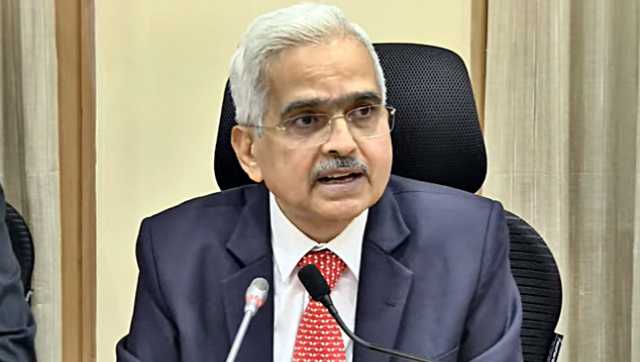

The Reserve Bank of India (RBI) on Wednesday (8 June) raised key repo rate by 50 basis points to 4.90 per cent. “The Monetary Policy Committee (MPC) vote was unanimous and has decided to keep stance withdrawal from accommodative,” RBI Governor Shaktikanta Das said. Today’s rate hike comes on the back of a 40 bps increase effected by RBI at an unscheduled meeting on 4 May. It is also to be recalled that last month, Das had said that another rate hike move at the June policy meeting was a “no-brainer”. The RBI Governor said that the rates have been increased on the back of inflationary pressures and higher supply shocks. He also said that the Russia-Ukraine war has led to globalisation of inflation. “Inflation has steeply increased much beyond the tolerance level. Process of recovery in emerging market economies is also getting affected. But the Indian economy has remained resilient. We have started a gradual withdrawal of the extraordinary accommodation. RBI will continue to be proactive and decisive in mitigating the fallout of geopolitical crisis on our economy. Our steps will be measured, calibrated,” Das said. The Standing Deposit Facility and Marginal Standing Facility rates also raised by 50 basis points. Standing Deposit Facility rate is now 4.65 per cent, while Marginal Standing Facility rate is at 5.15 per cent. GDP Forecast The real GDP forecast for FY23 has been retained at 7.2 per cent. Q1 (April-June) GDP growth forecast at 16.2 per cent, Q2 (July-September) GDP growth forecast at 6.2 per cent, Q3 (October-December) GDP growth forecast at 4.1 per cent and Q4 (January-March 2023) GDP growth forecast at 4.0 per cent. CPI Inflation The RBI Monetary Policy Committee has raised CPI inflation forecast for FY23 to 6.7 per cent from 5.7 per cent For April-June revised to 7.5 per cent from 6.3 per cent, for July-September revised to 7.4 per cent from 5.8 per cent, for October-December revised to 6.2 per cent from 5.4 per cent and for January-March 2023 revised to 5.8 per cent from 5.1 per cent. RBI revises inflation projection for FY23 The RBI on Wednesday also revised inflation projection for FY23 to 6.7 per cent from 5.7 per cent earlier. Inflation likely to remain above 6 per cent in first three quarters of current fiscal. “Our steps will be calibrated, focussed on bringing down inflation to target level,” the RBI Governor said. Inflation projection for April-June has been revised to 7.5 per cent from 6.3 per cent, for July-September it has been revised to 7.4 per cent from 5.8 per cent. Inflation projection for October-December has been revised to 6.2 per cent from 5.4 per cent, while for January-March 2023 it has been updated to 5.8 per cent from 5.1 per cent. Read all the Latest News , Trending News , Cricket News , Bollywood News , India News and Entertainment News here. Follow us on Facebook, Twitter and Instagram.

RBI Governor Shaktikanta Das announced that the central bank’s decision to raise MSF Rate and Bank rate to 5.15 per cent from 4.65 per cent

Advertisement

End of Article

)

)

)

)

)

)

)

)

)