Despite economic woes in North America, Europe, the Middle East and Africa (EMEA) and Japan, the worldwide external controller-based (ECB) disk storage market exceeded expectations and totalled $5 billion in the first quarter of 2011, according to Gartner, Inc. This is a 14.1 percent increase from revenue of $4.4 billion in the first quarter of 2010.

The Asia/Pacific and Latin America regions grew 28.9 percent and 15.9 percent, respectively, followed by North America at 12.9 percent, EMEA at 12.3 percent and Japan at 5.8 percent. With 30 percent year-over-year growth, the deployment of file-access ECB disk storage systems shows strength in general-purpose enterprise infrastructures, as well as disk-based backup and archiving.

“Reflecting storage infrastructure refreshments, coupled with expanded deployments in virtualised server infrastructures, the larger block-access ECB disk storage market segment grew 10.6 percent year over year,” said Roger Cox, research vice president at Gartner. The block-access ECB disk storage segment currently represents 79 percent of the total ECB disk storage market."

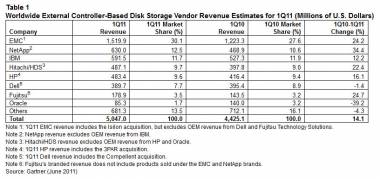

EMC increased its worldwide ECB disk storage revenue market share to 30.1 percent in the first quarter of 2011 (see Table 1). NetApp experienced the strongest growth among the top-tier vendors with a revenue increase of 34.4 year over year.

NetApp’s efficiency and flexibility features, along with its unified storage architecture, continued to resonate with end users regardless of geographic region. While EMC maintained an almost 2.5 times larger market share than its closest rival, 35 percent of its year-over-year growth in the first quarter of 2011 came from acquisitions made during the past three years. Gains by its DS8000 series, XIV and the newly released Storwize V7000 were offset by DS5000/4000/3000 series revenue deterioration.

Even though HP grew faster than the industry average, gaining 0.2 percent market share, the accretive impact of the 3PAR acquisition was offset by EVA and P9000-series revenue declines. As Dell disengages from EMC, its PS series (EqualLogic), MD3000 series and the just-acquired Compellent gains were counterbalanced by the ongoing Dell:ECM CX4/AX revenue shortfall.

Fujitsu is gaining increased traction with its Eternus ECB disk storage systems, particularly in EMEA and Japan. Most of Oracle’s year-over-year revenue decline was caused by its terminated relationship with Hitachi Data Systems (HDS), but analysts said it is also struggling to improve ZFS Storage Appliance revenue.

Gartner ECB disk storage reports reflect hardware-only revenue, as well as hardware revenue associated with financial leases and managed services. Optional and separately priced storage software revenue and storage area network infrastructure components are excluded.

)

)

)

)

)

)

)

)

)