The euro has fallen to two-year lows over the economic woes of the eurozone. The 17-nation currency is trading at a two-year low against the US dollar-1.245 -down over 14 percent over a 12-month period and 6.6 percent lower since the end of March this year to date. The weak euro is, in turn, affecting various asset classes, such as equities, commodities and emerging currencies.

[caption id=“attachment_325782” align=“alignleft” width=“380” caption=“The eurozone economy showed zero growth in the first quarter of calendar 2012 ,and is expected to go into mild recession in the coming quarters. Reuters”]

[/caption]

[/caption]

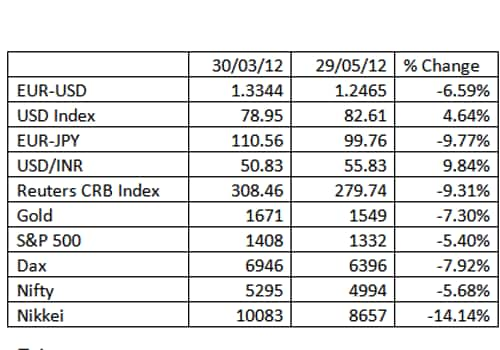

The table below shows the effect of a weak euro on other asset classes.

The 6.6 percent fall in the euro against the dollar since the end of March has been accompanied by a rise in the dollar index and a fall in equity indices ranging from the German Dax to the Indian Nifty. The dollar index, which tracks a basket of seven major currencies, has strengthened while the rupee has fallen close to 10 percent against the dollar. Commodity prices have fallen with the Reuters Jefferies commodity index down over 9 percent and gold down by over 7 percent.

[caption id=“attachment_325788” align=“aligncenter” width=“500” caption=“Source:Bloomberg”]

[/caption]

[/caption]

Will the euroweaken further?

The euro will continue to weaken to levels of 1.15 against the dollar, which represents a fall of 8 percent from current levels. The reason the euro will weaken is that economic conditions in the eurozone will continue to deteriorate, while worries on Spanish debt will weigh on the currency. The ECB (European Central Bank) will pump in more money through the LTRO (long term refinancing operation) leading to markets being flooded with euro liquidity, which has the effect of weakening the euro.

The eurozone economy showed zero growth in the first quarter of calendar 2012 ,and is expected to go into mild recession in the coming quarters on the back of austerity measures adopted by large economies such as Italy, France and Spain. The eurozone’s GDP growth contrasts with US GDP growth of 2.2% seen in first quarter 2012, indicating the strength of the US economy relative to the eurozone.

Spain is struggling with its debt and its ten-year bond yield, at 6.5 percent, is threatening to breach the psychological 7 percent mark, when debt servicing becomes unsustainable.

Spanish banks with exposure to real estate loans in a bubble-burst property market are under scrutiny for their balance sheet weakness. The euro is being dragged lower over the debt woes of Spain. Greece is always a threat to the euro and the threat will not go away unless Greece exits completely or toes the EU line on austerity.

The ECB, which has already pumped in over one trillion euros into the system through the two LTROs in December 2011 and February 2012, will be forced to engage in more rounds of LTROs to stabilise the banking system and prevent bond yields of Spain and Italy shooting up. The ECB will also be forced to play a role in the new growth target plans set by the EU. The ECB will flood the system with euro liquidity, thereby weakening the currency further.

Will other asset classes follow the euro?

The trend of a weak euro bringing down assets classes of equities and commodities and taking up the dollar index will see some breakaways. Equities, especially US equities will tend to go higher on the back of a more resilient US economy. The fact that the US Federal Reserve has kept rates low and liquidity high in the system, and refrained from more quantitative easing is helping the US economy as well as the dollar. The US is also adding jobs every month and its unemployment rate is down to 8.1 percent from levels of 9.5 percent seen in 2011.

Rising US equities will have a positive effect of other equity markets as it is a sign of resilient corporate performance in the face of weak macro economic trends. The Nifty will see stability at lower levels, with a bottom being formed around 4800 levels.

Emerging currencies that have tracked the euro down will also see bottoms forming at lower levels. The interest rate differentials with the US will help currencies such as the rupee. The wide 8 percent difference between the US Fed fund rate and the repo rate will help keep the rupee steady at lower levels, though volatility will be high due to a continuously falling euro. Markets will also have a tendency to start using the euro for carry trades by borrowing cheap Euros at 1 percent (ECB rate) and investing in higher rate-bearing currencies such as the rupee.

Commodities will continue to fall as the euro weakens as drivers of commodities including a weak dollar and strong economic growth are absent. Falling commodity prices will help net oil importers such as the US, Japan, China and India, while countries such as Russia, which are completely dependent on oil exports, will feel the heat.

Arjun Parthasarathy is the editor of www.investorsareidiots.com , a web site for investors.

Arjun Parthasarathy has spent 20 years in the financial markets, having worked with Indian and multinational organisations. His last job was as head of fixed income at a mutual fund. An MBA from the University of Hull, he has managed portfolios independently and is currently the editor of www.investorsareidiots.com </a>. The website is for investors who want to invest in the right financial products at the right time.

)