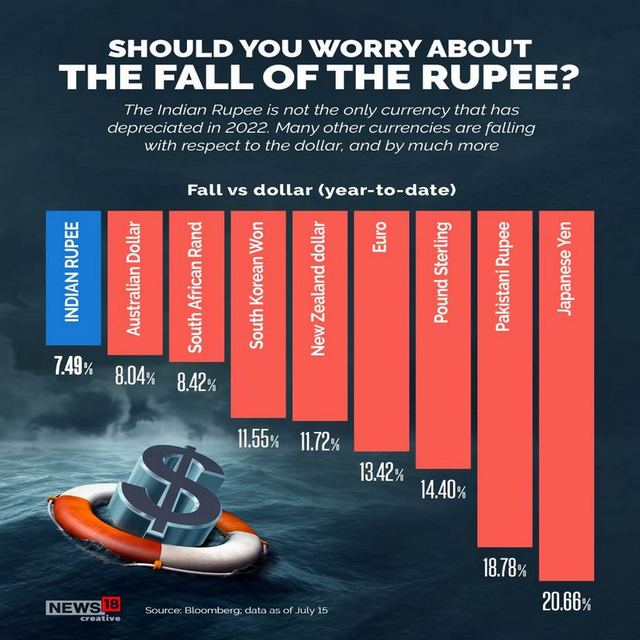

Friday saw the rupee rise seven paise against the dollar but continue to hover near the historic low of 80 against the greenback. While wholesale inflation remained double-digit for 15 straight months to June, expected deterioration in the country’s current account deficit and forex outflows dragged the local unit near to the psychological low level of 80 against the greenback. A sharp correction in crude oil prices in the past few days, however, has been a breather for the Indian currency, analysts said. However, the rupee has held up fairly well against the dollar compared to other currencies in 2022 and also actually appreciated against some. Let’s examine what’s happening and why: Why is the dollar in demand? First, it is important to understand that the dollar is the world’s premier reserve currency and has been for the past 80 years. [caption id=“attachment_10034581” align=“alignnone” width=“640”]  Representational image. News18[/caption] As per Business Standard, the dollar’s strength comes amid the worry over slowing global economic growth, an energy crisis in Europe and aggressive rate hikes by the Federal Reserve. All these have sent investors rushing into the arms of the haven. Experts say that at times of global financial uncertainty, investors shy away from risky assets (read equities) to safer ones (bonds, fixed income assets). Two of these are US Treasuries (bond markets) and the greenback (in currency markets). Currently, with the world seeing a greater risk of recession in the US and across key economies, global investors are rushing to the above two safe assets, and hence, the US dollar has appreciated in value. Why is the rupee falling against the dollar? India’s currency (like a number of other currencies across the world) has gone down in value vis-a-vis the dollar for a slew of reasons including inflation, prolonged COVID-19 lockdowns in China, monetary tightening campaigns of the key central banks, and supply chain disruptions caused by the Russia-Ukraine war. [caption id=“attachment_10916601” align=“alignnone” width=“640”]  The rupee’s performance against the dollar compared to other major currencies.[/caption] There’s nothing anyone can do to prevent this kind of depreciation, experts say. “The Indian rupee has been adversely affected mainly by the FIIs pulling out funds from the equity market, rising crude prices, the deteriorating trade balance and dollar strengthening,” analysts at Emkay Wealth Management were quoted as saying by India Today. Foreign institutional investors have sold local shares worth $28.4 billion so far in 2022 and dumped bonds worth $2.3 billion. “The Indian rupee has continued to move on the downhill journey since the beginning of the year, amid a backdrop of heavy foreign fund outflows from the domestic markets, strength in the safe-haven dollar towards two-decade highs, and firming crude oil prices,” Sugandha Sachdeva, vice president, commodity and currency research, Religare Broking Ltd told India Today. The rupee holds up against the dollar compared to other currencies The rupee has actually held up pretty well against the dollar (which itself has risen 13 per cent in 2022) when compared to the performance of other major currencies including the pound, the euro, and the Japanese yen. As these charts show:

Chart for USD performance against 6 top currencies for the period from January 1, 2021 to July 6, 2022.

