The ten-year benchmark bond yield can potentially fall by 100 basis points in coming months. The yield on the current on the run bond, the 8.79 percent 2021 bond, is at 8.35 percent levels, and its yield could fall to 7.35 percent or thereabouts levels if the current trend of record low global bond yields continues.

Indian bonds have severely underperformed their global counterparts in the past year and given current market conditions, Indian bonds are likely to benefit from the sharp fall in bond yields across the globe.

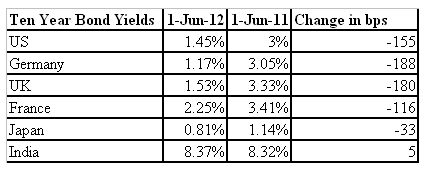

Bond yields in the US, Germany, UK, France and Japan have fallen considerably over the past year and are now trading at record lows. Table 1 shows the performance of global ten-year bond yields over a one-year period.

[caption id=“attachment_331587” align=“alignleft” width=“426” caption=“Source: Bloomberg”]  [/caption]

India is the only country among those listed in the table where bond yields have actually gone up. The reasons for Indian bond yields underperforming over past 12 months are a) Government exceeding its budgeted fiscal deficit for 2011-12 by 1.3 percentage points b) RBI raising policy rates by 125 basis points to fight inflation, which was trending at over 9 percent in 2011 and c) Tight liquidity among banks, which are consistently borrowing well over 1 percent of their NDTL (net demand and time liabilities) from the RBI on a daily basis to meet their day to day fund requirements.

The record low levels of bond yields from the US to UK and Japan is due to a) risk aversion to bonds of indebted sovereign countries in the eurozone, leading to banks and investors shifting out of bonds of countries such as Italy and Spain and moving into bonds of relatively safe countries of Germany and France b) central banks of US, UK and Japan buying bonds to infuse liquidity and stimulate growth in their economies and c) worries on global economic growth leading to fall in inflation expectations and fall in interest rates.

Time for Indian bonds to start performing

The conditions for Indian bonds to start rallying are good. The first sign of the market turning around its view on Indian bond yields is the sharp fall in yields post the release of the fourth quarter 2011-12 GDP numbers.

The yield on the ten year benchmark bond fell 14 basis points from 8.51 percent levels to 8.37 percent after India posted one of its worst quarterly GDP growth rates of 5.3 percent for January-March. The markets have now started factoring in rate cuts by the Reserve Bank of India in its June 18 policy review on the back of weak GDP growth.

The market sentiment is turning bullish on the back of a sharp fall in oil prices globally, with Brent crude down over 25 percent from its highs seen over the past year. The fall in oil prices negates the inflationary effects of the fall in the rupee, which has fallen by over 20 percent over the past 12 months.

Government bond supplies, with the government borrowing a record of Rs 4,79,000 crore in fiscal 2012-13 was a concern at the beginning of the current financial year. The concern over the absorption of the supply has reduced on the back of RBI buying Rs 50,000 crore of bonds fiscal year to date to infuse liquidity into the system. Bond traders are, in fact, running below optimum bond positions as the markets had to absorb only Rs 33,000 crore of the total supply of Rs 1,42,000 crore of government bonds auctioned fiscal year to date. Bond redemptions of Rs 59,000 crore plus RBI purchases of Rs 50,000 crores have negated most of the supply.

RBI bond purchases have reduced the worries of liquidity tightness. Banks are borrowing in a range of Rs 75,000 crore to Rs 1,10,000 crore from the RBI on a daily basis, and those borrowing are likely to reduce on the back of infusion of liquidity by the RBI.

The RBI may or may not cut rates in its June 18th policy review but the markets will start to factor in more rate cuts for fiscal 2012-13. Signs of economic weakness post the GDP growth numbers will give rise to expectations of a 100-150 basis point repo rate cut from current levels of 8 percent (100 basis points = 1 percentage point).

Rate cut expectations will drive down ten-year bond yields, and it is a good time for investors to increase the maturity of their fixed-income portfolios.

Arjun Parthasarathy is the editor of www.investorsareidiots.com, a web site for investors.

)

)

)

)

)

)

)

)

)