The Reserve Bank of India on Wednesday increased its repo rate by 40 basis points (bps) to 4.40 per cent with immediate effect. The surprise decision was taken by the monetary policy committee (MPC) in an off-cycle meeting with the central board amid rising inflation.

MPC votes unannimously to increase policy repo rates by 40 bps with immediate effect: RBI Governor Shaktikanta Das pic.twitter.com/JWM6ZwKTo3

— ANI (@ANI) May 4, 2022

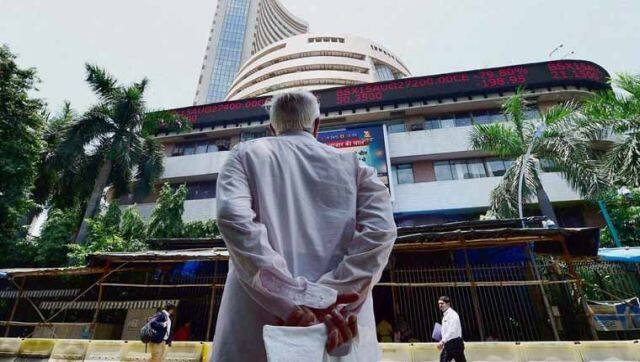

The last time there was a change in repo rate was in May 2020. The lending rate was cut then and has remained unchanged since. The repo rate has been hiked for the first time in four years. It was last increased by 25 bps to 6.50 per cent in August 2018. The central bank also hiked the cash reserve ratio by 50 basis points, RBI Governor Shaktikanta Das said on Wednesday. What is a repo rate? When commercial banks are short on funds, they borrow money from central banks. The repo rate is the rate at which the country’s central bank – the RBI in India – lends money to commercial. It is used by monetary authorities to control inflation, according to The Economic Times. Repo rates are increased by the RBI when there’s inflation. Raising the rates makes borrowing money from the central bank more expensive. Why has the RBI increased the repo rate? RBI Governor Shaktikanta Das said the decision to increase the repo rate was taken keeping in mind the rising inflation, geopolitical tensions, high crude oil prices, and shortage of commodities globally, which have impacted the Indian economy. “The decision today to raise repo rate may be seen as a reversal of rate action of May 2020. Last month, we had set out a stance of withdrawal of accommodation. Today’s action needs to be seen in line with that action,” Das said, according to NDTV. “I would like to emphasise that the monetary policy action is aimed at containing inflation spike and re-anchoring inflation expectation,” he said, adding that “high inflation is known as detrimental to growth”. The RBI on Wednesday cautioned that while the Indian economy appears capable of weathering the deterioration in geopolitical conditions amid the ongoing Russia-Ukraine war, it faces headwinds from global spillovers from geopolitical tensions, elevated commodity prices, and moderating external demand. The RBI Governor also noted that food Inflation is expected to remain high as spillovers from global wheat shortages are impacting domestic wheat prices, even though domestic supplies remain comfortable. Due to the Russia-Ukraine war, edible oil prices may go up as major producing countries have imposed export restrictions, he said, according to NDTV. What happens when the repo rate is hiked? The increase in repo rate will push banks and non-banking financial companies (NBFCs) to hike lending and deposit rates. This means the interest rates on loans will go up. Equated monthly installments (EMIs) on home, vehicle, and other personal and corporate loans are likely to rise. “The increase in the repo rate means that people might have to pay a slightly higher interest rate if they take out a home loan. However, this move may not have a major impact on the home loan market as of now since there are many other factors like demand and supply, and buyers, which play a major role in driving rates. But, if the repo rate hike continues to remain high, then it may have an effect,” Atul Monga, Co-Founder and CEO, BASIC Home Loan, told news18.com. [caption id=“attachment_10633201” align=“alignnone” width=“640”]  RBI’s surprise move caused the markets to crash with investors losing lost Rs 6.27 lakh crore. PTI[/caption] How have markets reacted to RBI’s announcement? Markets crashed after the RBI hiked the repo rate. The Sensex slipped 1,307 points to close at 55,669 and Nifty settled at 16,678. Investors reportedly lost Rs 6.27 lakh crore because of the crash, reports The Times of India. How have experts reacted? “The above 1,000-point crash in Sensex has soured the sentiments on the opening day of India’s largest IPO,” V K Vijayakumar, chief investment strategist at Geojit Financial Services told news agency PTI, as he referred to the Life Insurance Corporation (LIC) IPO opened for subscription today. Rupa Rege Nitsure, group chief economist, L&T Financial Holdings told Reuters news agency that the hike in repo rate and CRR are “the most appropriate steps when the nation is facing galloping inflation and a widening trade deficit”. “These are a kind of emergency measures to control extreme financial outcomes,” she added. “The central bank has to take these steps to prevent an extreme fall in the value of our currency and protect financial stability,” Nitsure said. With inputs from agencies Read all the Latest News , Trending News , Cricket News , Bollywood News , India News and Entertainment News here. Follow us on Facebook, Twitter and Instagram.

)

)

)

)

)

)

)

)

)