Stock Market Latest Updates: Indices gain for 3rd straight day, Sensex zooms 223 points, Nifty at 9,580-level; ONGC, Bajaj Auto among top gainers New York: Asian shares were set to dip in choppy trade on Friday as worries about worsening US-China ties offset the fillip from hopes massive government stimulus can jump-start the world economy. E-Mini futures for the S&P 500 ESc1 edged down 0.12 percent in early Asian trade, while Nikkei futures pointed to a loss of 10 points. Weaker Australian stock futures also indicated a softer open. Underscoring the ambivalence in markets, US stocks slid from a near three-month high in a late sell-off overnight, after US President Donald Trump signed an executive order that would weaken laws protecting social media companies, and said he’d hold a news conference about China on Friday. In the latest dispute between the world’s two biggest economies, the US government has signaled plans to punish Beijing for proceeding with a national security law for Hong Kong that critics fear would erode the city’s freedoms. All eyes are now on Friday’s press conference hosted by Trump where he will address his response to China over its treatment of Hong Kong. It is not clear if Trump will rescind some, none, or all of the US economic privileges that Hong Kong enjoys under US law. Larry Kudlow, Trump’s top economic adviser, said on Thursday Hong Kong may now need to be treated like China on trade and other financial matters, which could have implications for tariffs and stock market listings. “Risk appetite quickly disappeared after President Trump announced he would address China tomorrow at a press conference. It didn’t take much to help traders rush to exits,” Edward Moya, a senior market analyst at currency trader Oanda, wrote in a note. If tensions between China and the United States intensify, a build-up of short positions in the S&P 500 index, or bets that the index will fall, could spark a sell-off in shares, Moya added. Stock markets have rebounded from lows hit in mid-March on hopes that enormous government stimulus could help the world economy recover more quickly than expected from the coronavirus shutdown. Some analysts have warned, however, that such optimism is misplaced given the extent of economic devastation. Indeed, the latest US data showed the economy may be stabilising, but at a much lower level. Figures released overnight showed the number of Americans seeking jobless benefits fell for an eighth straight week last week, but claims remained astonishingly high. In a sign investors are undecided about how much risk to take on, prices for safe-haven gold rose, even as the US dollar and Japanese yen — in demand when investors shy from risk — softened. Spot gold was slightly firmer at $1,718.87 per ounce from $1,712.35 seen overnight. The dollar index slipped 0.4 percent to 98.51, held back in part by a stronger euro, as the common currency continued to bask in the glow of a 750-billion-euro coronavirus recovery fund for the European Union. The euro was firm at $1.1073 against the dollar, near a two-month high of $1.1087, while the yen edged down 0.07 percent to 107.07 on the dollar. US Treasury yields were steady after inching higher overnight as gains in stocks softened demand for bonds. Benchmark 10-year yields held at 0.7050 percent. Oil prices gave up some of their gains overnight, as concerns that Trump could impose sanctions on China over Hong Kong and a surprise build in inventories overshadowed a steady improvement in US refining activity. In early Friday trade, US West Texas Intermediate crude CLc1 had slipped 0.18 percent to $33.65.

Stock Market Latest Updates: Indices gain for 3rd straight day, Sensex zooms 223 points, Nifty at 9,580-level; ONGC, Bajaj Auto among top gainers

Stock Market Latest Updates: Indices gain for 3rd straight day, Sensex zooms 223 points, Nifty at 9,580-level; ONGC, Bajaj Auto among top gainers

)

Sensex zooms over 200 points, Nifty at 9,580-level

Benchmark indices rebounded from the losses in early session and ended higher for the third straight day driven by gains in auto, energy and FMCG stocks.

The Sensex zoomed 223.51 points or 0.69 percent to 32,424.10 while the broader Nifty was up 90.20 points or 0.95 percent at 9,580.30 at close.

On the BSE, ONGC was the top gainer jumping over 5 percent. Other gainers included Bajaj Auto, ITC, Sun Pharma, Nestle India, L&T and Hero MotoCorp. Infosys, Axis Bank, Bharti Airtel, TCS and Titan were among the top losers.

On the NSE, IOC, Coal India, Wipro, ONGC and Gail were among major gainers, while losers included Infosys, Adani Ports, TCS, Axis Bank and Bharti Airtel.

Among sectors, except IT other indices ended in the green. BSE Midcap and Smallcap indices rose between 1-2 percent.

