The banking industry in the Asia/Pacific is poised to implement major core banking system projects in the next three years, ushering in a new wave of significant financial technology spending especially among top tier institutions. The findings were revealed in a recently published report by IDC Financial Insights that examined the core banking modernisation plans of the 10 largest banks in 12 major markets across Asia/Pacific.

Michael Araneta, Associate Consulting and Research Director for IDC Asia/Pacific says, “After lacklustre deal-making in the last few years, core banking vendor deal sheets have started to fill out with new and impending projects. We expect at least 32 of the top 120 Asia/Pacific ex-Japan banks to undertake significant changes to their current core banking systems from now to 2015.” Araneta noted that these projects include not just whole-of-core transitions but also significant changes to key components of core systems such as chart of accounts, GLs, and loans and deposit systems — reflecting the growing preference for iterative creation of core banking platforms for many banks worldwide.

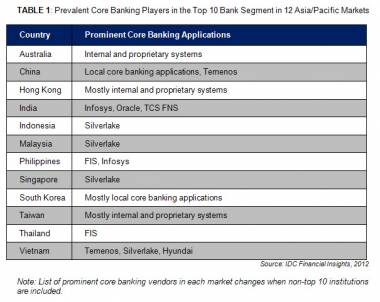

Araneta stated, “As for vendors most likely to succeed in this hotly anticipated round of upgrades, our view is that not one vendor will dominate the core banking vendor landscape across the region. The leading core banking vendors worldwide have their fair share of references in the region’s top banks. There are, however, notable market strongholds where vendors are deployed in not just one, but several top 10 financial institutions.”

Several business imperatives have proven to be constant justifications for greenlighting core banking projects and they include cost management, time-to-market, and scalability. However, there are a few relatively new goals that are driving banks to shift to new or modernised core platforms. These ‘new’ drivers include improvements in data management, enhancement of risk analytics, and super-regionalisation, reveals IDC Financial Insights.

Araneta commented, “Risk management and regulatory compliance requirements are driving demand. More than ever, banks would like to see their core banking systems help them cope with the onslaught of new regulations and the new reporting requirements that come along with the new rules. This requires better information management, common data models, and integration with core analytics and reporting systems.”

Furthermore, as banks vigorously pursue single customer views and other enterprise-wide consolidated views, they discover that data structures in and around the core banking systems are far from ideal — multiple silos exist, the same customers have multiple customer information files (CIFs), and product systems cannot be reconciled, among many other issues.

Araneta concluded “The problem of disorganised data structures gets more severe for large banks that are growing regional businesses, or super-regionalising. Thus, we say that a gradual and iterative re-architecting of data models will be the best solution, and this will be intrinsic in many core banking projects moving forward.”

)

)

)

)

)

)

)

)

)