Markets all over the world, including Wall Street, are breathing a sigh of relief after tech giant Nvidia released its quarterly results today (20 November). The BSE Sensex was trading at 85,555.74, up 369.27 points or 0.43 per cent, while the NSE Nifty50 was trading at 26,171.55, up 118.90 points or 0.46 per cent earlier today.

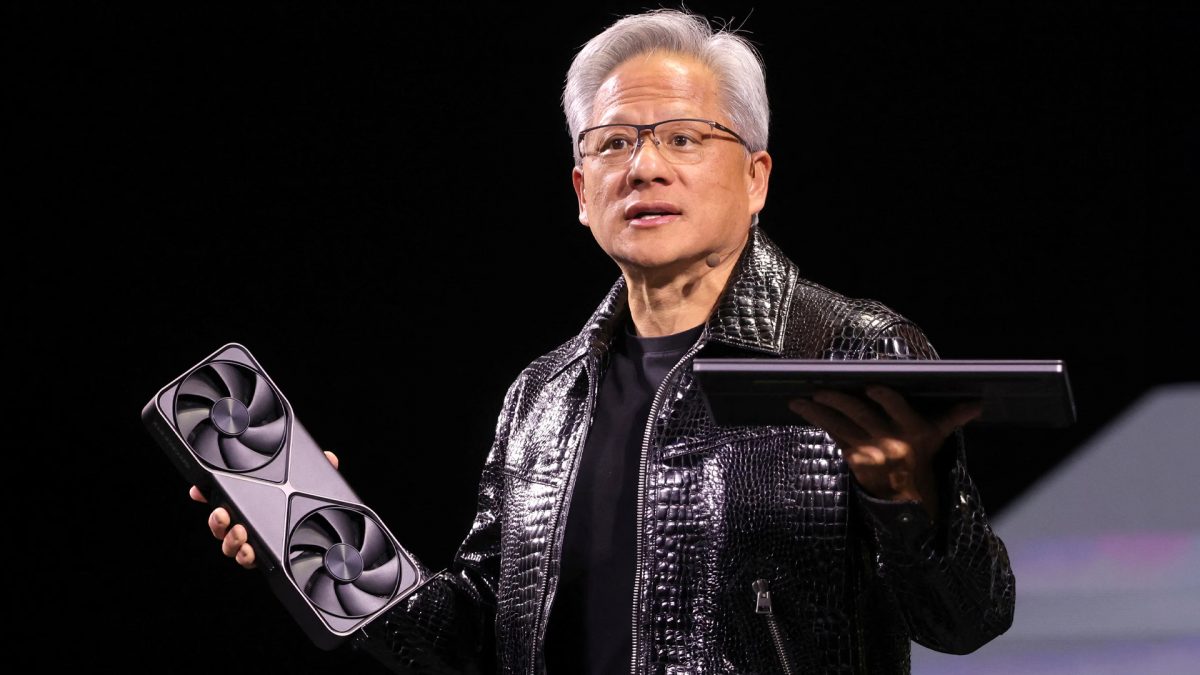

The tech firm, headed by CEO Jensen Huang, recently became the first company in history to briefly cross the $5 trillion (Rs 442.9 lakh crore) valuation mark.

“There’s been a lot of talk about an AI bubble. From our vantage point, we see something very different,” Huang told investors on a conference call. “We’re in every cloud. The reason why developers love us is because we’re literally everywhere. We’re everywhere from cloud to on-premise to robotic systems, edge devices, PCs, you name it. One architecture. Things just work. It’s incredible."

However, over the past few months, many were increasingly beginning to wonder if the stock markets, particularly in the United States, are being propped up by an artificial tech bubble and whether the promise of what artificial intelligence (AI) can deliver, at least in the short term, has been wildly overblown.

But what do we know about the Nvidia earnings? Why are markets breathing a sigh of relief?

Nvidia’s big booming quarter

Nvidia announced its third quarter earnings for the fiscal 2026. Revenue for the quarter touched $57.0 billion (Rs 5.05 lakh crore). This is a massive 62 per cent increase from the same period last year. This was also a 22 per cent increase from the prior quarter.

Nvidia’s net income jumped 65 per cent in the third quarter, hitting $31.91 billion (Rs 2.83 lakh crore). This figure was $19.31 billion (Rs 1.71 lakh crore) over the same period last year. Most of Nvidia’s revenue in this quarter, $51.2 billion (Rs 4.54 lakh crore), came from its primary data centre division. Experts had predicted that Nvidia would generate around $49.3 billion (Rs 4.37 lakh crore) from its data centres.

Gaming PC chips, meanwhile, accounted for just $4.3 billion (Rs 38,1,000 crore) – a sea change from a few years ago when it once comprised the bulk of Nvidia’s revenue. Analysts had predicted revenue from gaming chips to be around $4.4 billion (Rs 38,9,000 crore).

