It feels like a flashback for some – back to 8 November 2016 when Prime Minister Narendra Modi announced demonetisation. Now Reserve Bank of India (RBI) has decided to withdraw the Rs 2000 notes and there has been panic. While the term “note bandi” is being thrown around again, the Friday announcement is different. The notes are not being demonetised. RBI governor

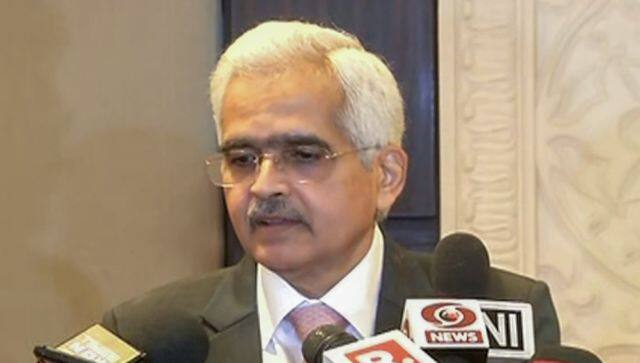

Shaktikanta Das

said on Monday that there was no need to

panic or worry

. “There is no reason to rush to banks now. You have four months, till September 30,” he assured. He also asserted that even after September 30, the deadline set by the central bank to deposit the notes, they would continue to be legal tender. If the notes of the Rs 2000 denomination will still be valid, then why are people being asked to deposit them? And what happens if the notes are not deposited? We take a look at the journey of the note and what happens next. When and why was the Rs 2000 note introduced? In November 2016, the Rs 2000 banknote was introduced after

demonetisation

, in which the legal status of Rs 1000 and Rs 500 notes in circulation at the time was withdrawn to curb a rise in fake currencies and black money. The Rs 2000 notes were introduced to remonetise the system under Section 24(1) of the RBI Act, 1934, which allows the central bank to issue notes of any denomination not exceeding Rs 10,000, primarily to meet the currency requirement of the economy “in an expeditious manner” after the demonetisation exercise. “Rs 2000 notes were introduced to replenish the notes withdrawn following the notes ban,” the RBI chief said on Monday. [caption id=“attachment_12631922” align=“alignnone” width=“640”] A bank employee checks stacks of new 2000 rupee notes in Ahmedabad. The high-value notes have been withdrawn under the RBI’s ‘Clean Note Policy’. File photo/AFP[/caption] However, the central bank had stopped printing the notes in 2018 and 2019. “With fulfilment of that objective and availability of banknotes in other denominations in adequate quantities the printing of Rs 2000 banknotes was stopped in 2018-19,” RBI said. Also read: Why has RBI withdrawn Rs 2000 notes? How is this different from demonetisation?

But why are the notes being withdrawn? The RBI on Friday said that the

withdrawal

was part of the “clean note policy” that aims to maintain the integrity of Indian currency by removing damaged, counterfeit or soiled notes from circulation. Under this rule introduced in 1999, banks and financial institutions are required to withdraw unfit or damaged notes from circulation and replace them with new ones. The objective is to provide good-quality currency notes and coins. Das said on Monday that the exercise was part of the “currency management system” of the central bank. Also, withdrawing the denomination made sense since they were not much in use compared to the other denominations.

A bank employee checks stacks of new 2000 rupee notes in Ahmedabad. The high-value notes have been withdrawn under the RBI’s ‘Clean Note Policy’. File photo/AFP[/caption] However, the central bank had stopped printing the notes in 2018 and 2019. “With fulfilment of that objective and availability of banknotes in other denominations in adequate quantities the printing of Rs 2000 banknotes was stopped in 2018-19,” RBI said. Also read: Why has RBI withdrawn Rs 2000 notes? How is this different from demonetisation?

But why are the notes being withdrawn? The RBI on Friday said that the

withdrawal

was part of the “clean note policy” that aims to maintain the integrity of Indian currency by removing damaged, counterfeit or soiled notes from circulation. Under this rule introduced in 1999, banks and financial institutions are required to withdraw unfit or damaged notes from circulation and replace them with new ones. The objective is to provide good-quality currency notes and coins. Das said on Monday that the exercise was part of the “currency management system” of the central bank. Also, withdrawing the denomination made sense since they were not much in use compared to the other denominations.