NABARD sanctions Rs 1,050 cr credit support to West Bengal

The National Bank for Agriculture and Rural Development (NABARD) has sanctioned credit of Rs 1,050 crore in the current fiscal so far to West Bengal for benefit of farmers and poor people in rural areas, an official said on Friday.

The credit support under special liquidity facility (SLF) will be extended to state cooperative banks, regional rural banks and micro-finance institutions (MFIs), he said.

The NABARD has already disbursed an amount of Rs 720 crore to state coperative and regional rural banks, he said, adding that disbursements to MFIs will commence shortly.

Yes Bank launches overdraft facility against FDs via digital channels

Yes Bank announced the launch of overdraft facility (OD) against fixed deposits (FDs) through the bank’s digital channels – Yes Mobile and Yes Robot to support customers during the ongoing lockdown.

The bank said its customers can now avail instant OD facility on FDs from the safety and comfort of their homes in three simple steps.

Resident individual customers with single holding savings account are eligible to avail this facility for an FD of a minimum value of Rs 50,000 and maximum value of not less than Rs 1 crore for a minimum tenure of 181 days.

Applicable interest rate of 2 percent per annum for individual and 1 percent for senior citizen customers will be charged to customers while they continue to earn on their FDs for applicable rates.

There would be no EMIs and the repayment can be done in lump sum. Further, the Bank will not charge any processing fee and no additional documentation would be required, it said.

Symphony Q4 revenue up

Sensex jumps over 250 points, Nifty close to 9,600-mark

Indices staged a sharp recovery as Sensex jumped 265.78 points or 0.83 percent to 32,466.37 while the Nifty was up 106.45 points or 1.12 percent at 9,596.55 at around 3 pm.

Energy, auto, FMCG and banking shares helped the rally on BSE.

On the BSE, ONGC, Bajaj Auto, ITC, Hero MotoCorp, Nestle India, Maruti and L&T were among the top gainers.

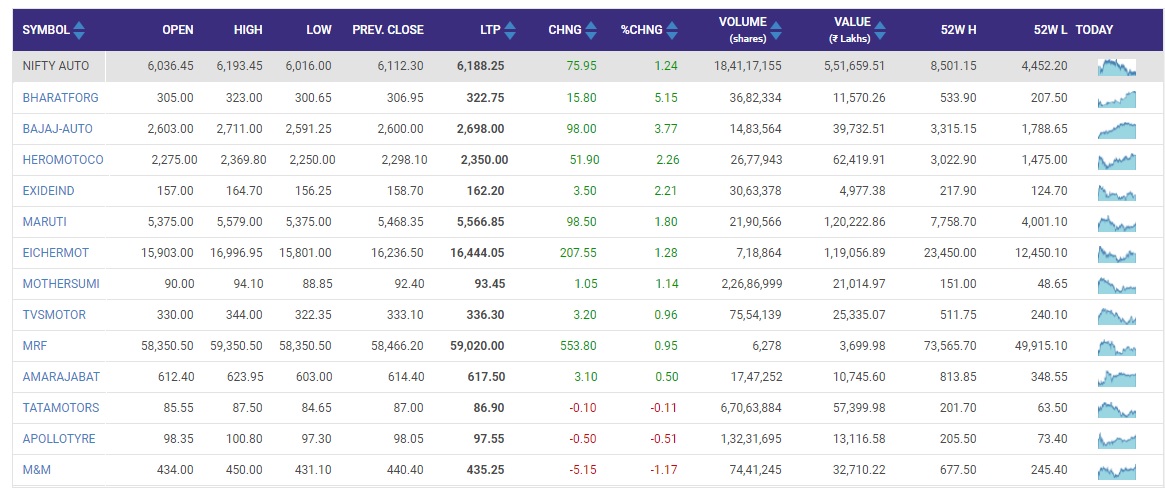

Nifty Auto up over 1%

Two-wheelers, passenger vehicles witness resurgence in inquiries: Motilal Oswal

Leading automobile industry channel partners say that two-wheelers and passenger vehicles are seeing a resurgence in inquiries but commercial vehicles are seeing negligible demand amid the COVID-19 led lockdown, according to interactions done by Motilal Oswal Financial Services.

While the demand for two-wheelers and passenger vehicles is seeing some recovery from semi-urban and rural markets, commercial vehicles have minimal demand due to low economic activity and cautious financiers as many operators have already opted for the moratorium.

