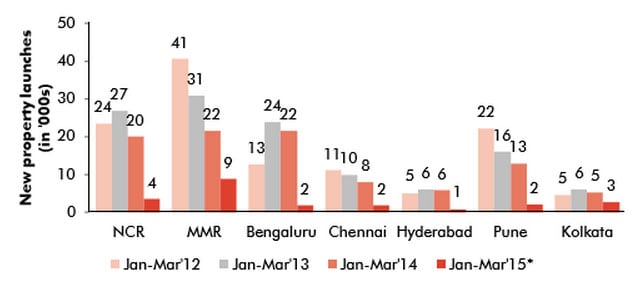

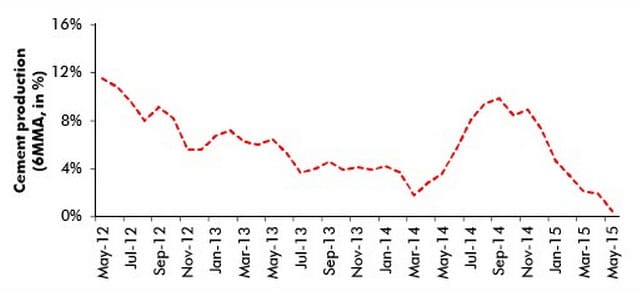

High prices, drying up of bank lending and government efforts to reduce black money could possibly result in a crash in realty prices in the country’s metropolitan cities, according to a report by brokerage firm Ambit Capital. In addition, rental yields in property markets in India have remained extremely low as compared to its other Asian peers. “Whilst the RBI’s Housing Price Index suggests that prices have moderated on a pan-India basis, data from property websites suggest a deeper slowdown in India’s large cities, with prices falling by 7-18 percent y-o-y,” the report, authored by Ambit’s Saurabh Mukherjea and Sumit Shekhar, says. “Our visits to five property registration offices in Mumbai suggest a sharp drop in the registration of new residential properties and data from property valuers in Maharashtra and Tamil Nadu suggest that transaction volumes have fallen by 10-15 percent per annum for three consecutive years now. Also, new launch volumes are down 40-80 percent on a pan-India level,” it adds. In fact new launches have dropped by 40-80% YoY in Jan-Feb 2015 [caption id=“attachment_2352384” align=“aligncenter” width=“643”]  Source: Ambit[/caption] This slowdown in realty is also evident from the fact that there has been a sharp decline in cement production on a pan-India basis. Data released by the Office of the Economic Adviser, the Ministry of Finance, suggests that cement production has dropped significantly in recent months. The six-month moving average for cement production dropped to 0% in May 2015 [caption id=“attachment_2352398” align=“aligncenter” width=“641”]  Source: Ambit[/caption] Moreover, a significant drop in transaction volumes has also been witnessed. With demand being sluggish, not only have new launches fallen, but real estate inventory has also started piling up. Metros like Mumbai and Delhi would take as much as 11-14 quarters to clear the existing inventory. The time taken to clear the inventories in a healthy real estate market should be around 4-6 quarters. A recent report by Bank of America-Merill Lynch said that the Noida property market has witnessed new sales of only about 3,800 homes during the April-June period, the lowest in the last eight years, due to a dip in demand from investors.Even Gurgaon’s unsold inventory has seen an exponential rise over the last 2.5 years. “We foresee the weakness to stay through calendar year 2015 before possible recovery in calendar year 2016,” the report said. The situation is grim in Mumbai too. Around 77,460 apartments remain unsold in Mumbai, Thane and Navi Mumbai region and only 3.35 percent of this inventory in Mumbai is actually completed or ready for possession, according to a report by property consultant JLL India. The inventory of 77,000 flats translates into 30 months of inventory, which is very high. In other words, despite the delay of over 30 months, flats are still not ready yet! Apart from rising inventory, the price correction has already begun, not just in metros but in Tier Two cities too. Prices in South Delhi are already down by 20-25 percent. In the smaller cities, the situation seems to be worse, with Jaipur, Rajkot and Lucknow also pointing to a 15-20 percent y-o-y correction. Real estate prices have fallen both in Tier I and Tier II cities [caption id=“attachment_2352436” align=“aligncenter” width=“800”]  Source: Ambit[/caption] Land prices are down too Even land prices have stagnated over the past 18 months as transactions in primary real estate markets have dried up; and developers fund land purchase from debt, and given the extremely low demand, they do not want an interest burden right now. The report concludes that in cities like Mumbai, prices “could halve” from current levels in order to arrive at a sustainable level. According to the report’s