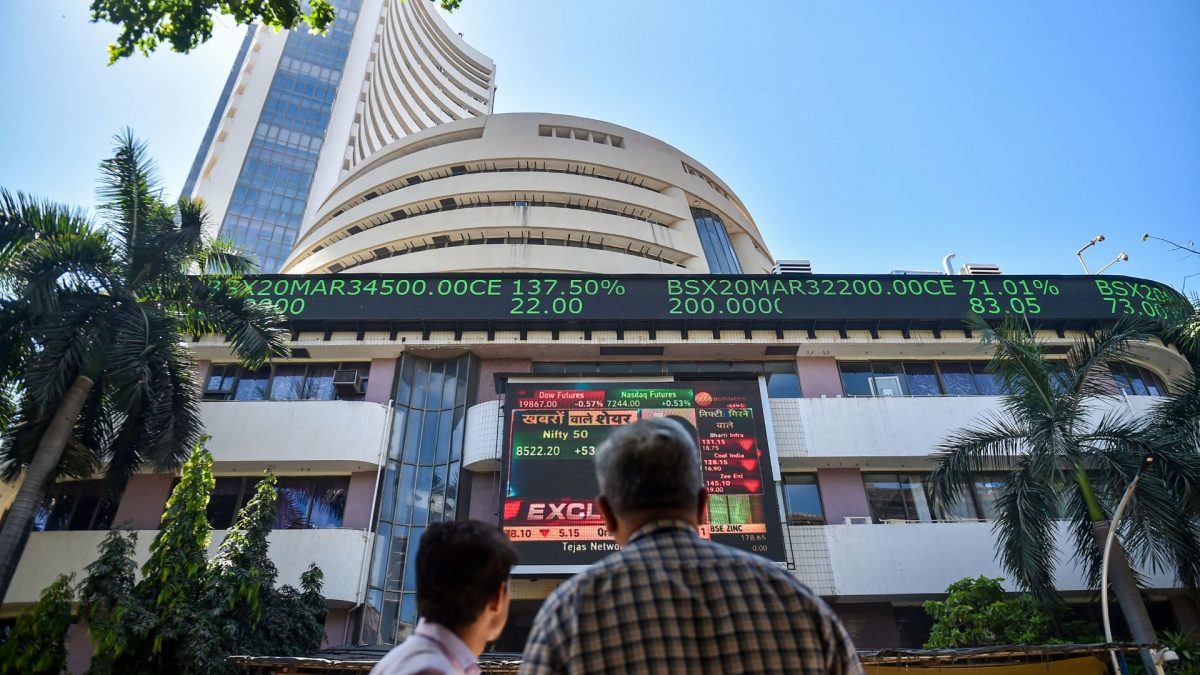

Indian stock markets fell sharply in early trade on Monday after US President Donald Trump’s renewed tariff threats hurt investor confidence.

The Sensex dropped over 700 points to 80,688, while the Nifty fell more than 200 points to 24,538 during the earnings season. Sentiment was further hit by heavy foreign fund outflows.

Data from exchanges showed that Foreign Institutional Investors (FIIs) sold shares worth nearly ₹6,450 crore on Friday. Top losers in the Sensex included HDFC Bank, HCL Tech, Infosys, Tech Mahindra, and Tata Steel. On the other hand, Hindustan Unilever, Adani Ports, and Mahindra & Mahindra managed to gain.

Experts say while global concerns like trade tensions are weighing on markets, strong domestic earnings could provide some support in the near term.

Indian markets fell in line with other Asian markets, which traded lower due to fears over higher US steel tariffs. Major indexes in South Korea, Japan, Shanghai, and Hong Kong remained weak, while US markets ended mixed.

Last week, Donald Trump said he plans to double tariffs on steel and aluminium exports from 25 per cent to 50 per cent. He accused China of breaking their agreement to roll back tariffs and trade restrictions.

“We are going to be imposing a 25 per cent increase. We’re going to bring it from 25 per cent to 50 per cent - the tariffs on steel into the United States of America, which will even further secure the steel industry in the United States,” Trump had said in Pennsylvania.

)

)

)

)

)

)

)

)

)