Worldwide server shipments grew 1.4 percent in the first quarter of 2014, while server revenue declined 4.1 percent year over year, according to Gartner, Inc.

“The first quarter of 2014 produced relatively weak growth on a global level with a variation in results by region,” said Jeffrey Hewitt, research vice president at Gartner. All regions showed a decline in either shipments or revenue except for Asia/Pacific. Asia/Pacific posted a 3.3 percent increase in revenue and an 18 percent increase in shipments. In Japan shipments increased by 13.5 percent, but revenue declined by 9.2 percent while in Western Europe shipments declined by 4.8 percent and revenues rose 6.7 percent."

“x86 servers managed to produce an increase with growth of 1.7 percent in units for the year and 2.8 percent in revenue,” Hewitt said. “RISC/Itanium Unix servers fell globally in the first quarter of 2014 - down 19.9 percent in shipments and a 16.9 percent decline in vendor revenue compared with the same quarter last year. The ‘other’ CPU category, which is primarily mainframes, showed a decline of 37.6 percent year over year in terms of revenue.”

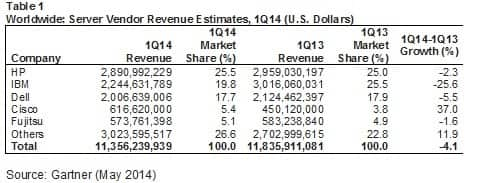

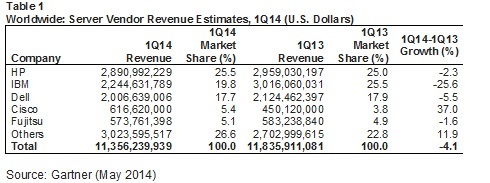

HP led the worldwide server market in revenue terms in the first quarter of 2014 (see Table 1). The company ended the quarter with $2.9 billion in revenue, for a total share of 25.5 percent worldwide. This was down 2.3 percent compared with the same quarter in 2013.

Cisco was the only company in the top five that increased revenue in the first quarter of 2014, with growth of 37 percent compared with the same quarter in 2013.

In server shipments, HP remained the worldwide leader in the first quarter of 2014 (see Table 2) even though its shipments declined 7.9 percent compared with the first quarter of 2013. HP’s worldwide server shipment share was 22.6 percent, followed by Dell with 19.7 percent of the market.

Of the top five vendors in server shipments worldwide, only Huawei and Inspur Electronics increased shipments in the first quarter of 2014, with growth of 61 percent and 288.7 percent, respectively. This is the first time Inspur Electronics made the top five in server shipments.

In terms of server form factors, x86 blade servers decreased 3.9 percent in shipments, but increased 5.2 percent in revenue for the quarter. The rack-optimised form factor climbed 1.4 percent in shipments and 1.7 percent in revenue in the first quarter of 2014.

“After some challenges in 2013, vendors will be relieved to see 2014 get off to a relatively good start,” said O’Connell. “The demand environment is stabilising but challenges remain. We expect users will continue to be conservative in their investments for some time and platform migrations will remain a challenging factor. We are likely to see revenue growth in 2014, but the reality is that the market is operating from a significantly lower level than it was prior to the downturn in 2008.”

)

)

)

)

)

)

)

)

)