By Shubho Roy and Ajay Shah.

The macroeconomic setting

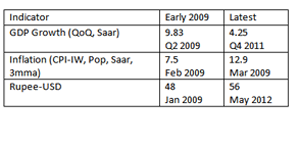

India’s macroeconomic woes consist of high inflation, low GDP growth and a drop in asset prices. The loss of momentum is visible in the seasonally adjusted data (saar):

[caption id=“attachment_330926” align=“alignleft” width=“300” caption=“Table”]  [/caption]

The picture is not uniformly bleak. The most important asset price of the economy, the Nifty, has not dropped across this period. On 1 January 2009, Nifty was at 3,033. Today (28 May), it is at 4,920, which is a good 62 percent higher. More generally, stock prices have held up rather well so far.

The trailing P/E of the broad market index, the CMIE Cospi, stands at 17.3, while the median value across its full history (from June 1990 to April 2012) is 17.83. We may think that conditions in India are difficult, but the stock market is saying that they’re roughly median conditions in terms of the outlook for earnings growth.

The current account deficit

In recent years, the fiscal condition of the government plus PSUs has worsened. This has led to a large gap between savings and investment (the worsening in public finance has diminished savings). There is an accounting identity: The gap between savings and investment is the amount of capital that has to be imported. This is the current account deficit. We have a capital shortfall within India, so we are importing capital.

[caption id=“attachment_330930” align=“alignleft” width=“380” caption=“It is likely that in the coming year, we will have a current account deficit of 4 percent of GDP, or $80 billion a year, or Rs 1,700 crore a day. Reuters”]  [/caption]

It is likely that in the coming year, we will have a current account deficit of 4 percent of GDP, or $80 billion a year, or Rs 1,700 crore a day. This means that we have to worry about how foreign capital views India. Under these conditions, if there is even a short hiccup in capital inflows (as appears to have come about after the government proposed to modify the Mauritius route, and more generally with the problems of governance in India), it yields sharp rupee depreciation.

We import a lot of capital; government policy actions interrupt that flow of capital; the rupee depreciates. This is not misbehaviour of the financial system. The system is not malfunctioning; it is behaving as it should.

What should the responses be?

There are five sensible paths for government to take, in this situation:

- We need to see that at heart, this is a problem of macroeconomics. The root cause of the current account deficit is the fiscal deficit. If we want a lower CAD, we need a lower fiscal deficit.

- To ensure the smooth flow of Rs 1,700 crore a day into the country, we should not spook foreign investors. We should not interfere with the de facto residence-based taxation framework which India is giving foreign investors, as long as they come through Mauritius. This policy framework is, in fact, in India’s best interests.

- Deeper problems about the loss of confidence of foreign investors, owing to governance problems, need to be solved by strengthening governance.

- In the face of these difficulties, it would make little sense for the Reserve Bank of India (RBI) to trade in the currency market, to try to block the rupee depreciation. There is good reason for rupee depreciation; the currency market is doing a pretty good job of translating the fundamentals into a price. And, in any case, even if the RBI desired to do something about it, its weapons are puny when compared with the size of the currency market and the Indian economy.

- It is an opportune time to continue with the liberalisation of the capital account. However, it is useful to think deeply about how to proceed with this. Some kinds of liberalisation can be dangerous. It is important to think about sequencing, and at all times, to worry about unhedged currency exposure. A good deal of expertise has built up on the subject, through the Raghuram Rajan Committee and the UK Sinha Working Group.

An evaluation of what has been done

There are three features of recent policy responses which appear to be on track:

- By and large, RBI’s trading on the currency market appears to be at a low scale, nearing zero in many recent months. This is wise. It increases respect for the brainpower at RBI.

- The government raised the price of petrol, so as to cut the fiscal deficit. This increases respect for the brainpower and political capabilities of the government.

- The government decided to defer the attack on the Mauritius treaty by a year (though not to shelve it altogether). In the absence of clear policy statements about the importance of residence-based taxation, this shelving does not increase respect for the government.

