fraudulent activities linked to the listing of his entertainment agency.

Bang’s legal troubles come against the backdrop of the reunion of all seven members of the boy band BTS after military service . Amid the controversy, the Hybe chairman has cancelled a scheduled keynote speech titled Beyond the BTS Phenomenon: The Future of K-pop, which he was to deliver at the 2025 Korea Enterprises Federation’s Summer Forum for Business Leaders in Jeju.

But what are the allegations against Bang Si-hyuk? We will explain.

Bang Si-hyuk accused of fraud

Korea’s Financial Supervisory Service (FSS), the financial watchdog, is set to convene the meeting of its Securities and Futures Commission (SFC) on Wednesday (July 16) to discuss the level of disciplinary action against Bang Si-Hyuk, as per an allkpop report.

Bang has been accused of engaging in fraudulent and unfair trading under the Capital Markets Act related to Hybe’s 2020 IPO.

The FSS has found evidence indicating Bang was involved in deceptive practices related to private equity firms before and after Hybe’s IPO, The Korean Economic Daily reported, citing sources.

The financial watchdog has been investigating Bang over allegations that he pocketed money while he misled investors in 2019 that Hybe, then known as Big Hit Entertainment, had no plans to go public.

Believing him, some investors sold their shares to a private equity fund established by Bang’s acquaintance.

However, at the same time, Hybe began the process of going public, including designating an external auditor.

How Bang Si-hyuk benefited from ‘misleading’ investors

Bang allegedly signed a private shareholders’ agreement with local private equity firms, including STIC Investments Inc, Estone Equity Partners and New Main Equity, to share profits from a future listing, reported The Korean Economic Daily.

The details of the deal were not disclosed during the IPO process, a violation of the Capital Markets Act, according to The Korea Herald.

The value of Hybe’s shares soared as it went public in 2020. Priced at 135,000 won per share, its stock price more than doubled, reaching 420,000 won on its debut.

But, within a week, the stock plunged nearly 70 per cent from its peak due to private equity funds’ massive selloffs of Hybe’s shares.

While investors faced heavy losses after the selloffs, Bang reportedly received 400 billion won (Rs 2,475 crore) from the private equity funds following the confidential deal.

Bang Si-hyuk could face jail

The FSS is probing Bang to determine whether his statements constituted false disclosures and key information linked to the IPO was intentionally withheld. The watchdog questioned Bang in late June over alleged irregularities.

It suspects that Bang could have used a private equity fund to bypass lock-up regulations that prevent major shareholders from offloading large amounts of stock immediately after an IPO, as per The Korea Herald.

Last week, the capital market investigation team, an advisory body under the Securities and Futures Commission (SFC), held talks and decided to file a complaint with the prosecution against Bang.

The team informed the SFC, which is expected to deliberate during its meeting on July 16.

Referring cases to the prosecution is the most severe action financial regulators can take against those accused of violating the Capital Markets Act. The decisions taken by the investigation team are rarely reversed.

Hybe has reacted to the controversy, asserting that “all transactions were carried out legally by undergoing thorough legal reviews.”

“We apologise for causing concern due to news related to our IPO process,” the company said in a statement last week. “We are actively cooperating with financial authorities and the police by providing detailed explanations and submitting relevant documents regarding the matters currently under investigation.”

As per reports, the Seoul Metropolitan Police Agency is also conducting a parallel inquiry into the matter.

If the allegations are proved, Bang could face a jail term. In South Korea , offences involving illegal profits or avoiding losses of over five billion won can attract a punishment of a minimum of five years imprisonment and up to a life term.

Known as “Hitman” Bang, the Hybe chairman is a songwriter, composer and producer who created hit songs for many popular K-pop idols. His discovery of BTS helped take K-pop on the global stage. It remains to be seen what the impact of his legal troubles will be on the K-pop band’s comeback.

With inputs from agencies

)