Pressure arising out of bad loans and slowdown in economic activities continued to weigh on the business of India’s state-run banks in April-June, while private banks emerged relatively unscathed.

The pace of bad loan accretion, however, slowed giving early signals of a gradual reversal in the asset quality scenario, analysts said.

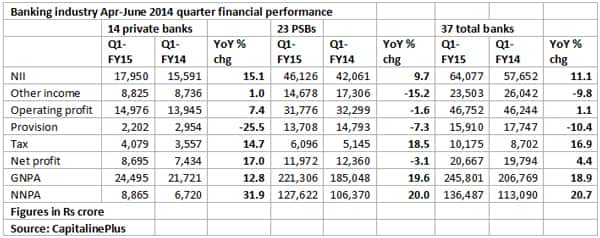

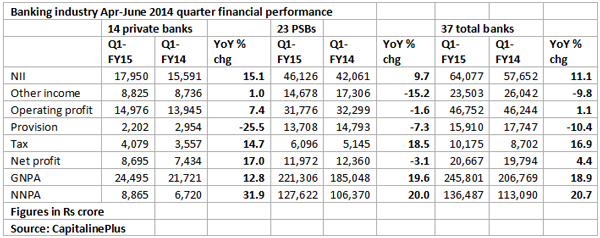

Total gross non-performing assets (NPAs) of 37 commercial banks, which announced June quarter earnings, stood at Rs2.45 lakh crore, up 19 percent, compared with Rs2.06 lakh crore in the year-ago quarter, a FirstBiz analysis showed. In the March quarter, the gross NPAs of these banks had stood at Rs2.37 lakh crore.

What is more important is that of the total bad loans, about 90 percent of the bad loans emerged from state-run banks.

Among the lenders with highest level of bad loans are Central Bank of India (6.15 percent), Andhra Bank (5.98 percent), Indian Overseas Bank (5.84 percent), IDBI Bank (5.64 percent), Allahabad Bank (5.48 percent) and Punjab National Bank (5.48 percent).

A sharp rise in the bad loan levels has been a major concern for policymakers for several quarters.

Besides the bad loans, the chunk of restructured assets too has risen substantially. Total restructured loans under the so-called corporate debt restructuring mechanism alone stood at over Rs 2.5 lakh crore. The actual number of restructured loans will be even higher because banks also do bilateral loan recasts.

A significant portion of stressed assets in the banking system has come from loans given to large companies to fund projects. Many of these projects got stalled due to lack of clearances and economic slowdown, thus impacting the cash flows of companies resulting in repayment delays to banks.

Under norms, if a loan turns bad, banks need to provide between 20 percent and 100 percent of the loan value as provisions depending upon the category of the bad asset. If a new loan is recast, banks need to set aside 5 percent. For a standard loan, the provision is 0.4 per cent of the loan value.

“The good thing in this quarter is that the pace of bad loan accretion is eased in the June quarter. Whether this trend will sustain is to be watched,” said a Mumbai-based banking analyst.

The gross NPAs of 14 private sector banks announced earnings in the June quarter grew by 13 percent to Rs 24,495 crore from Rs 21,721 crore in the same quarter last year, while that of 23 state-run banks grew by 20 percent to Rs 2.21 lakh crore.

Besides the economic slowdown and delayed clearances for projects, another major reason for bad loan accretion is the careless lending and interested-party lending by banks over many years, which has led to huge additions of bad loans, analysts said.

Last week, the Central Bureau of Investigation arrested SK Jain, chairman of Syndicate Bank, for allegedly taking a bribe of Rs 50 lakh to extend credit facilities to private sector companies, Bhushan Steel and Prakash Industries, violating norms. The CBI arrested Bhushan Steel vice chairman and managing director Neeraj Singal in connection with the case.

The CBI has extended the bribery probe to other banks too. Besides the investigating agencies, the Reserve Bank of India (RBI) too has initiated an inspection into the developments that led to the arrest of Syndicate Bank chairman, RBI governor Raghuram Rajan said early this week.

Bankers optimistic

With a stable government at the centre and positive growth indicators, bankers are expecting a reversal in the bad loan scenario, even though no new projects companies are coming up as yet, bankers said.

Talking to reporters on Friday, SBI chairman Arundhati Bhattacharya said the pressure on account of bad loans have begun subsidizing but a stable recovery in the asset quality will depend on how soon the economy revives. “We are not seeing any new projects coming up actually,” Bhattacharya said.

In the June quarter, several banks sold bad assets to asset reconstruction companies to clean up their balance sheets. From a lender, the loan is transferred to a specialist in bad loan management, which issues security receipts that are shown as investments on banks’ balance sheet.

But ultimately, only when the ARC is able to recover loans and pays to the bank is the asset actually resolved. SBI alone sold about Rs 5,566 crore in the June quarter that included Rs486 crore, which are standard.

A significant chunk of the loans that are restructured too run the risk of turning bad in the absence of revival in the economy. “Many loans that would have gone into the bad loan category have been recast by banks. The fate of these loans depends on economic revival,” the analyst quoted earlier said.

(Kishor Kadam contributed to this story)

)

)

)

)

)

)

)

)

)