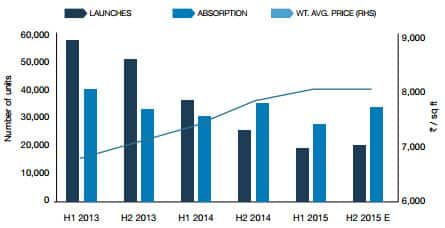

Mumbai’s real estate sector has recorded the lowest number of new launches in the first half of 2015 since the realty slowdown began in 2008. Add to it the fact that there are around two lakh unsold homes and slowing sales, and what this means is that there will be no recovery in the housing market for at least another six months, according to a new report by real estate consultancy firm Knight Frank India. The report found that during January-June 2015 the number of new launches in the Mumbai Metropolitan Region (MMR) declined by 47 percent — 18,887 units compared to 35,512 units launched in the same period last year. The number of sales also saw a decrease — 28,447 units were sold during January-June 2015 compared to 31,210 units last year. Over the last two years, demand has slipped 30 percent, while launches have plummeted nearly 70 percent in Mumbai. The worst hit is the luxury residential market. Not a single residential project priced at more than Rs 5 lakh has been launched in the first half of the current year. [caption id=“attachment_2369256” align=“alignleft” width=“445”]  Source: KnightFrank[/caption] According to Samantak Das, chief economist and national director-research, Knight Frank India, five major factors have led the realty sector to stagnate. 1. Builders have less access to funds and are saddled with a huge pile of unsold inventory. 2. The confusion in the Development Plan (DP) 2034 which has delayed approvals 3. Investors are staying away due to muted price appreciation and better alternative investment options 4. High property prices and low income growth. Buyers find homes unaffordable 5. Buyers still lack confidence in the economic conditions and the ability of builders to give them possession of apartments on time. According to Shishir Baijal, chairman and MD at Knight Frank, the current inventory of unsold houses will require at least three years to be cleared at the current prices and premium projects could take nearly 4 years . And the inventory in South Mumbai, the most premium location in the city, could take five years to clear . [caption id=“attachment_1975175” align=“alignleft” width=“380”]  Thinkstock Images[/caption] “Despite the economic scenario strengthening, we are seeing no improvement in the residential market across the top eight cities. Going forward, we do not see any improvement until the end of 2015 in terms of sales,” he said. On an all-India level, the global consultancy firm said that launches and absorptions have reached an inflection point for the first time in the last 5 years. Over 7 lakh housing units remain unsold in eight major cities as housing sales dropped by 19 percent and new launches by 40 percent during January-June 2015 in Delhi-NCR, Mumbai, Bengaluru, Pune, Kolkata, Chennai, Hyderabad and Ahmedabad. Earlier this month, Ambit Capital came out with a report which said property prices in India are beginning to decline. Property prices have fallen by between 7 percent and 18 percent in the largest cities over the past year. In Mumbai, India’s most expensive property market, prices might plunge as much as fifty percent, it said. “Our visits to five property registration offices in Mumbai suggest a sharp drop in the registration of new residential properties. Also, new launch volumes are down 40-80 percent on a pan-India level,” said Ambit’s Saurabh Mukherjea and Sumit Shekhar in the report. ( Read more on that here) Data from the Reserve Bank of India shows that between May 2014 and May 2015, lending to the commercial real estate business grew at 7.5 percent whereas in the corresponding period a year ago it grew at 17.8 percent. ““Usually in India, lending to real estate grows much faster than overall bank credit growth… RBI data suggest the banking system seems to have turned the tap off for property developers over the past year. This has, in turn, made developers either stop construction or cut prices,” said the Ambit report. Given this lending squeeze, developers have either stopped construction — which has led to an increase in unfinished homes — or have cut prices through freebies and various schemes. This cash crunch also explains the slowdown in launches. Another survey by JLL found that Mumbai’s sluggish sales are probably because most of the ready units, which account for only 3.35 percent or 2,600 units, are priced above Rs 1 crore. In fact, 5,311 unsold units are priced above Rs 5 crore while 17000 unsold units are priced between Rs 2 and 5 crore, implying that there are no more investors left in the market. While suburbs from Vile Parle to Goregaon have 205 completed-yet-unsold units in the range of Rs 2 crore and above, a major chunk of the unsold units are concentrated in Navi Mumbai. Moreover, units priced below Rs 65 lakhs are situated in emerging areas of Navi Mumbai like Ulwe, Karanjade, Dronagiri, or on distant stretches off the Ghodbunder Road in Thane. So how long will builders sit on this unsold inventory? A recent Assocham survey has the answer. It says “A large inventory is piling up despite prices correcting by over 20 per cent in the last one year, while there is a huge fall in the new projects being launched by developers who are hard-pressed for cash… The increase in inventory level is because of the falling demand from actual users as also the investors. Even ready-to-move flats are finding few buyers.” All this data suggests that prices are heading for a fall. So sit tight and wait for better deals.

Mumbai’s real estate sector has recorded the lowest number of new launches in the first half of 2015 since the realty slowdown began in 2008. Add to it the fact that there are around two lakh unsold homes and slowing sales, and what this means is that there will be no recovery in the housing market for at least another six months, according to a new report by real estate consultancy firm Knight Frank India.

Advertisement

End of Article

)

)

)

)

)

)

)

)

)