Meanwhile, the company also projected a revenue of $65 billion (Rs 5.76 lakh crore) in sales for the fourth quarter with a margin of error of around 2 per cent. Analysts had predicted Nvidia would generate around $62 billion (Rs 5.49 lakh crore) in its fourth quarter. Nvidia also said that it had paid out around $37 billion (Rs 3.28 lakh crore) to shareholders via dividend and repurchases in nine months of this fiscal year. It still has around $62.2 billion (Rs 5.51 lakh crore) available under its share repurchase authorisation.

Huang, who also founded Nvidia, noted, “Blackwell sales are off the charts, and cloud GPUs are sold out.”

“Compute demand keeps accelerating and compounding across training and inference, each growing exponentially. We’ve entered the virtuous cycle of AI. The AI ecosystem is scaling rapidly with the emergence of new foundation model makers and AI start-ups across multiple industries and in numerous countries. AI is going everywhere, doing everything, all at once.”

Nvidia shares, which had been down 8 per cent prior to the earnings call, rose by five per cent after the announcement. Shares of the tech giant are up 39 per cent thus far in 2025. Over the last few years, Nvidia shares have risen by an incredible 1,200 per cent.

Nvidia’s net income increased 65 per cent in the quarter, rising to $31.91 billion (Rs 2.83 lakh crore), up from $19.31 billion (Rs 1.71 lakh crore) in the same period last year.

Huang has said Nvidia has around $500 billion (Rs 44.3 lakh crore) in orders for its chips for this year and the next. “This is how much business is on the books. Half a trillion dollars’ worth so far,” Huang said.

Why markets are breathing a sigh of relief

Because, as many have pointed out, much of the gains over the past few years in the markets have been on the back of the tech companies. Nvidia’s performance comes as a riposte to many of those critics of AI.

Dan Ives, managing director at Wedbush Securities financial group, told CNBC, “This was a golden quarter for Nvidia with demand massive and well above Street whisper numbers."

“These numbers validate the AI revolution is still in its early days and send the bears back into hibernation mode.”

“This is a ‘So goes Nvidia, so goes the market’ kind of report,” Scott Martin, chief investment officer at Kingsview Wealth Management, told Bloomberg.

More and more people, including investors and critics, were growing concerned that AI is in a bubble. Julian Emanuel, Evercore ISI’s chief equities strategist, summed up the mood, telling Financial Times that the “angst around ‘peak AI’ has been palpable”.

Nvidia “delivered yet another master class in AI dominance,” said Tony Sycamore, market analyst at IG in Sydney.

“We think the investment boom has room to run,” Goldman Sachs researchers wrote, as per CNBC.

Critics not impressed

However, not everyone is convinced that fears of an AI bubble have been overblown.

After all, companies have shovelled hundreds of billions of dollars into AI, and people like OpenAI CEO Sam Altman have taken on the role of evangelists – with no sign on the horizon yet that it can generate anywhere close to the type of returns needed to justify such massive investment.

Critics have noted that a handful of these major tech companies are making billion-dollar deals among themselves – for example, Nvidia’s $10 billion (Rs 8.87 lakh crore) commitment along with Microsoft to fund AI software Anthropomorphic. This, they claim, is a sort of circular play that keeps passing money from one hand to the other and propping up the value of the companies.

“It goes to show how sentiment has turned more negative in the last few weeks, with the circular AI deals being treated with increasing caution as the conversation around a potential bubble has gathered pace,” Deutsche Bank analysts wrote in a note published Wednesday.

Altman himself had to backpedal after it was reported that OpenAI was seeking guarantees from the US government to act as a backstop – essentially to bail them out if things went horribly wrong. Investors and even some from the industry are seemingly growing concerned about the hype around AI.

Michael Burry, who gained fame for shorting the stock market in 2008 – events that were later immortalised in the movie The Big Short – has been cryptically warning of an AI bubble. Last month, he announced that he was closing his hedge fund firm, Scion Asset Management.

Earlier this week, Google CEO Sundar Pichai warned of irrationality in AI optimism, even as he said humanity was living through an “extraordinary moment”. “I think no company is going to be immune, including us,” Pichai said, recently cautioning.

“The concern that AI infrastructure spending growth is not sustainable is not likely to ebb,” Stifel analyst Ruben Roy said.

“While results and outlook were stronger than consensus expectations, we think investors will remain concerned about the sustainability of its customers’ capex spending increase and the circular financing in the AI space,” added Kinngai Chan, analyst at Summit Insights.

“While GPU demand continues to be massive, investors are increasingly focused on whether hyperscalers can actually put this capacity to use fast enough,” said Jacob Bourne, an analyst with eMarketer. “The question is whether physical bottlenecks in power, land, and grid access will cap how quickly this demand translates into revenue growth through 2026 and beyond.”

It remains to be seen who emerges on top – the AI bulls or the stock market bears.

With inputs from agencies

)