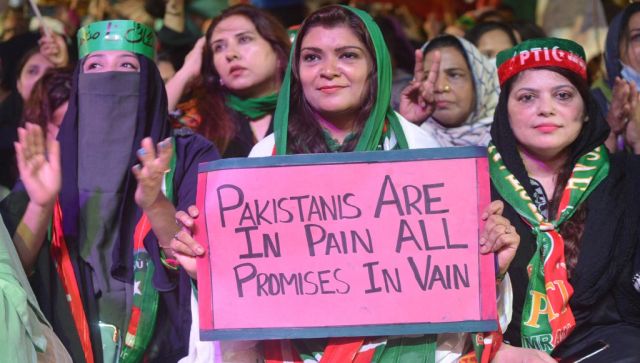

Sri Lanka’s Gotabaya Rajapaksa fled the nation and was forced to resign as president amid the country’s worsening economic crisis. But the island nation’s troubles are far from over. The country faces an acute shortage of fuel, medicine, and food. It has run out of money to purchase these essentials. Public transport has been hit and schools are forced to shut down time and again. The economic crisis in Sri Lanka has a lot to do with the mismanagement of its finances. The 2019 Easter bombings and the COVID-19 pandemic, which hit the country’s tourism economy, made matters worse. The troubles of Sri Lanka came amid a time of instability across the world. The war in Ukraine and the fallout of it has had a ripple effect. The tiny South Asian nation is not the only one suffering. Several developing and underdeveloped nations are on the brink of an economic crisis with the rising dollar suppressing buying power of many currencies in international markets and depleting foreign exchange reserves. We take a look at nations that might just go the Sri Lanka way. Pakistan Not all is well in the neighbouring nation of Pakistan. Last week, the country reached an agreement with the International Monetary Fund (IMF) to resume its loan programme. The country is facing a serious economic crisis since last year. Like Sri Lanka, Pakistan is indebted to heavy loans and investments from China. While Sri Lanka has defaulted on repayment and is already in a debt trap, the investments under the China Pakistan Economic Corridor (CPEC) are a close second. Pakistan has leased some of its big industrial projects to Chinese firms, which has led them to incur more debts. This is the same vicious cycle that Lanka was caught in and then it became impossible to escape. [caption id=“attachment_10926381” align=“alignnone” width=“640”]

Pakistan’s inflation has been soaring. There are fears of it going the Sri Lanka way. AFP[/caption] The rise in the cost of energy imports means the nation could face a balance of payments crisis. The country’s foreign exchange reserves have dwindled to only $9.8 billion, just enough for five weeks’ worth of imports, according to a report in Reuters. Petrol and diesel prices have skyrocketed and Pakistan is reeling under a severe electricity crisis. Poor policy decisions, political unrest in the country and external factors such as external debt, foreign exchange reserves, and inflation are responsible for the deepening economic crisis in Pakistan. Nepal The Himalayan nation is seeing a rise in imports even as forex reserves deplete and there is a growing imbalance in the balance of payments. Prices of essential prices – food and fuel – have risen. Its annual retail inflation accelerated to 8.56 per cent in June, the highest in six years. A rise in imports over the past few months has drained Nepal’s foreign exchange reserves. According to Nepal’s customs department, the country’s total import bill ballooned to Rs 1.76 trillion in the first 11 months of the current fiscal year. The figure represents a staggering year-on-year jump of 27.5 per cent, according to a report in Katmandu Post. Nepal is facing a liquidity crunch and as a result, banks and other financial institutions are struggling to extend loans to productive sectors like the agriculture, tourism, manufacturing, and energy sectors.

