Will India see a gold rush this Diwali?

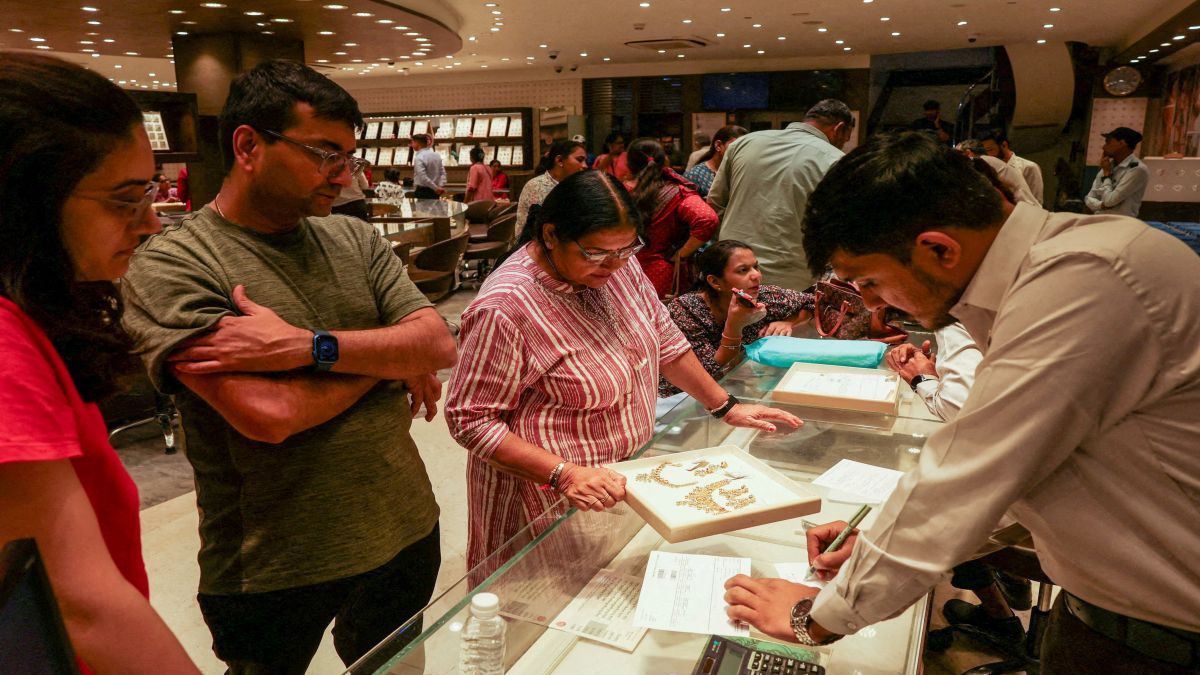

With Dhanteras, the beginning of the Diwali festivities scheduled for October 18, everyone is readying themselves to buy gold and silver as it is considered an auspicious time to do so. However, as the cost of the yellow and white metal (silver) keeps rising, there’s uncertainty if the public will indulge.

As we prepare for Diwali, here’s everything you need to know — from how expensive is gold and silver to whether purchasing the precious metals make sense this festive season.

Dhanteras and tradition of buying gold

Dhanteras, also known as Dhantrayodashi, is the beginning of Diwali festivities in India. This year, it will be observed on October 18. Dhanteras is dedicated to Goddess Lakshmi (wealth and prosperity), Lord Dhanvantari (divine healer) and Lord Kubera (treasurer of the gods).

On this day, traditionally people buy gold or silver, as it is believed to be auspicious. Many note that the tradition is linked to Lord Dhanvantari, the deity of health and wealth, making gold purchases a way to seek blessings for the coming year.

“Purchasing gold coins and bars during the auspicious festive season of Dhanteras continues to hold immense significance in our culture. Dhanteras marks the beginning of Diwali and purchasing gold is a traditional custom, symbolising prosperity and well-being, either for oneself or as a gifting option. It is also associated with Goddess Lakshmi and Lord Dhanvantari, who are linked to wealth and health. Purchasing even a small gold coin during this auspicious time symbolises inviting abundance and long-term prosperity. Gifting gold at this time gives an enduring emotional and spiritual meaning,” Samit Guha, Managing Director & CEO, MMTC-PAMP, was quoted as telling Upstox.

