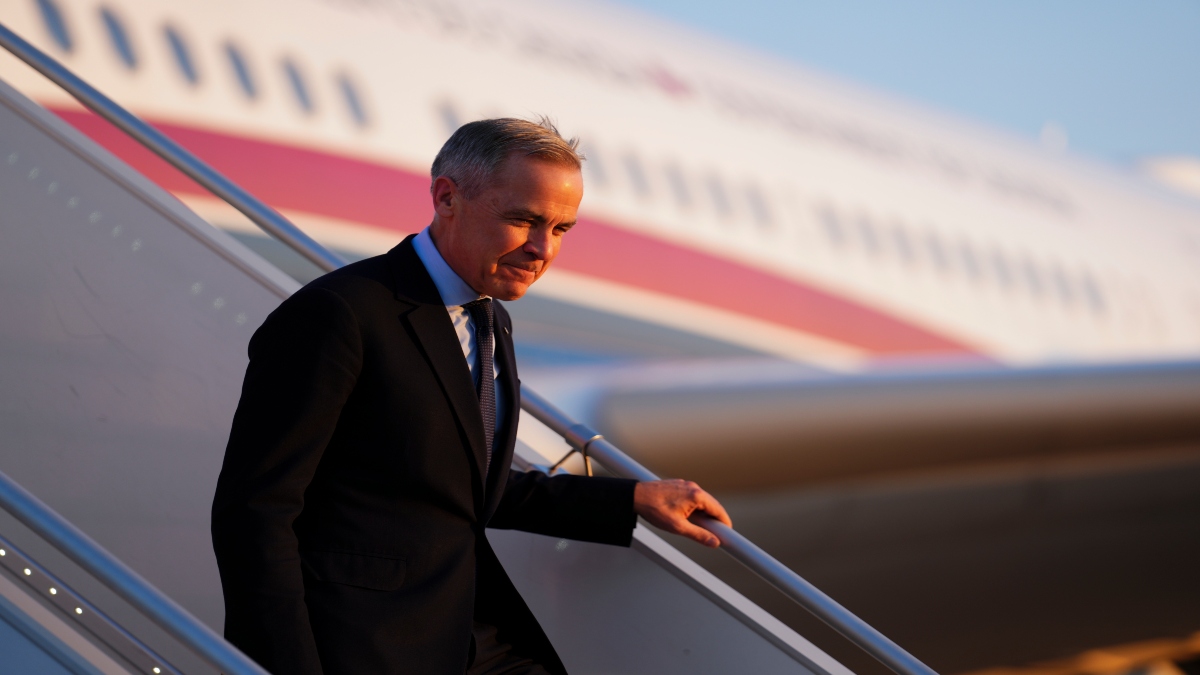

US President Donald Trump has undeniably tested America’s relationships with its allies. Meanwhile, under Prime Minister Mark Carney’s leadership, Canada is in advanced negotiations with the European Union (EU) to join the bloc’s new defence industry initiative—a strategic move that could redefine the country’s military manufacturing sector.

According to Stevis-Gridneff in The New York Times, this potential collaboration would enable Canadian firms to contribute to the production of European fighter jets and military equipment within domestic industrial facilities, signaling a shift in Canada’s traditional defence partnerships.

Canada’s defence manufacturing is not one to be taken lightly. Canada’s defence manufacturing industry is a key player in global security, producing a wide range of military equipment for both domestic and international markets.

The country is known for its advanced land systems, particularly the Light Armoured Vehicle (LAV) series, manufactured by General Dynamics Land Systems–Canada (GDLS-C), which is widely used by the Canadian Armed Forces and exported to allied nations.

In aerospace, Canada contributes significantly to fighter jet production, including components for the F-35 Lightning II, while also developing unmanned aerial vehicles (UAVs) and military helicopters. Naval defence is another strong sector, with Canadian shipyards constructing Arctic and Offshore Patrol Ships (AOPS) and modernising Victoria-class submarines.

Additionally, Canada leads in cyber warfare and electronic defence, with firms like Blackberry and Thales Canada providing encryption, surveillance, and radar systems to bolster national security.

Impact Shorts

More ShortsBeyond hardware, Canada’s defence sector extends to space technologies, missile guidance systems and training solutions. Companies like MDA develop military-grade satellite communications, while precision-guided munitions and air-to-ground missiles enhance Canada’s modern warfare capabilities.

The country is also a leader in military training, with CAE producing advanced flight simulators and combat simulation software. Ammunition manufacturing, cybersecurity innovations and electronic warfare systems further strengthen the sector’s contributions.

Strict export regulations under the Canadian Commercial Corporation (CCC) and the Export and Import Permits Act ensure that Canadian defence products align with international security agreements.

With a strong focus on technological innovation and global partnerships, Canada remains a significant player in defence manufacturing, supplying critical military solutions to Nato allies and other strategic partners.

However, with tensions rising between Canada and the US, largely due to President Trump’s unpredictable stance on Nato and defence commitments, Ottawa is exploring alternatives to reduce dependence on Washington. This shift is driven by both economic and strategic considerations as the EU ramps up its military industry to ensure self-reliance.