Pakistan’s inflation has been soaring. There are fears of it going the Sri Lanka way. AFP[/caption] The rise in the cost of energy imports means the nation could face a balance of payments crisis. The country’s foreign exchange reserves have dwindled to only $9.8 billion, just enough for five weeks’ worth of imports, according to a report in Reuters. Petrol and diesel prices have skyrocketed and Pakistan is reeling under a severe electricity crisis. Poor policy decisions, political unrest in the country and external factors such as external debt, foreign exchange reserves, and inflation are responsible for the deepening economic crisis in Pakistan. Nepal The Himalayan nation is seeing a rise in imports even as forex reserves deplete and there is a growing imbalance in the balance of payments. Prices of essential prices – food and fuel – have risen. Its annual retail inflation accelerated to 8.56 per cent in June, the highest in six years. A rise in imports over the past few months has drained Nepal’s foreign exchange reserves. According to Nepal’s customs department, the country’s total import bill ballooned to Rs 1.76 trillion in the first 11 months of the current fiscal year. The figure represents a staggering year-on-year jump of 27.5 per cent, according to a report in Katmandu Post. Nepal is facing a liquidity crunch and as a result, banks and other financial institutions are struggling to extend loans to productive sectors like the agriculture, tourism, manufacturing, and energy sectors.

Egypt With a debt-to-GDP ratio of about 95 per cent, Egypt has experienced one of the largest outflows of foreign funds this year, totalling $11 billion, according to JP Morgan. Egypt is expected to have to pay $100 billion in hard currency debt over the next five years, including a sizable $3.3 billion bond, in 2024, according to fund management company FIM Partners, reports Reuters. On Sunday, the Egypt government denied rumours that the country was facing shortages of food commodities because of the ongoing global food crisis. The nation has far exceeded its lending quota from the IMF but entered a new accord with the agency which disbursed loans of $20 billion in May 2022. Argentina With global inflation rising and the fear of recession looming large, Argentina’s economy is headed for trouble. In May, the country’s inflation was at 58 per cent. Even in a world where prices are soaring almost everywhere, the South American nation remains an outlier. And things are not getting any better. Domestic inflation is heading towards 70 per cent by the end of the year. Argentina is an important global supplier of soybeans, corn, and wheat. But grain exports are falling in the second half of the year. This will make it difficult for the country to meet targets linked to a $44 billion deal agreed with the IMF. [caption id=“attachment_10926351” align=“alignnone” width=“650”]

Members of social organisations protest on 14 July in Plaza de Mayo square in front of Casa Rosada presidential palace in Buenos Aires, Argentina, to demand that the government expand social plans and take urgent action against high inflation. AFP[/caption] Amid the growing economic worries, the country’s Finance Minister Martín Guzmán quit in early July after a split within the ruling Peronist coalition. Silvina Batakis, who replaced Guzmán, vowed to stick to commitments made to the IMF. However, investors are worried about another sovereign debt default amid galloping inflation and poor public finances, according to The Financial Times. Nicolás Dujovne, former finance minister for the centre-right opposition, told FT the Argentine economy’s problems were deep-seated. “The government has far more problems than the {political} divide: a high deficit, excessive money printing and they’ve lost market confidence.” The country is also witnessing massive protests against the government over inflation, poverty, and unemployment. Nigeria The World Bank recently listed Nigeria amongst the top 10 countries in the world with the worst inflation rate, based on 2021 figures. It ranked eighth on the list with an annual inflation rate of 16.95 per cent. Inflation, debt, and food crisis are pushing the Nigerian economy to the brink of a collapse, Kristalina Georgieva, managing director of the IMF, said. The prices of groceries, beverages, and provisions have more than doubled since last year. Africa’s largest economy had total outstanding debt of $100 billion as of March 31, according to the latest figures from the country’s Debt Management Office. External loans comprising concessional and commercial debt stood at $40 billion, with the balance of $60 billion owed to domestic issuers, reports Bloomberg. “The unexplained government preference of eurobonds at high-interest costs, with the associated exchange rate risk, may likely hurt Nigeria sooner than anticipated,” said Robert Asogwa, a member of the Monetary Policy Committee of the Central Bank of Nigeria. Kenya Kenya is among other African nations on the brink of an economic crisis, according to a report released by Moody’s Investors Service. A collapsing currency and depleted foreign exchange remain a major concern. According to David Rogovic, vice president and senior analyst at Moody’s, the quantity of debt owed compared to reserves and the fiscal difficulties Kenya is facing in managing debt loads make it vulnerable. [caption id=“attachment_10926361” align=“alignnone” width=“640”]