Apart from these three good moves, a slew of dubious ideas have been afoot.

- Enlarging the scope for dollar-denominated borrowing by Indian firms

On 20 April 2012: external commercial borrowings regulations were amended to:

- Increase the limit on power companies to refinance their borrowings in rupees with foreign currency loans (also called external commercial borrowings or ECBs).

- Allow companies to borrow in foreign exchange to make capital expenditure for maintenance and operations of toll systems ( See here)

- Companies were allowed to refinance their ECBs with subsequent ECBs at higher interest rates ( See here).

Evaluation: Do we really want Indian firms to hold dollar denominated debt? In particular, firms in the field of infrastructure who have cashflows in rupees? Sensible firm should see the high ex ante currency volatility and stay away from borrowing in dollars without hedging; so the impact upon capital flows will be small at best. And firms that do borrow in dollars and keep it unhedged are probably not going to fare well.

B. Enlarging the scope for dollar-denominated borrowing by banks

On 4 May, 2012: The maximum interest payable on forex deposits by NRIs in Indian banks was increased ( See here):

- For deposits between 1 to 3 years the increase was 75 basis points.

- For deposits between 3 to 5 years the increase was 175 basis points.

Evaluation: Banks are disaster-prone 19th century institutions. Do we really want them to hold more unhedged foreign currency exposure? Of all places in the economy, this is the worst place to keep unhedged currency exposure. The wise ones will not borrow in this fashion, so the impact upon capital flows will be small at best. And the unwise ones, that borrow in dollars and keep it unhedged, are probably not going to fare well.

C. Reducing the economic freedom of exporters

On 10 May, 2012: the right of exporters to hold foreign exchange was reduced by 50 percent ( See here):

- Exporters were allowed to keep their forex earnings in special accounts called EEFC accounts. They were not mandated to convert it into rupees. This allowed them the ability to fund imports for their business without going through costly conversions.

- Now only 50 percent of their export earnings will be allowed to be kept in forex. The rest will be converted into Rupees against their wishes.

Evaluation: In the old India, Fera made ownership of foreign exchange an exotic and rare thing. Many businessmen in India engaged in import/export misinvoicing and tried to hold assets outside the country. In the early 1990s, C Rangarajan’s RBI embarked on a modern arrangement. Exporters were given greater economic freedom. We are now rolling the clock back by 20 years; we are tampering with current account liberalisation.

The number “50 percent” has not been justified in the RBI notification. Any exporter, with significant raw material import cost will now pay unnecessary transaction charges. In global trade, where every country takes the utmost effort to keep their exports competitive, any small distortion impacts on export competitiveness; this is pushing in the other direction - it is an attempt to reduce India’s export competitiveness.

This is a new low in Indian economic policy. Every internationally oriented household in India will now be more keen to hold assets and liquid balances outside India, safe from the clutches of Indian capital controls. This measure will thus exacerbate capital flight and worsen the problems of the rupee. Success in the marketplace will tend to accrue to businessmen who break laws as opposed to the law-abiding ones.

D. Damaging the currency futures market

On 21 May, 2012: restrictions were put on exchange-traded derivatives ( See here):

- The net overnight open positions that the banks hold shall not include positions in the exchanges.

- The positions in exchanges cannot be used to offset positions in the OTC market for

- The position of banks in currency exchanges shall be limited to $100 million or 15 percent of the market (whichever is lower)

Evaluation: The world over, there is a clear understanding that the exchange is a superior way to organise financial trading. When compared with the OTC market, the exchange has superior transparency and risk management. Policy makers need to continually modify policies so as to favour a migration of all standardised products away from the OTC market to the exchange-traded contracts.

RBI’s moves go in the wrong direction. How do we ensure that the price on a financial market is driven by fundamentals? The answer: We must have a deep and liquid market, and a broad array of sophisticated speculators. RBI’s actions are going in the exact opposite direction. They are trying to make the market illiquid. But it is in an illiquid market that we will get market inefficiencies and weird behaviour of the price. They are increasing the chance that something nutty happens on the rupee.