— Gaurav Dalmia (@gdalmiathinks) July 8, 2022

Indian Currency did the best among the rest top 5 currencies.

INR down by 8.1%

AUD down by 11.5%

GBP down by 12.0%

NZD down by14.3%

EUR down by 16.9%

JPY down by 23.9% pic.twitter.com/LaLLm6WkE3

Here’s a chart of INR vs USD, EUR, JPY, GBP and AUD. @RahulBajoria_ pic.twitter.com/RpzWTU0DFy

— Rajeev Mantri (@RMantri) July 14, 2022

The rupee appreciates against other currencies The rupee has also appreciated against other major currencies over the past year. As writer and economist Sanjeev Sanyal noted on Twitter:

The Rupee hit 80/US$ today. However, it is appreciating against other majors: 80.2/EUR vs 88 a year ago; 0.58/JPY vs 0.68; 94.3/GBP vs 103.2; and broadly flat to 11.8/CNY vs 11.5 a year ago. RBI is using reserves to smoothen move but correctly allowing mkt adjustment 1/n

— Sanjeev Sanyal (@sanjeevsanyal) July 14, 2022

Sanyal, in a series of tweets, wrote: The macro vitals of the economy in good shape: latest industrial growth reading is 19.6% yoy; bank credit at 13.2%; PMI for services at 59.2; both direct & indirect tax revenues buoyant.” “The only real cause for concern is imported inflation from energy prices. Given oil import dependence, there is little India can do about this in short term beyond some domestic adjustments (say cutting taxes at the margin) but all such measures have a price.” “As a general principle, central banks should avoid defending a hard level. Having spent over 2 decades in financial markets, I learned that it just gives a target to speculators. Better to maintain monetary credibility and let the tide turn in medium term.” What happens next? Though the Reserve Bank of India (RBI) has announced a slew of measures to ease pressure on the rupee, currency traders predict an unfavourable near-term outlook for the domestic currency amid global headwinds. [caption id=“attachment_10761681” align=“alignnone” width=“640”]  Reserve Bank of India. ANI[/caption] As per Moneycontrol, the Indian rupee is likely to depreciate further in the coming days with the exchange rate between 80 and 81 per US dollar. The rupee has actually been one of the best-performing currencies and the stable one out of the Asian currencies, Sugandha Sachdeva, vice-president, commodities and currency research at Religare Broking, told Moneycontrol. This, despite facing several hurdles over the past few weeks. “Rupee being one of the stable currencies, it has further room for depreciation. It may even touch 81 soon,” added Sachdeva. ‘Far better placed than peers’ Experts say the rupee is far better placed than its emerging market peers such as South Africa, Turkey, and key economies in Southeast Asia. [caption id=“attachment_10908961” align=“alignnone” width=“640”]  A cashier changes a 50 Euro banknote with US dollars at an exchange counter in Rome. AP[/caption] First, growth fundamentals are sound with consumer spending in recovery. Second, India also didn’t go overboard on raising debt to spend during the pandemic. While fiscal balances and debt levels may be higher than pre-pandemic levels, they are far more manageable given the size of the economy and the domestic-driven growth. Third, unlike countries like Turkey where the central bank moves on the whims and fancies of the government, the RBI has been proactive enough to tackle inflation and commands a sizeable amount of independence and respect from global investors. Finally, India’s total foreign reserves amount to about $600 billion. That puts it in a stable position to ensure that whether the currency appreciates or depreciates, there is enough intervention using these reserves to keep volatility as little as possible, experts say. With inputs from agencies Read all the Latest News , Trending News , Cricket News , Bollywood News , India News and Entertainment News here. Follow us on Facebook, Twitter and Instagram.

)

)

)

)

)

)

)

)

)