Members of social organisations protest on 14 July in Plaza de Mayo square in front of Casa Rosada presidential palace in Buenos Aires, Argentina, to demand that the government expand social plans and take urgent action against high inflation. AFP[/caption] Amid the growing economic worries, the country’s Finance Minister Martín Guzmán quit in early July after a split within the ruling Peronist coalition. Silvina Batakis, who replaced Guzmán, vowed to stick to commitments made to the IMF. However, investors are worried about another sovereign debt default amid galloping inflation and poor public finances, according to The Financial Times. Nicolás Dujovne, former finance minister for the centre-right opposition, told FT the Argentine economy’s problems were deep-seated. “The government has far more problems than the {political} divide: a high deficit, excessive money printing and they’ve lost market confidence.” The country is also witnessing massive protests against the government over inflation, poverty, and unemployment. Nigeria The World Bank recently listed Nigeria amongst the top 10 countries in the world with the worst inflation rate, based on 2021 figures. It ranked eighth on the list with an annual inflation rate of 16.95 per cent. Inflation, debt, and food crisis are pushing the Nigerian economy to the brink of a collapse, Kristalina Georgieva, managing director of the IMF, said. The prices of groceries, beverages, and provisions have more than doubled since last year. Africa’s largest economy had total outstanding debt of $100 billion as of March 31, according to the latest figures from the country’s Debt Management Office. External loans comprising concessional and commercial debt stood at $40 billion, with the balance of $60 billion owed to domestic issuers, reports Bloomberg. “The unexplained government preference of eurobonds at high-interest costs, with the associated exchange rate risk, may likely hurt Nigeria sooner than anticipated,” said Robert Asogwa, a member of the Monetary Policy Committee of the Central Bank of Nigeria. Kenya Kenya is among other African nations on the brink of an economic crisis, according to a report released by Moody’s Investors Service. A collapsing currency and depleted foreign exchange remain a major concern. According to David Rogovic, vice president and senior analyst at Moody’s, the quantity of debt owed compared to reserves and the fiscal difficulties Kenya is facing in managing debt loads make it vulnerable. [caption id=“attachment_10926361” align=“alignnone” width=“640”]

Kenyans demonstrate on the streets to protest the high cost of food. AFP[/caption] Kenya was reported to be spending almost 30 per cent of its income on interest payments, according to media reports. Since the country now lacks access to financing markets and has bonds worth over half a billion dollars that mature in 2024, this situation is problematic, a Reuters report said. Ethiopia African governments owe three times as much debt to private creditors in the West as they do to China, according to a report by UK-based Debt Justice. Ethiopia faces a double burden of paying up and returning its economy to its pre-Covid GDP growth levels. Its latest budget shows debt reduction will be the priority if the country is to pull back its economic growth and recover from the Tigray conflict. After the civil war broke out in November 2020, it lost billions of dollars and left roads, factories, and airports destroyed. Foreign donors withdrew financial support and Washinton ended Ethiopia’s tariff free-access to the US market, threatening jobs, according to a report in the FT. Ghana Ghana’s annual inflation soared to 29.82 per cent in June 2022, for the first time in 18 years. From transportation to utilities like electricity, gas, and water, the prices of all essentials have escalated in the west African country as it faces worsening economic conditions. The country’s fiscal situation, which was affected by the pandemic, was worsened by the Russia-Ukraine war. Last December, unemployment was at 13.4 per cent, three times higher than ten years ago. The economy is facing a debt crisis because of excessive borrowing. Ghanaians have protested for days in June against the rising cost of living. The government has been able to negotiate an IMF bailout. Panama Year-on-year inflation in Panama of 4.2 per cent was recorded in May, along with an unemployment rate of about 10 per cent and fuel price hikes of nearly 50 per cent since January, reports AFP. Despite its dollarised economy and high growth figures, the country has a high rate of social inequality. Economic woes have led to a shortage of fuel in some parts of the country, and stalls at food markets in the capital have run out of products to sell. [caption id=“attachment_10926371” align=“alignnone” width=“640”]

