In recent months, there has been a surge of optimism that the inflation crisis is coming to an end. However, a careful look at the seasonally adjusted data reveals that there is cause for concern.

[caption id=“attachment_278058” align=“alignleft” width=“318” caption=“Table”]  [/caption]

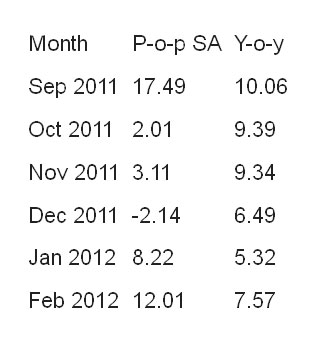

In September 2011, point-on-point seasonally adjusted (annualised) inflation was at 17.49 percent. The year-on-year inflation was running at 10.06 percent.

We then had three good months: October, November and December, where the point-on-point seasonally adjusted (annualised) inflation dropped to 2.01, 3.11 and -2.14 percent. This yielded a sharp decline in the year-on-year inflation to 6.49 percent in December 2011 and further to 5.32 percent in January 2012.

But after that, things haven’t gone well. Point-on-point seasonally adjusted inflation, which is the thing to watch for in understanding what is happening every month, is back up to 8.22 percent in January 2012 and 12.01 per cent in February 2012. Year-on-year inflation is back up to 7.57 percent in February 2012.

A casual examination of the key graph (see below) shows that the worst of double-digit inflation seems to have ended. But we are not inside the target zone of four to five percent, and neither are we likely to achieve this in the rest of this year. It would be unwise to declare victory over the inflation crisis, with this information set in hand.

[caption id=“attachment_278057” align=“alignleft” width=“550” caption=“We are not inside the target zone of four to five percent, and neither are we likely to achieve this in the rest of this year.”]  [/caption]

Looking forward

Looking forward, there are two main problems worth worrying about. The first is the expectations of households. At the heart of India’s inflation spiral is the problem that the man in the street has lost confidence that inflation will stay in the four-to-five per cent target zone. Survey evidence about household expectations has shown double digit values. This generates persistence of inflation; idiosyncratic shocks tend to not quickly die away.

The mistrust of households is rooted in the lack of commitment to low and stable inflation at RBI, and this problem is not going to go away quickly. Despite all the problems faced in fighting inflation, the RBI continues to communicate, through speeches and official documents, its lack of focus on inflation.

The second problem is that of the exchange rate. Exchange rate depreciation feeds into tradeables inflation. With a large current account deficit, with policy impediments putting a cloud on capital inflows, rupee depreciation has taken place and may continue to take place. This would be inflationary. Indeed, if the RBI chooses to cut rates today, there will be further weakening of the rupee (since the interest rate differential will go down thus deterring debt flows), which will further exacerbate tradeables inflation.

The media and financial commentators treat it as a given that the RBI will cut rates today. However, the outlook on inflation is worrisome. India’s inflation crisis, which began in 2006, has not ended. Year-on-year CPI-IW (consumer price index for industrial workers) inflation has not yet got into the target zone of four-to-five per cent, nor is this likely to happen anytime soon.

Our thinking on this needs to factor in the general elections, which are looming at the horizon in May 2014. Given the salience of inflation in India for the poor, the ruling UPA coalition is likely to be quite concerned about getting inflation back to the informal target zone of four-to-five per cent, well ahead of elections. This also suggests that the time for hawkish monetary policy is now, so as to get inflation under control by mid-2013, well in time for elections in mid-2014.

A historical perspective

Inflation went out of control in 2006/2007 because the RBI’s pursuit of the exchange rate peg required very low interest rates at a time when the domestic economy was booming. (The capital controls that were then prevalent failed to deliver monetary policy autonomy; the only way to get towards exchange rate goals was through distortions of monetary policy). Given the lack of anchoring of household expectations, that inflation crisis has not yet gone away. Today, the RBI is substantially finished with exchange rate pegging; we are mostly a floating exchange rate.

In the future, inflationary expectations will not get unhinged owing to a pursuit of exchange rate policy by the RBI. But while a pegged exchange rate pins down monetary policy, a floating exchange rate does not define monetary policy. The RBI has yet to articulate what it wants to do with the lever of monetary policy. The first task for the lever of monetary policy should be the conquest of the inflation that is in our midst, owing to the monetary policy stance of 2006/2007.

In the early 1990s, unsterilised intervention in the pursuit of Rs 31.37 a dollar gave an inappropriate stance of monetary policy, which kicked off an inflation. Dr C Rangarajan wrestled it to the ground, even though the monetary policy transmission was weak then. In 2006, we ignited another inflation, once again owing to exceedingly low policy rates in the pursuit of an exchange rate policy. Dr D Subbarao’s challenge lies in wrestling this to the ground. His job is easier when compared with what Dr Rangarajan faced, thanks to the progress which has taken place on financial reforms and capital account decontrol.

)

)

)

)

)

)

)

)

)