Also, financiers currently are stringent and highly risk-averse in lending to commercial vehicles and three-wheelers, said Motilal Oswal Financial Services on Friday.

KPIT Technologies expects 15% dip in June quarter revenues

Automobile industry-focused software exporter KPIT Technologies expects a 15 percent shrinkage in revenues in the June quarter and a difficult first half of the current financial year, a top official has said.

The business should stabilise in the second half of 2020-21 as the world comes out of the COVID-19 pandemic, its co-founder, Managing Director and Chief Executive Kishor Patil told PTI.

He said the automobile industry has been among the worst hit by the pandemic and some players have been left without any revenues for the first quarter.

“We were looking for a high growth in 2020-21 after delivering a 14.5 percent revenue growth in constant currency terms to $303 million in 2019-20. There will be impact to our business, but our long-term strategies are correct,” Patil said.

Bharti Airtel trims losses after Vodafone Idea clarification

Indices rebound, Sensex rises 100 points, Nifty at 9,543

Indices staged a sharp recovery as Sensex rose 100.13 points or 0.31 percent to 32,300.72 while the Nifty was up 52.90 points or 0.56 percent at 9,543 at around 2.35 pm.

ONGC was the top gainer in the Sensex pack rising nearly 4 percnet followed by Bajaj Auto (3.80 percent), ITC (3.33 percent), Nestle India (2.89 percent) and L&T (2.54percent).

The major losers were Bharti Airtel, Infosys, TCS and Tata Steel.

Crisil affirms AA-negative, A1-plus on Vedanta’s debt instruments, bank facilities

Vedanta Ltd said on Friday that Crisil reaffirmed its ratings on the company’s debt instruments and bank facilities totalling Rs 40,303 crore at AA-negative and A1-plus.

Crisil has withdrawn its rating on the Rs 900 crore non-convertible debentures of Vedanta on receiving confirmation of redemption by the trustee.

The reaffirmation of ratings reflects an expectation of sustained operating profitability (earnings before interest, tax, depreciation, and amortisation) in fiscal 2021 despite the weaker outlook for commodity prices, said Crisil.

This is mainly led by the expected improvement in earnings in the aluminium segment aided by lower alumina cost and increased coal and bauxite linkages, and volume growth in the zinc and oil and gas businesses.

Vodafone Idea clarifies on reports of Google stake buy interest

Markets trading flat at half-time

Indian markets at half time are trading on a flat note as it oscillates between 9,500 on the upside and 9,430 on the downside, said Aditya Agarwala, Senior Technical Analyst, YES Securities.

A breakdown from the support of 9,430 will trigger profit booking dragging the Index lower to levels of 9,360-9,300. However, if bulls manage to take the Index beyond the 9,500 resistance mark then the rally will resume extending the gains to levels of 9,580-8,660, he said.

“On shorter time frame thought the rally seems to be fizzling out as RSI has turned lower from overbought zone. Broader markets however are outperforming the headline Indices,” said Agarwala

FMGC, Pharma and Realty stocks are taking markets higher while Bank and IT stock are dragging markets lower. European markets opened with cuts of 1 percent which may keep Indian markets under pressure, he added.

Dilip Buildcon raises Rs 100 cr through NCDs

Highways builder Dilip Buildcon on Friday said it has raised Rs 100 crore through allotment of NCDs on a private placement basis.

The company said it has allotted 1,000 Non Convertible Debentures (NCDs) of face value of Rs 10 lakh each.

“The debenture committee of directors…today allotted 1,000 rated, senior, secured, listed redeemable, NCDs, rupee denominated face value of Rs 10,00,000 at par aggregating to Rs 100 crore in dematerialized form, bearing a coupon rate 8.75 percent per annum annualized to identified investors on private placement basis,” the company said in a BSE filing.

Indian banks’ balance sheet risks rise with increasing lending pressure: Fitch

Indian banks are looking at significant asset quality challenges for at least the next two years despite regulatory measures, according to Fitch Ratings.

Fitch estimates that the impact on impaired loan ratios could be anywhere between 200 to 600 basis points depending on the severity of stress and banks’ individual risk exposures.

The latest set of measures announced by Reserve Bank of India (RBI) includes an extension of the 90-day moratorium on recognition of impaired loans to 180 days in addition to several relaxations in bank lending limits including allowing banks to fund interest on working capital loans.