The total value of these banknotes has declined from Rs 6.73 lakh crore at its peak on 31 March 2018, with 37.3 per cent of notes in circulation to Rs 3.62 lakh crore, constituting only 10.8 per cent of notes in circulation on March 31, 2023, according to RBI data. Is there a ‘counterfeit money’ problem? The Rs 2000 notes are used widely by

illegal elements

and continue to pose a challenge to government and tax officials. These notes comprise a major junk of black money seized in recent years, as per data from the income tax department. Finance Minister Nirmala Sitharaman told Parliament in November 2019 that 43.22 per cent of unaccounted cash seized in the financial year 2020 was in the form of Rs 2,000 notes. In the financial year 2019, the notes made up 65.93 per cent of such money and the figure was 67.91 per cent in FY 2018. There is no data available from 2020 to 2022 but the trend is expected to be similar to the previous years, reports moneycontrol. [caption id=“attachment_12632022” align=“alignnone” width=“640”] RBI governor Shaktikanta Das speaks to the media in Mumbai, assuring people not to panic over the withdrawal of the Rs 2000 notes. PTI[/caption] The Rs 2000 notes were also used widely by the fake currency mafia. Most of the

fake money

seized in the last three years was in the Rs 2000 denominations, according to a report by Business Standard. In 2021, fake Rs 2000 notes whose value was Rs 4,84,78,000 crore were seized. Around 2,44,834 lakh fake notes of Rs 2,000 were seized in 2020 and 90,566,000 notes in 2019. Since the printing of the notes stopped in 2019, they would have gone out of circulation. But it could be a way to expose those hoarding black money. They are bound to get exposed if they go to deposit large sums in the bank. Also read: India scraps the Rs 2000 note: Will this affect the economy?

What does the RBI say about black money? The RBI chief denied that one of the reasons the notes were being withdrawn was because they could be easily counterfeited. He said that the security features of the notes were not breached but added that high-value notes were prone to be cloned. Will large deposits come under the scanner? India’s biggest public bank, the

State Bank of India

, has said that no form or slip would be required while exchanging or depositing Rs 2,000 notes. People can

exchange

2,000-rupee notes up to Rs 20,000 any number of times in a day. When asked how the government would monitor black money without identification, the RBI governor said, “We have asked banks to follow their existing procedure. We have not asked them to do anything differently.” [caption id=“attachment_12632042” align=“alignnone” width=“640”]

RBI governor Shaktikanta Das speaks to the media in Mumbai, assuring people not to panic over the withdrawal of the Rs 2000 notes. PTI[/caption] The Rs 2000 notes were also used widely by the fake currency mafia. Most of the

fake money

seized in the last three years was in the Rs 2000 denominations, according to a report by Business Standard. In 2021, fake Rs 2000 notes whose value was Rs 4,84,78,000 crore were seized. Around 2,44,834 lakh fake notes of Rs 2,000 were seized in 2020 and 90,566,000 notes in 2019. Since the printing of the notes stopped in 2019, they would have gone out of circulation. But it could be a way to expose those hoarding black money. They are bound to get exposed if they go to deposit large sums in the bank. Also read: India scraps the Rs 2000 note: Will this affect the economy?

What does the RBI say about black money? The RBI chief denied that one of the reasons the notes were being withdrawn was because they could be easily counterfeited. He said that the security features of the notes were not breached but added that high-value notes were prone to be cloned. Will large deposits come under the scanner? India’s biggest public bank, the

State Bank of India

, has said that no form or slip would be required while exchanging or depositing Rs 2,000 notes. People can

exchange

2,000-rupee notes up to Rs 20,000 any number of times in a day. When asked how the government would monitor black money without identification, the RBI governor said, “We have asked banks to follow their existing procedure. We have not asked them to do anything differently.” [caption id=“attachment_12632042” align=“alignnone” width=“640”] An army personnel stands guard outside the RBI headquarters, in Mumbai. The central bank introduced the Rs 2000 notes after demonetisation and stopped printing them in 2018-2019. File photo/PTI[/caption] According to an NDTV report, to the question of whether large deposits would come under the scanner, he said, “RBI never scrutinises deposits in banks. The income tax departments do that. Banks have a reporting system, and they will take care of this.” What happens to the Rs 2000 notes after 30 September? From 23 May to 30 September, people can start approaching banks to give up the high-value currency. However, Das said that the notes would be legal even after the deadline. The September date was announced only so that people would take the exercise seriously and make efforts to return the notes.

An army personnel stands guard outside the RBI headquarters, in Mumbai. The central bank introduced the Rs 2000 notes after demonetisation and stopped printing them in 2018-2019. File photo/PTI[/caption] According to an NDTV report, to the question of whether large deposits would come under the scanner, he said, “RBI never scrutinises deposits in banks. The income tax departments do that. Banks have a reporting system, and they will take care of this.” What happens to the Rs 2000 notes after 30 September? From 23 May to 30 September, people can start approaching banks to give up the high-value currency. However, Das said that the notes would be legal even after the deadline. The September date was announced only so that people would take the exercise seriously and make efforts to return the notes.

A series of MythBusters posted by MyGovIndia, the official citizen engagement platform of the Government of India, tweeted, “The ₹2000 notes will continue to be legal tender even after September 30, 2023. Your currency remains valid, so keep calm and let’s bust the panic!” With inputs from agencies Read all the Latest News , Trending News , Cricket News , Bollywood News , India News and Entertainment News here. Follow us on Facebook , Twitter and Instagram .

)