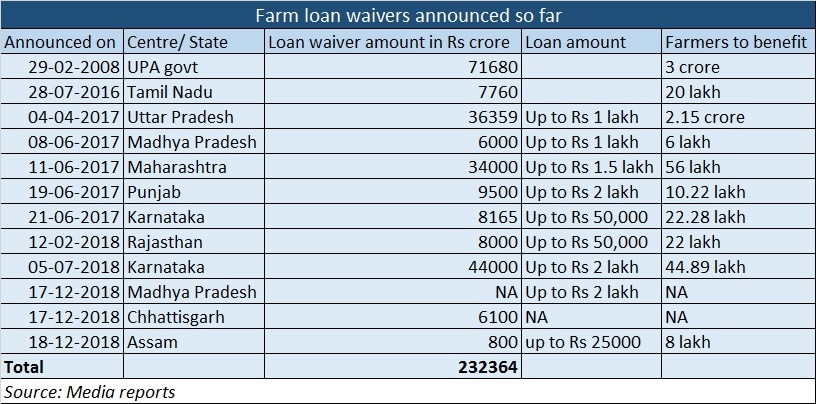

Agricultural distress, farmer suicides and loan waiver announcements dominated newspaper headlines in 2018; and will likely do so in 2019 as well. The suicide-prone Indian farmer doesn’t have a reason yet to begin the New Year on a happy note, except of course a few recent farm loan waiver announcements. But, if loan waivers could do the trick, why did the farmer suicides continue in 2018? To begin with, there is no consolidated, updated data available on farmer suicides in India. Even the National Crime Records Bureau of India data comes with a two-year lag (the latest available is till 2015-end and whatever data is available for 2016 is provisional). But a look at the news reports from agrarian districts in multiple states show us a disturbing picture. They tell us that the trend of farmers resorting to the extreme step of suicide has continued in 2018. According to report by news agency United News of India, some 909 farmers ended their lives in the Marathwada region alone between the first week of January-December. A severe drought situation in this part of the country with an average rainfall just 63 percent in 2018 destroyed the crop pattern, the report said. Are all of them related to agri distress? Not sure. But, chances are that a majority of them are. [caption id=“attachment_5636881” align=“alignleft” width=“380”]  Representational image. Reuters[/caption] Remember, Maharashtra is one of the states that rolled out a farm loan waiver programme for farmers in distress. Continuing suicides despite the rollout of freebies should be an important lesson to the government that waiving off farm loans is hardly a way to address farm distress, either in the short-term or long-term. The problem and the solution lies somewhere else; certainly not in instant debt resolution. If the government is still clueless about the heart of the problem, this report may be of some help. It talks about a farmer getting a paltry sum of Rs 10,000 for selling 27 quintal of onions in Mandsaur mandi in Madhya Pradesh. That works out to less than Rs 4 per kilo. Onion sells at Rs 15-20 per kilo in retail markets. In a separate report, distressed at the falling prices, an onion-grower from Maharashtra who had to sell his produce for little over Re 1 per kg sent his earnings to the Prime Minister to mark his protest, a PTI report said. It’s a mistake to consider these as one-off cases; they symbolise the ground situation in many parts of India. There are many reasons as to why farmers are left with a pitiable sum for their produce. A faulty pricing mechanism, lack of warehouses/ storage facilities and distant _mandi_s make sure farmer gets a raw deal and the profit is pocketed by the middle man. So essentially, the problem faced by the Indian farmer can be categorised as: a) Lack of irrigation facilities in drought-prone areas (if rains fail, everything is lost for the farmer in that year) b) Over-indebtedness (the farmer easily gets loan after loan from all types of banks, but is not in a position to repay), and c) A faulty market infrastructure that fails the crop grower when it comes to pricing. Farmer suicides in India had touched a record high in 2009 and had declined thereafter but since 2013 is showing a rising trend.  Loan waivers grabbed the headlines in 2018 prior to every state election. Of course, the farmer is of value to the vote-seeking politician and there is enough taxpayers money in the coffers to play with. Naturally, a series of loan waiver announcements were made in 2018; the major ones being the packages announced in Karnataka, Madhya Pradesh and Rajasthan. A few other states like the Punjab, Maharashtra and Uttar Pradesh had already announced mammoth packages in the period before that. But as this writer explained in an earlier piece, loan waivers hardly was of any benefit to the struggling farmer, the really needy ones and the landless agriculture labourers. In fact, this effective tools of political populism only helped to put the banking sector in bigger troubles. Most economists have already issued warnings against the implications of the waivers on the broader economy, citing a serious damage to credit culture and the financial health of banks. Besides, the forced loan waivers could also prompt banks to slow lending to farmers in the period ahead owing to the increasing risk on their balance sheets. Not only that, since loan waivers are not a sustainable solution to farmers’ problems and only offers a temporary relief, ultimately these announcements will end up hurting the farmer. If loan waivers could solve the farm sector stress in India, the 2008 UPA waiver would have done the trick.

So, what is the solution? The rot is much deeper in the farm sector on account of multiple factors that call for a structural overhaul to repair damaged farm-infrastructure via a reforms-based approach.

However, the governments are merely relying on temporary solutions in the form of hiking MSPs, offering loan waivers and giving growers hope of unrealistically good days ahead. For instance, promising a doubling of farm income by 2022 without doing any groundwork is nothing but a Utopian idea, especially when a majority of Indian farmers still depend on seasonal rains as the main source of irrigation. The Indian farmer has the smallest landholding the world over. The global average of landholding size is 5.5 hectares. The per capita availability of land in India from 1951 to 2011 declined by 70 percent from 0.5 hectares to 0.15 hectares. Now, what is the problem with holding of smaller pieces of land? It makes the life of the farmer a lot tougher as his costs escalate on all counts—equipment, labour and crop treatment. Unlike rich farmers who own several hectares of land, these farmers will not have enough appeal among bankers as well. What does Year 2019 hold for the farmer? Year 2018 saw no roadmap or innovative thinking from Indian politicians to resolve farmers’ woes. The general theme that played out in 2018 was loan waivers and loan waivers alone. And that arguably benefited politicians to win some votes, but, certainly, not the crisis-ridden farmer. A strong roadmap for structural reforms in the Indian agriculture sector is still awaited. Will Year 2019 be any different for our _kisan_s? Follow full coverage of Union Budget 2019-20 here (Data support from Kishor Kadam)

)

)

)

)

)

)

)

)

)