authors, the demand and supply factors that have together tightened their stranglehold on the already-stressed real estate sector in recent times include: No bank lending: RBI data suggests that the banking system seems to have turned the tap off for property developers over the past year. The NDA has cut subsidies sharply (down 9 percent in FY16) and is shifting subsidies to Direct Benefits Transfer. As a result, the ability of the politician and builder to pilfer subsidies to fund real estate construction has been checked. Investors are holding back: The knowledge that there is many years’ worth of unsold real estate inventory in most of India’s tier-1 and tier-2 cities is causing investors to hold back further purchases. The black money bill is scaring off HNIs : More than 30 percent of India’s real estate sector is funded by black money. In Delhi, the ratio of the unaccounted value of real estate transactions to the total value is as high as 78 percent. The same ratio is 50 percent in Kolkata and Bangalore. In smaller towns and semi-urban centres, nearly 100 percent of property transactions are conducted in cash, according to data by National Institute of Public Finance and Policy. The draconian Black Money Bill went live on 1 July and has made high-net-worth families reluctant to invest in real estate. According to a report in The Economic Times, 80,000 Indians have already applied for tax residentship in Dubai and Singapore to escape the clutches of this new law. In fact, post the Income Tax Department publishing the rules on the implementation of the Black Money Bill in late June, there are reports that in several Indian high net- worth families, at least one member will seek citizenship abroad to escape the sanctions of this bill. Difference between rental yields and bank base rates: The 8 percentage point gap between gross rental yield and bank base rates highlights the unattractiveness of real estate for investors. In a fairly-priced real estate market, the rental yield tends to be somewhere close to the cost of borrowing. Instead, Mumbai has a rental yield of close to 2 percent whilst the lending rate hovers around 10 percent. The difference between lending rates and rental yields is one of the highest in India. Hike in ready reckoner rates: Key state governments (such as Maharashtra, West Bengal, Delhi) have hiked “ready reckoner” rates sharply this year and thus prevented prices from dropping to a market clearing level. Some builders are now ceding to this realty. Orbit Corporation MD Pujit Aggarwal told CNBC-TV 18 that though there was little room to cut prices due to high costs, builders were now willing to reduce prices and sell units even at a loss. “They will sell in order to meet cash flow requirements such as interest payments, overhead costs or further construction,” he told CNBC-TV18 in an interview. According to Aggarwal, prices in some pockets of Mumbai could fall about 20-25 percent. “Till now, builders had been reducing prices through indirect means such as the 80:20 schemes and interest-free EMIs, but a direct price reduction is absolutely on the table now,” he said “We will witness that in the months and quarters to come.”

High prices, drying up of bank lending and government efforts to reduce black money could possibly result in a crash in realty prices in the country’s metropolitan cities, according to a report by brokerage firm Ambit Capital. In addition, rental yields in property markets in India have remained extremely low as compared to its other Asian peers. “Whilst the RBI’s Housing Price Index suggests that prices have moderated on a pan-India basis, data from property websites suggest a deeper slowdown in India’s large cities, with prices falling by 7-18 percent y-o-y,” the report, authored by Ambit’s Saurabh Mukherjea and Sumit Shekhar, says.

Advertisement

End of Article

)

)

)

)

)

)

)

)

)