This circular is also a reminder about poor legal process at RBI. Every action by a regulator must articulate a rationale. Financial regulations are motivated by exactly two possibilities - consumer protection or micro-prudential regulation. The government agency that wields the power of financial regulation must show the clear rationale, describing what is the market failure that this regulation is seeking to address. The government agency must show the cost-benefit analysis, explaining why the costs of this action outweigh the benefits. As is typical of financial regulators in India today, RBI’s documents show no rationale.

It is possible to conjure one conspiracy theory. The attempts at damaging the liquidity of the currency futures market should be seen in connection with previous work on damaging the liquidity of the OTC market. Perhaps there is a grand plan here. The scale of RBI’s trading on the currency market is implausibly small when faced with the size of the Indian economy, with the size of India’s cross-border interactions and the size of the currency market (both onshore and offshore).

Perhaps these recent moves are designed to damage the liquidity of the market, so as to get to a point where RBI intervention can make an appreciable dent on the price. Perhaps the gameplan is to gnaw away at the capability of the currency market through a series of moves, and then take off doing large scale manipulation of the market. If this is the game plan, it reflects very poorly on the economic policy capability at RBI. It would also generate massive profit opportunities for the speculators of the world, who would short the rupee when the large scale manipulation commences.

Rumours about other bad ideas abound. Eg, it is suggested that RBI will sell dollars to exporters directly. How is this different from selling dollars on the market?? It is suggested that the currency futures and the OTC markets should be completely cutoff by banning the arbitrage. How would this solve the macroeconomic problems which bedevil the rupee?

Microeconomic distortions are not a good way to address macroeconomic problems

What does one make of this spectacle? A simple principle worth reiterating is:

Problems rooted in macroeconomics must be addressed using macroeconomic instruments.

We got into this mess because of inappropriate fiscal and monetary policy. We need to solve these - monetary policy must get back to the business of delivering low and stable inflation, we have to fight inflation until we see y-o-y headline inflation (i.e. CPI-IW inflation) going to the 4-to-5 per cent range. Alongside this, fiscal policy needs to correct itself. Each of these has a clear direction to move in, and movement on any one is valuable regardless of what the other does.

A big element in the picture is the loss of confidence, in the eyes of the private sector, on an array of issues ranging from ethical standards to the sophistication of fiscal, financial and monetary policy. This is an important problem and it needs to be addressed. The spectacle of a government flailing at the macro problems using micro instruments is worsening matters. Perhaps there is constant pressure to announce `new measures’ to solve the problem. Deeper solutions are hard, and there is enthusiasm for `doing something’ (large or small) [ example].

We’ve seen this movie before. In the last decade, again and again, RBI tried to wield capital controls as a tool for macroeconomic policy. They failed. It is disappointing to see the lack of learning.

Some of the moves above have come out of the reflexive socialism that lurks within the Indian bureacracy. Perhaps, in a crisis environment, the ordinary immune system within each government agency, which keeps the sub-clinical socialism under check, is not working as well. This hurts from two points of view. It betrays the lack of capability of these government organisations; it reminds us that the Indian state is strewn with people who have a low knowledge of economics and a taste for dirigisme. It also reminds us of the policy risk: Precisely when the best capabilities are required (in a crisis), we seem to be slipping into the lowest quality policy initiatives.

Everyone who sees the government /RBI engaged in one ill thought out measure after another gets worried about India’s future. How can a $2 trillion economy flourish while such immense powers are placed with individuals and institutions with such weak capabilities? This further damages confidence, which deepens the macroeconomic crisis.

Acknowledgements: We are grateful to Apoorva Ankur, Sumathi Chandrashekaran, Pratik Datta and Kaushalya Venkataraman for useful suggestions.

Ajay Shah’s Blog

)

)

)

)

)

)

)

)

)