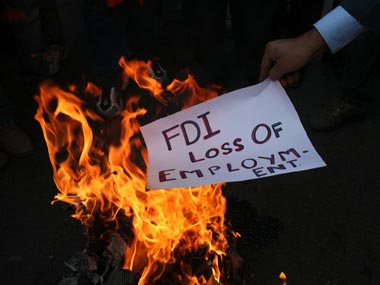

New York: After largely ignoring flip-flops by Prime Minister Manmohan Singh’s government, US business leaders suddenly confronted the issue of how the government creates a cloud over everything. The bitterness reached a new high — or a low — on Tuesday at the annual fund-raising gala of the American India Foundation in Washington when normally tight-lipped Ron Somers, president of the US-India Business Council (USIBC), indulged in some plain speak. If Somers, an Indophile, is put off, you can tell how frustrated other business leaders are by the government’s policy paralysis. After all, Somers was so firmly in India’s corner that he exulted “Jai Hind” in letters drumming up support for the Indian nuclear deal. He engaged the politically well-connected Patton Boggs law firm with a billing rate of $495 an hour to lobby lawmakers in Washington to push the nuclear deal. [caption id=“attachment_156587” align=“alignleft” width=“380” caption=“US businessmen are convinced India wants FDI but has no commitment to execution. Reuters”]  [/caption] “I just want to kind of start with getting rid of the 800-pound gorilla in the room,” said Somers, while American CEOs picked at the first course of a $500 plate dinner. “On Thanksgiving, the big news coming out of India was the opening of the multi-brand retail sector. And, there we were — all of us — feverishly on our BlackBerrys trying to conceive a press release in the middle of Thanksgiving in order to herald the most extraordinary economic policy in perhaps the last 10 years in India.” “Alas,” Somers said, “Five days later, the decision was suspended.” The disgust was so palpable by now that most of the CEOs in the elegant dining room just pushed away their dinner plates. “We’ve seen much worse than this,” added Somers, cataloguing the year’s disappointments. Somers talked about US frustration with India’s domestic nuclear liability laws, which it contends is tough on suppliers of reactors. “The nuclear riles coming out of India that don’t quite limit liability in the unlikely event of a nuclear accident,” was followed by the “disappointment of US companies,” in April of “not being selected for the Multi-Role Combat Aircraft procurement.” Last year, Parliament passed a nuclear liability act that made companies liable to pay compensation without monetary limit in the event of a nuclear accident. But India posted new rules in November, called Civil Liability for Nuclear Damage Rules 2011, effectively limiting the liability on foreign suppliers and imposing time constraints on claimants seeking compensation. [caption id=“attachment_156588” align=“alignright” width=“200” caption=“If Somers, an Indophile, is put off, you can tell how frustrated other business leaders are by the government’s policy paralysis.”]  [/caption] The new rules implementing the act have laid a cap of Rs 1,500 crore as damages that can be claimed by a plant operator from reactor suppliers in the event of faulty equipment causing an accident. The rules also set a five-year time limit within which the operator can claim damages from the supplier. Earlier, the nuclear liability bill made equipment suppliers liable for 80 years in the event of an accident. However, these new rules still don’t assuage all the concerns of foreign suppliers, which include GE Hitachi Nuclear Energy and Westinghouse Electric Co. US companies argue that international norms put the onus on the operator of nuclear power plants to maintain safety, not on equipment suppliers. They want India’s nuclear liability laws to be in alignment with the international standards of the Convention on Supplementary Compensation for Nuclear Damage. Not only has the nuclear deal turned out to be a lemon for US companies, but they aren’t being able to invest as much as they would like, in insurance, airlines or the retail sector due to pending legislation. India spends roughly $21 billion, or a tenth of its budget, on food, fuel and other subsidies each year. About 13 percent of spending goes to defense and 20 percent to pay interest on national debt. That leaves little for other needs, such as health, education and power plants, boosting borrowings. India desperately needs foreign investment to grow its infrastructure, but the Congress-led UPA II doesn’t have the backbone to move legislation through Parliament. Some say it is inexplicable as the Congress has the support of 322 lawmakers in the Lok Sabha, with the party getting 206 lawmakers of its own. That’s the most since 1991, when Singh as finance minister introduced free-market policies that have helped India’s economy quadruple in size. “Investors are pulling out money and India is no longer the darling of the investment community. Over the last few years, we’ve quietly ignored policy-makers in the hopes that industrialists would find ways around them; that cannot continue indefinitely,” Krishna K Gupta, general partner in Massachusetts-headquartered Romulus Capital, earlier told Firstpost. “India wants FDI — there is no doubt about that. But it is unable to execute on its goals. Incompetence is the problem we face and this derives, in my opinion, from the lack of power at the Centre,” added Gupta. The drop in portfolio inflows and the hefty current account and fiscal deficits have been key factors behind the rupee’s sharp decline. Foreign direct investment in India fell 31 percent to $24 billion last year even as investors flocked to developing nations as a group and in November alone, foreign investors pulled $661 million out of the Indian stock market. On Tuesday, a Bank of America Merrill Lynch Survey of Fund Managers, which polled 190 largely US institutional investors with combined assets of $608 billion, also gave India the thumbs-down. “Investors end 2011 overweight Brazil, Russia, China but resolutely underweight India,” said the survey. A slowing economy, soaring inflation, lack of big bang reforms, policy paralysis on the part of the Indian government, and growing investor pessimism have created a downward spiral. US investors are also exhausted with India’s bureaucratic red tape and say it has the world’s most interventionist economic policies. “A babu will tell you ‘No, problem. The work is done’. And, that is the beginning of all your problems,” said a US businessman who didn’t want to be named.

The sentiment at the annual fund-raising gala of the American India Foundation in Washington was that of frustration with India’s policy flip-flops.

Advertisement

End of Article

)

)

)

)

)

)

)

)

)