“These measures will put a heavy onus particularly on public sector banks (with already-weakened balance sheets) to bail out the affected sectors due to their quasi-policy role, considering that much of the state’s recently announced stimulus measures is in the form of new loans,” said Fitch in the report titled ‘Major Indian Banks Peer Review 2020.

IIFL Finance March quarter profit plunges 81% to Rs 59 cr

IIFL Finance on Friday reported 81 percent plunge in March quarter consolidated net profit at Rs 58.91 crore due to provisions related to COVID-19.

The company, which is mainly engaged in financing and investment business, had logged a profit of Rs 305.89 crore in January-March, 2018-19.

Income during March quarter, 2019-20 was down at Rs 1,322.64 crore from Rs 1,441.34 crore in the year-ago period, IIFL Finance said in a regulatory filing.

In 2019-20, the net profit was down by 37 percent to Rs 503.47 crore, while the income fell by 5.2 percent to Rs 4,820.73 crore.

Traders eligible to get Rs 3 lakh cr credit benefit announced for MSMEs: Piyush Goyal

Rupee jumps 14 paise to Rs 75.61 at close

The rupee ended with a gain of 14 paise at 75.61 per dollar on Friday, amid volatile trade seen in the domestic equity market.

The locla unit appreciated 11 paise to 75.65 against the US dollar in opening trade as foreign fund inflows and weak American currency boosted investor confidence.

Forex traders said investors are awaiting the country’s gross domestic product data for the January-March quarter, due later in the day, for further cues.

Economy needs support from PSBs: Union Bank chief

The country’s economy, which has been hit by the COVID-19 outbreak, needs support from the public sector banks (PSBs) to boost credit growth, an official said on Friday.

The number of PSBs has come down after amalgamation of several lenders, and their ability to lend has increased manifold, Union Bank of India MD and CEO Rajkiran Rai G said.

Recently, Oriental Bank of Commerce and United Bank of India were merged into Punjab National Bank, Syndicate Bank into Canara Bank, Allahabad Bank into Indian Bank and Andhra and Corporation banks into Union Bank of India.

He said the lenders will be able to meet the expectations of the business community.

Gold futures rise on spot demand

Gold prices on Friday rose by Rs 130 to Rs 46,535 per 10 gram in futures trade as speculators created fresh positions on firm spot demand.

On the Multi Commodity Exchange, gold contracts for June traded higher by Rs 130, or 0.28 percent, to Rs 46,535 per 10 gram in a business turnover of 2,650 lots.

The yellow metal for August delivery edged up by Rs 158, or 0.34 percent, to Rs 46,651 per 10 gram in a business turnover of 14,366 lots.

Fresh positions built up by participants mainly led to the rise in gold prices, analysts said.

Gold prices traded higher by 0.20 percent at $1,731.70 per ounce in New York.

Customs Duty exemption on medical equipments to fight COVID-19

Decision to open shops in malls soon after taking into account health ministry’s norms: Govt

The decision to open shops in malls, will be taken soon, after taking into account the guidelines of the health ministry, the commerce and industry ministry said on Friday.

Issues of retail traders were discussed in a meeting between Commerce and Industry Minister Piyush Goyal on Thursday with representatives of traders associations through video conferencing.

Regarding some of the hardships being faced by the retail traders even after the relaxations of the guidelines, he said that a majority of shops have been allowed to be opened, without any distinction of essential and non-essential.

Indices erase losses, Sensex down 39 points, Nifty above 9,500-mark

Indices recovered mostly as Sensex was trading 38.66 points or 0.12 percent lower at 32,161.93 while the Nifty was up 14 points or 0.15 percent at 9,504.10 at around 1.40 pm.

Bharti Airtel was the top loser in the Sensex pack slipping nearly 3 percent. Other losers included Infosys, Axis Bank, Titan, M&M and TCS.

Bajaj Auto, ITC, Hero MotoCorp, Nestle India, L&T, Asian Paints, IndusInd Bank and Ultra Cement.

Google mulling stake in VIL positive but inadequate to solve telcos’ debt woes: Analysts

A potential investment by Google into cash-strapped Vodafone Idea (VIL), if materialises, will be a strategic positive for the Indian telecom operator, but a 5 percent stake would be still be inadequate to solve the telcos’ debt problems, analysts said on Friday.

Acquisition of a controlling stake by an outsider or a sizable equity infusion by current promoters remains the need of the hour, Credit Suisse said in its latest note.

