China will celebrate Singles’ Day on November 11.

This day, which is described as the world’s biggest shopping event, first began being celebrated decades ago. It was originally conceived as a celebration of singlehood as a counter to the Western Valentine’s Day.

However, with November 11 still weeks away, the shopping and sales have already begun. Singles’ Day comes just weeks after the country celebrated ‘Golden Week’, which Chinese officials had hoped would dig the economy out of its hole.

But what do we know about Singles’ Day? And why has it started five weeks early this year?

Let’s take a closer look.

What is it?

The idea for Singles’ Day traces its origins to China's Nanjing University in 1993. It was originally known as “Bachelor’s Day.” The date itself, 11/11, is thought to represent singlehood. It witnessed people, mostly men, showering themselves with gifts and presents and also organising social gatherings and parties.

A US-based podcaster previously told Time Magazine that the day was pushed at a time when China had little idea about dating. It came about as a result of growing exposure to Western culture. While society focused on families and couples, the day became a way for single people to revel in their identities.

In recent years, Singles’ Day has been pushed by Chinese firms like Alibaba as a counterpart to Amazon’s Prime Day or Black Friday in America, which is the biggest shopping day in the country. The Chinese firms often get high-profile celebrities like Taylor Swift to kick off the day with a performance.

It was Alibaba in 2009 that kicked off the shopping on Singles’ Day with a 24-hour sales festival. Its tagline for the event read: “Even if you don’t have a boyfriend or girlfriend, you can at least shop like crazy.” Today, other players such as JD.com and PDD Holdings-owned Pinduoduo have also joined in alongside Alibaba-owned Tmall and Taobao.

The sales during Singles’ Day account for hundreds of billions of dollars. In 2023, sales of goods on Singles’ Day, which was estimated at $156.4 billion (Rs 13.77 lakh crore), eclipsed the $38 billion (Rs 3.35 lakh crore) US shoppers spent during Cyber Week – from Black Friday to Cyber Monday.

In 2022, the sales figure for Singles’ Day was even higher at $157.97 billion (Rs 13.91 lakh crore). According to Coresight Research, Alibaba and JD.com alone sell more than Black Friday and Cyber Monday combined.

From 2014 until 2021, Singles’ Day grew around 34 per cent a year compared to 17 per cent for Cyber Week, data from Bain and Adobe Analytics showed. But some argue Singles’ Day has been losing its lustre in recent years. According to the data, the increase in sales from 2022 to 2023 — just two per cent — was the lowest ever.

Other similar events including the “618” sales that occur mid-year, the country’s second-biggest festival, are also affecting Singles’ Day.

“Vendors are becoming more rational, gross merchandise value is not the core pursuit, profit is,” said Lu Zhengwang, an independent e-commerce expert. “However, profit is hard to reach, the competition is still super intense, and only the cheaper price sells.”

Why shopping has begun early

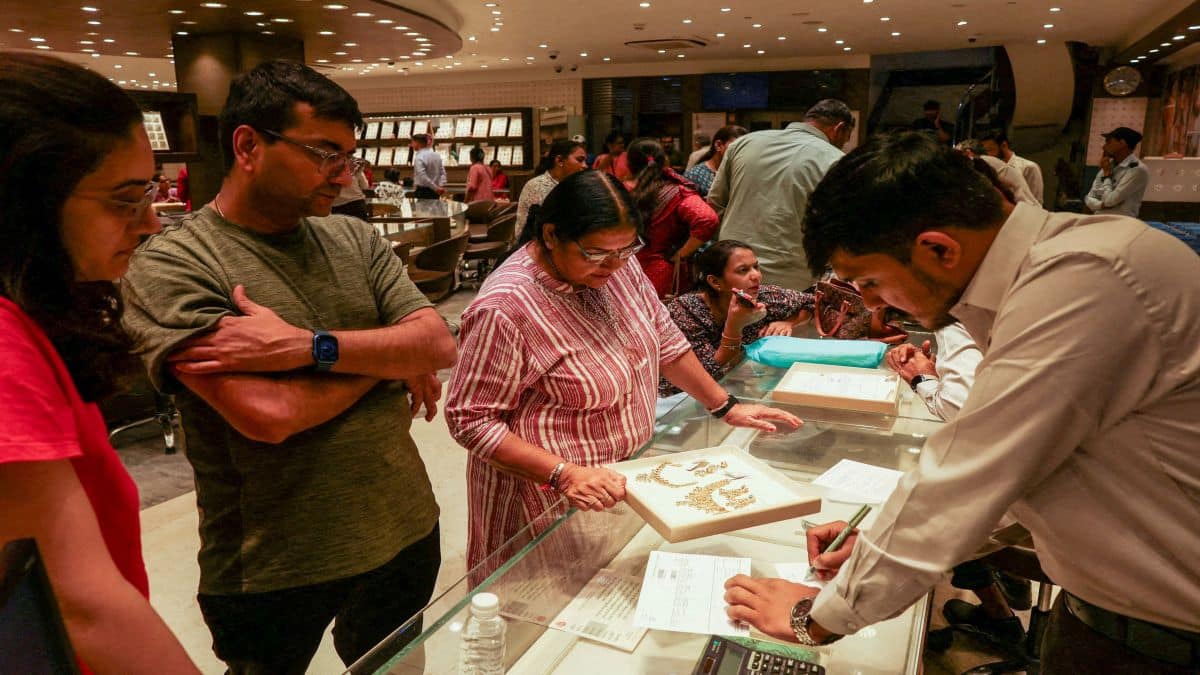

The event has begun early this year as Chinese firms are hoping that consumers will spend big. This comes as the country has witnessed its economic growth slowing, as consumer sentiment remains sluggish.

China has witnessed a slowdown in its real estate sector with giants going under, local governments are struggling for cash, and President Xi Jinping is cracking down on the affluence of party officials.

China’s ‘Golden Week’, which took place from October 1 to October 8, saw spending dip to a three-year low. This despite a massive push from authorities and hundreds of millions of people travelling across China. In fact, a total of 888 million trips were made during the holiday, as per the Culture and Tourism Ministry. That was up from 765 million trips over the same period in 2024.

However, average spending per trip during the holiday in 2025 actually fell, touching $113.52 (Rs 9,998) – 0.55 per cent lower than the same period in 2024. That was the lowest since 2022, when spending fell to $95.54 (Rs 8,411) during the COVID-19 pandemic lockdowns.

China’s commerce ministry had also unveiled a slew of measures to boost consumption, with a focus on expanding its services sector and subsidies for businesses. However, none of these efforts seemed to have found favour with customers.

“It has been less exciting than ever,” said Deng Lei, a 49-year-old who runs ameditation studio in Beijing. “The only thing I’m looking for is a pair of comfortable sports shoes, but I haven’t spotted any I really like yet.”

But that hasn’t stopped several major American firms such as Nike, Estée Lauder, and Procter & Gamble from joining in on the fun in recent years. All these companies have a major presence on Chinese e-commerce platforms such as Tmall and JD.com.

Aggressive discounting has been a hallmark of Chinese shopping festivals, especially since the end of the country’s harsh COVID-19 restrictions in late 2022, with low prices leveraged to manufacture a consumption comeback that hasn’t really materialised.

With inputs from agencies

)

)

)

)

)

)

)

)

)