China’s Ministry of Finance has established a new department focused solely on managing government debt, as Beijing intensifies efforts to curb hidden local borrowing and strengthen fiscal discipline.

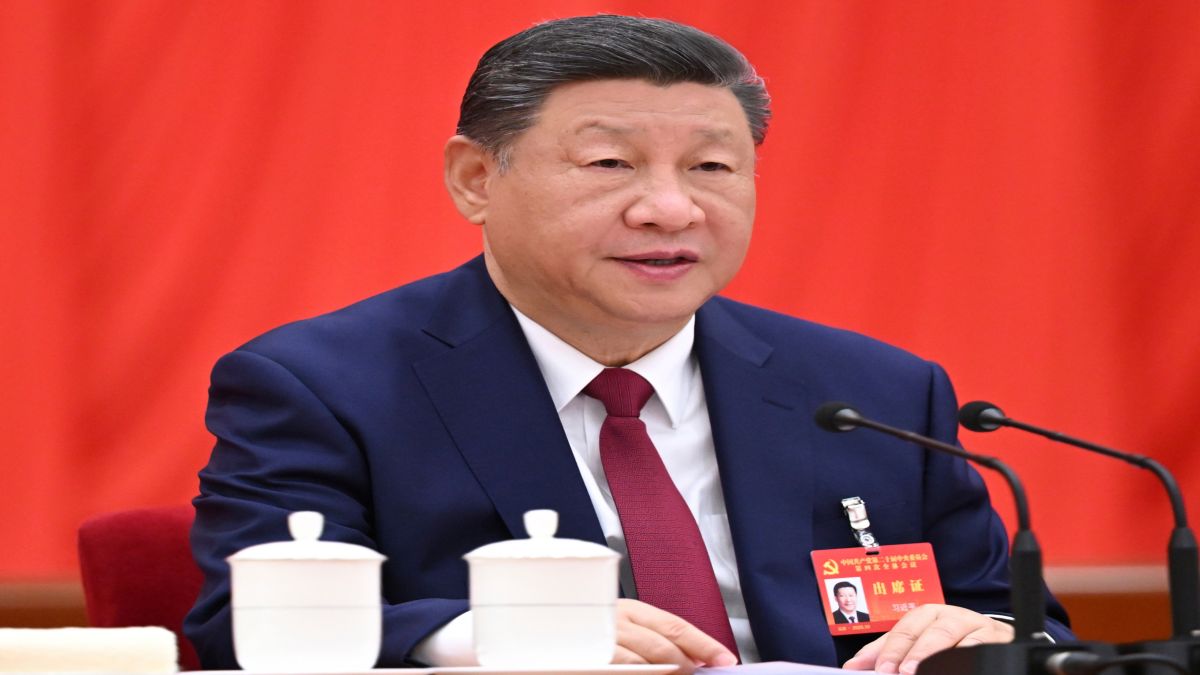

According to a South China Morning Post report, Finance Minister Lan Foan called for “ironclad discipline” to prevent off-balance-sheet financing, highligting the government’s resolve to address mounting debt risks across provinces and municipalities.

The new debt management department — now formally listed — will oversee the design and implementation of government debt policies, manage the issuance and redemption of government bonds, and help determine borrowing quotas for both national and local authorities, added the report, citing the ministry’s official website.

Li Dawei, formerly with the ministry’s budget department and head of its government debt research and evaluation center, has been appointed as the department’s director.

The new unit consolidates functions that were previously spread across multiple divisions, taking charge of strengthening oversight and resolving hidden debt risks as part of China’s broader fiscal reform drive.

Centralising debt management

The new department will enable the government to centralise its fiscal oversight and speed up the creation of a long-term mechanism for resolving public debt, the report quoted Huatai Securities as saying in a research note on Monday.

The move is the latest step in Beijing’s sweeping campaign to tackle the vast hidden debts accumulated by local governments through off-balance-sheet financing vehicles, known as local government financing vehicles (LGFVs).

These entities proliferated after the 2008 global financial crisis as local authorities borrowed heavily to fund large infrastructure projects, driving a surge in concealed liabilities across the Chinese economy.

Impact Shorts

More ShortsLast year, Beijing announced plans to raise the local government debt ceiling by 6 trillion yuan (US$840 billion) over three years under a debt-swap programme aimed at shifting hidden debt onto official balance sheets, reported SCMP.

By the end of September, the number of LGFVs and the volume of their outstanding operating debts had fallen by 71% and 62%, respectively, compared with March 2023 levels, added the report, citing official data.

Finance Minister Lan recently reiterated that the government will continue advancing a comprehensive debt resolution plan and facilitate swaps for existing hidden local government debt as part of China’s next five-year strategy.

“Upholding the principle of no new hidden debt with ironclad discipline, we will promote the establishment of a unified long-term monitoring system for local government debt,” Lan wrote in a recent article.

Lan warned that officials involved in unauthorised borrowing or fraudulent debt resolution activities would face strict accountability measures, stressing the need to prevent a resurgence of local debt risks in the future.

“Debt structure will be optimised, and we will expedite the development of a long-term government debt management mechanism aligned with high-quality development,” he wrote.

With inputs from agencies

)

)

)

)

)

)

)

)

)