Gold and silver prices reach sky high

However, this year Diwali celebrations are under a cloud as gold and silver continue their bull runs, surging to new peaks.

Gold prices in India hit a new lifetime high of Rs 1,28,395 per 10 grammes on Thursday (October 16). Internationally too, gold touched a new peak above $4,300 an ounce on Friday, marking its best weekly performance in five years.

Similarly, silver prices too are soaring — hitting Rs 1,64,660 per kilogramme. In the global markets, the white metal surged past $54 an ounce, breaking its all-time record from 1980.

But why are the prices breaking records? Experts point to a number of factors for the rise in bullion prices. Sustained central bank buying, increased investments in gold-backed ETFs, and a series of rate cuts by the US Federal Reserve is one of the reasons the yellow metal is seeing such a surge in costs. There’s also the safe-haven demand that has increased recently, driving up the price of gold and silver.

“Price surged after US President Donald Trump reignited trade tension on Friday by threatening to impose tariffs of up to 100 per cent on Chinese imports and tighten export controls on critical technology,” said Tejas Shigrekar, Chief Technical Research Analyst at Angel.One to Republic News.

This, coupled with the ongoing US government shutdown has spooked investors and driven them toward safe-haven asset, said Sugandha Sachdeva, Founder of SS WealthStreet.

And there seems to be no signs of the prices of gold and silver reducing anytime soon. Some experts expect gold to trade between Rs 1,20,000–Rs 1,30,000 per 10 grammes this Dhanteras, with a potential target of $4,150–4,250 per ounce. “We may even see Rs 1,50,000 in early 2026,” Vandana Bharti, Head of Commodity Research at SMC Global Securities, told Moneycontrol.

Silver too has seen a surge in prices due to a demand supply mismatch.

As a result of this, many are wondering how to buy gold this Diwali. In fact, many are rethinking their purchases with some considering silver to be a better alternative. Many jewellers are noting that an increasing number of customers are already asking for silver than gold at their stores. Bullion market trader Ratan Jain told PTI, “People are attracted by the rise in silver prices over the past year. Obviously, the expectation of good returns is driving the increase in silver investment.”

To buy or not to buy

In light of these circumstances, many are wondering if they should buy gold or silver this Diwali — that is if they can afford it.

Analysts note that the intent behind the buying would decide the answer. Suvankar Sen, MD and CEO of Senco Gold and Diamonds told India Today, “For purchases tied to weddings, Dhanteras, or gifting, cultural and emotional value usually outweighs short-term price concerns. Customers still want to mark special occasions, even when rates are high.”

However, if one’s intent is investment-driven then a staggered approach is better. “Some may prefer to buy in phases rather than wait for a dip, especially given the unpredictability of macroeconomic signals. This strategy helps reduce timing risk while still maintaining exposure.”

Even Puneet Singhania, Director at Master Trust Group, told Moneycontrol, “For those investors who wish to get exposure this Diwali to these metals, taking a staggered investment route through gold/silver ETFs or mutual fund will be an efficient means of dealing with volatility and possible corrections following such a dramatic rally while still capturing long-term trend.”

Anuj Gupta, Director at Ya Wealth Global, was quoted as saying: “There’s no need to rush into buying gold right now. Experts anticipate that gold prices might undergo a correction after the Diwali festival. This potential dip could present a better opportunity to enter the market. So, it might be wise to wait until after Diwali before starting your gold purchases, allowing you to potentially buy at more favourable prices.”

Digital gold sees a boom

Experts have noted that this time around, there’s a shift from physical gold to digital — we are talking about gold ETFs. According to data from ICRA Analytics, inflows into Gold Exchange Traded Funds (ETFs) have surged over six-fold in September 2025, touching Rs 8,363 crore, compared to Rs 1,232 crore during the same month last year — a 578 per cent jump year-on-year.

And experts note that this Dhanteras, one should take a balanced approach: digital gold for flexibility and physical gold for legacy. That’s the way, experts believe, one will hedge both volatility and tradition.

With inputs from agencies

)

)

)

)

)

)

)

)

)