Alphabet Inc’s Google is said to be eyeing about 5 per cent stake in VIL, the Financial Times had reported on Thursday. Such an investment in VIL will pit the search giant against Facebook which has picked up a stake in Jio Platforms, the firm that houses India’’s youngest but biggest telecom company – Reliance Jio.

Google investment into VIL can be incrementally positive, but a 5 percent stake is unlikely to move the needle or provide any meaningful relief to VIL’s debt problems, said Credit Suisse.

GST Council needs to decide on tax rates for non-essential items: Govt Sources

China’s PMI to show gradual factory recovery from lockdown paralysis: Report

China’s factory activity likely rose for a third straight month in May as the economy recovered from strict lockdowns implemented to contain the coronavirus outbreak, which has hammered global business activity.

The official manufacturing Purchasing Manager’s Index (PMI), due for release on Sunday, is forecast to rise to 51.0 in May, from 50.8 in April, according to the median forecast of 23 economists polled by Reuters. A reading above 50 indicates an expansion in activity.

Recent PMIs in many other economies have plummeted to previously unimaginable lows.

The Chinese government earlier this month omitted a gross domestic product (GDP) growth target for 2020 in its yearly work report, citing uncertainties brought on by the epidemic.

Hobbled by the coronavirus, China’s economy shrank 6.8 percent in the March quarter from a year earlier, the first contraction since current quarterly records began.

Madras HC issues notices to Franklin Templeton MF, SEBI: Investors Group

Notices have been issued to crisis-hit Franklin Templeton Mutual Fund and SEBI by the Madras High Court after a petition was filed by an investors group to safeguard nearly Rs 28,000 crore of investors’’ money stuck in six schemes shut down by the fund house, according to a statement.

The statement by investors group also said it is separately launching an online petition to bring together all affected investors and the same would be forwarded to the Prime Minister’’s Office as well as the US parent of the fund house and the US markets regulator SEC.

It further said mutual funds and the fund managers should be made to answer questions on their choice of investment, and compliance with regulatory and prudential norms, among others.

In the statement issued on Thursday, the investors group, Chennai Financial Markets Accountability (CFMA), said the Madras High Court on 26 May issued notices to SEBI, Franklin Templeton Asset Management India Pvt Ltd (FTAMC), the trustees of the mutual fund, its President Sanjay Sapre, CIO for fixed income Santosh Kamath and other key management personnel after a Public Interest Litigation was filed by it.

French carmaker Renault announces 15,000 job cuts worldwide

Struggling French carmaker Renault on Friday announced 15,000 job cuts worldwide as part of a 2 billion-euro cost-cutting plan over three years. Renault said on Friday that nearly 4,600 jobs will be cut in France in addition to more than 10,000 in the rest of the world.

The group’s global production capacity will be revised from 4 million vehicles in 2019 to 3.3 million by 2024, the company said.

“The difficulties encountered by the group, the major crisis facing the automotive industry and the urgency of the ecological transition are all imperatives that are driving the company to accelerate its transformation,” the statement said.

Jean-Dominique Senard, chairman of the board of directors of Renault, said, “The planned changes are fundamental to ensure the sustainability of the company and its development over the long term.”

The group, which employs 180,000 workers worldwide, announced the suspension of planned capacity increase projects in Morocco and Romania.

SC agrees to hear Cyrus Mistry’s plea

Sensex down 112, Nifty below 9,500

Indices remained volatile as Sensex was trading 111.81 points or 0.35 percent lower at 32,088.78 while the Nifty was down 6.55 points or 0.07 percent at 9,483.55 at around 12.50 pm.

On the BSE, Infosys, Axis Bank, Titan, Tata Steel, HDFC Bank, Bharti Airtel and TCS were among the top losers.

The gainers included Bajaj Auto ITC, L&T, Hero MotoCorp, IndusInd Bank and Sun Pharma.

Shares of state-run OMCs rise

Japan April household spending slumps: Report

Japan’s April household spending likely tumbled at the fastest pace in decades, a Reuters poll showed on Friday, as the nation’s state of emergency to fight the spread of the coronavirus prompted people to stay home and businesses to close.

The depth of the economic fallout from the pandemic in the current quarter has already been signaled by April data for exports, factory output and the jobs market, with the broader economy having already slipped into recession in the March quarter.

Household spending is forecast to have fallen 15.4 percent in April from a year earlier, the poll of 13 economists showed, heralding the biggest decline since comparable data became available in 2001.