Kenyans demonstrate on the streets to protest the high cost of food. AFP[/caption] Kenya was reported to be spending almost 30 per cent of its income on interest payments, according to media reports. Since the country now lacks access to financing markets and has bonds worth over half a billion dollars that mature in 2024, this situation is problematic, a Reuters report said. Ethiopia African governments owe three times as much debt to private creditors in the West as they do to China, according to a report by UK-based Debt Justice. Ethiopia faces a double burden of paying up and returning its economy to its pre-Covid GDP growth levels. Its latest budget shows debt reduction will be the priority if the country is to pull back its economic growth and recover from the Tigray conflict. After the civil war broke out in November 2020, it lost billions of dollars and left roads, factories, and airports destroyed. Foreign donors withdrew financial support and Washinton ended Ethiopia’s tariff free-access to the US market, threatening jobs, according to a report in the FT. Ghana Ghana’s annual inflation soared to 29.82 per cent in June 2022, for the first time in 18 years. From transportation to utilities like electricity, gas, and water, the prices of all essentials have escalated in the west African country as it faces worsening economic conditions. The country’s fiscal situation, which was affected by the pandemic, was worsened by the Russia-Ukraine war. Last December, unemployment was at 13.4 per cent, three times higher than ten years ago. The economy is facing a debt crisis because of excessive borrowing. Ghanaians have protested for days in June against the rising cost of living. The government has been able to negotiate an IMF bailout. Panama Year-on-year inflation in Panama of 4.2 per cent was recorded in May, along with an unemployment rate of about 10 per cent and fuel price hikes of nearly 50 per cent since January, reports AFP. Despite its dollarised economy and high growth figures, the country has a high rate of social inequality. Economic woes have led to a shortage of fuel in some parts of the country, and stalls at food markets in the capital have run out of products to sell. [caption id=“attachment_10926371” align=“alignnone” width=“640”]

Protestors block the Pan-American highway in Aguadulce, Panama. The government is facing continuous protests against rising inflation and corruption. AFP[/caption] Thousands have been protesting on the streets for the past two weeks and they have one demand: the government should contain the prices of basic food items. The protests have led to the closing of public schools, suspension of transportation and calls for strikes. Albania Albanians marched in the capital city of Tirana, demanding that the government resign because of alleged corruption and a massive increase in consumer prices. The Albanian central bank announced a 1.25 per cent interest rate increase, while official June inflation was 6.7 per cent, reports Forbes. With inputs from agencies Read all the Latest News

, Trending News

,

Cricket News

, Bollywood News

, India News

and Entertainment News

here. Follow us on

Facebook

,

Twitter

and

Instagram

.

Protestors block the Pan-American highway in Aguadulce, Panama. The government is facing continuous protests against rising inflation and corruption. AFP[/caption] Thousands have been protesting on the streets for the past two weeks and they have one demand: the government should contain the prices of basic food items. The protests have led to the closing of public schools, suspension of transportation and calls for strikes. Albania Albanians marched in the capital city of Tirana, demanding that the government resign because of alleged corruption and a massive increase in consumer prices. The Albanian central bank announced a 1.25 per cent interest rate increase, while official June inflation was 6.7 per cent, reports Forbes. With inputs from agencies Read all the Latest News

, Trending News

,

Cricket News

, Bollywood News

, India News

and Entertainment News

here. Follow us on

Facebook

,

Twitter

and

Instagram

.

)