In March, the spending fell 6 percent.

From the previous month, household spending is expected to have fallen 8.7 percent in April from a 4 percent decline in March.

Indonesia imposes tariffs on some textile imports until 2022

Indonesia has imposed tariffs on imports of some textile products for the period until November 2022, according to a finance ministry regulation, in a bid to protect local producers from a surge of imports of fabrics, curtains and yarn.

“Safeguard duties” of up to 11,426 rupiah ($0.7799) per metre have been imposed for textile fabrics in three stages, and the tariff will be gradually lowered by Nov. 8, 2022, said the regulation signed on 27 May and made public on Friday.

Indonesia will also start imposing tariffs on imports of curtains and yarn during the same period.

The Southeast Asian country started an investigation in September last year on the request of the Indonesia Textile Association (API) after a surge in imports of woven fabrics, yarn and curtains.

China’s Geely raises $836 mn from share sale

Geely Automobile Holdings Ltd said on Friday it raised HK$6.48 billion ($836 million) from a share placement as the Chinese automaker looks to replenish its coffers to finance growth in the world’s largest auto market.

Hong Kong-based Geely has sold 600 million primary shares at the bottom of the HK$10.80-HK$11.20 ($1.39-$1.44) price range, or at a 7.85% discount to the last closing price of HK$11.72, according to its release.

The offering represents about 6.1 percent of its enlarged share capital, and the company plans to use the proceeds to support its business development and general growth.

Its share placement comes after China’s economy suffered a 6.8 percent contraction in the first quarter, as the country reeled from an epidemic that started in the central city of Wuhan.

GDP growth in Q4 expected 2.2%

SpiceXpress receives DGCA approval for drone trials

Budget carrier SpiceJet on Friday said its freighter arm SpiceXpress has received approval for conducting drone trials from aviation regulator Directorate General of Civil Aviation (DGCA).

Post trials and approvals, the airline plans to use drones in delivery of essential supplies to remote areas, the company said in a release.

“A SpiceXpress-led consortium had submitted a proposal to the regulator for conducting experimental beyond visual line of sight (BVLOS) operations of remotely piloted aircraft in response to a DGCA notice inviting expression of interest,” SpiceJet said.

Based on the recommendations of the BVLOS Experiment Assessment and Monitoring Committee, SpiceXpress was granted permission for conducting experimental BVLOS operations, it stated.

India uses public digital infra to gain economic goals at home: Envoy Jawed Ashraf

India is using its public digital infrastructure to take a leap into digital economy in a bid to achieve economic goals in the country and connect globally, India’s High Commissioner to Singapore Jawed Ashraf has said.

The envoy further noted that building digital connectivity and partnerships with Singapore and ASEAN countries, is a priority for India and highlighted how technology has been used effectively to achieve public policy goals in the country during COVID-19 disruptions.

“We are using our public digital infrastructure, rated as the largest in the world, to take a leap into digital economy to achieve our public policy and economic goals at home and connect globally," Ashraf told an online Fintech forum this week.

He highlighted India’’s several initiatives with Singapore such as interoperability of payment systems, with Singapore being the first country to see the launch of RuPAY in 2018 and BHIM QR at the Singapore Fintech Festival last year, and said that Singapore’’s NETS cards likely to be accepted in India soon.

Expect higher level of utilisation as demand rises: CEAT CFO Kumar Subbiah

Indices volatile, Sensex falls over 100 points, Nifty at 9,479-mark

Indices continued to stay in the negative zone Sensex was trading 131.45 points or 0.41 percent lower at 32,069.14 while the Nifty was up 11.35 point or 0.12 percent at 9,478.75 at around 11.45 am.

On the BSE, Infosys was the top loser falling nearly 3 percent. Other losers included Titan, Axis Bank, Tata Steel, HDFC Bank, Bharti Airtel and TCS.

Bajaj Auto was the top gainer jumping over 3 percnet followed by ITC, Hero MotoCorp, L&T, IndusInd Bank and Sun Pharma.

Vodafone Idea extend gains, zooms over 30%

Shares of Vodafone Idea on Friday zoomed over 30 percent amid reports that tech titan Google was eyeing a minority stake in the British telecom group’s struggling India business.

Reacting to the reports, stock of the company rallied 30.24 percent to Rs 7.58 on BSE. On NSE, it rose sharply 31.03 percent at Rs 7.60.

)

)