Rationale behind Canada’s EU defence collaboration

The EU is aggressively expanding its military production capabilities, having proposed a €150 billion ($163 billion) loan programme to finance shared defence projects. With a goal of producing at least 65 per cent of defence components within the bloc or from approved partners, the EU sees Canada as a crucial collaborator to fill the remaining 35 per cent gap. The collaboration would offer Canada privileged access to the European defence market, reducing its reliance on American-made military equipment.

Additionally, Canada’s defence spending has been under scrutiny. Nato mandates a minimum of 2 per cent of GDP allocation to defence, while Canada currently spends only 1.3 per cent. However, Ottawa has pledged to meet the 2 per cent benchmark by the end of the decade. The alignment with the EU could help achieve this goal while simultaneously expanding Canada’s defence manufacturing base.

One of the most significant consequences of Canada’s pivot is its reconsideration of the Lockheed Martin F-35 fighter jet purchase. Canada has long been a partner in the F-35 programme but is now reviewing its procurement strategy in light of growing concerns over US reliability.

According to the Associated Press, the EU’s defence expansion offers alternative aircraft, such as the Swedish Saab Gripen, the Eurofighter Typhoon and France’s Dassault Rafale. While these jets lack the stealth capabilities of the F-35, they provide more control and fewer geopolitical risks. The Saab Gripen, in particular, is viewed as a cost-effective option, already deployed by Sweden, Brazil, and Thailand.

Another key factor influencing Canada’s shift is the fear that the US could use embedded software to disable F-35 jets if relations sour. Though the Pentagon has denied any such “kill switch,” the requirement for constant US software updates raises concerns that the aircraft could be rendered inoperable at Washington’s discretion.

Canada’s defence industry, though relatively small, has been a key player in producing American military equipment. According to a 2022 industry review, nearly 50 per cent of Canada’s military exports go to the US. By joining the EU’s initiative, Canadian manufacturers would gain access to new markets and reduce reliance on American contracts.

Canada has already begun diversifying its defence partnerships. Prime Minister Carney’s recent overseas visits to Paris and London highlighted his intent to strengthen military-industrial ties with Europe. Additionally, Ottawa has secured a $4.2 billion deal with Australia for an early warning radar system, further signalling its shift away from US-centric defence procurement.

While the EU-Canada defence collaboration presents promising opportunities, it remains a long-term endeavour. The EU’s defence industry has historically lagged behind the US and rebuilding depleted arsenals will take years. However, with the ongoing war in Ukraine exposing vulnerabilities in European security, the urgency to bolster domestic production has intensified.

For Canada, aligning with the EU on military production is not just about economic gains but also about strategic positioning in an increasingly uncertain geopolitical landscape. If the partnership materialises, it could mark a fundamental shift in transatlantic security dynamics—one where Canada and Europe operate with greater independence from the US.

Trump’s annexation talk unnerves Europe

According to a Global News report, on March 13, 2025, President Trump reiterated his long-expressed desire to acquire Canada and Greenland, making the statement in the presence of Nato Secretary-General Mark Rutte. Despite visible unease from European allies, Trump continued to push his agenda, often putting them in uncomfortable positions.

When asked about the possibility of the US taking over Greenland, Trump expressed confidence that it would happen and suggested that Rutte could play a key role in facilitating it. However, Rutte declined to involve Nato in the matter, though he acknowledged the significance of Arctic security and the need for northern nations to collaborate under US leadership to counter China and Russia.

Addressing trade disputes with Canada, Trump reiterated his view that Canada should become the 51st US state. He criticised the existing border as an arbitrary division created many decades ago and argued that merging the two countries would enhance their visual appeal. Rutte remained silent on the implications of threatening the territorial integrity of a Nato ally.

Meanwhile, Canadian officials, including incoming Prime Minister Mark Carney, repeatedly rejected the idea of Canada joining the US Trump’s stance had also fuelled a surge of patriotism among Canadians, with nearly 70 per cent expressing a declining opinion of Americans due to increasing tariffs.

Despite diplomatic efforts from Canadian representatives, Trump remained firm on maintaining tariffs, including new reciprocal duties set to take effect on April 2. Rutte’s visit to Washington coincided with Trump’s broader push to test Nato’s unity, pressuring member states to increase defence spending and warning that the US might not support those failing to meet their commitments.

Canada, which has long fallen short of Nato’s target of spending at least two per cent of GDP on defence, insisted it had a credible plan to reach the threshold by 2032 or earlier, though specific details had not been disclosed.

Implications for Nato and transatlantic security

Trump’s stance on Nato has forced many member states to reassess their defence strategies. His assertion that Canada should become part of the US due to its military dependence has only further alienated Ottawa. The EU, facing a similar challenge, has been actively reducing its reliance on American defence systems. The prospect of Canada joining the EU’s military industry program signals a broader shift where traditional Nato allies seek greater autonomy.

The geopolitical ramifications of this move extend beyond Canada and the EU. According to an Associated Press report, if more Nato members, such as Portugal and others reconsidering their reliance on US defence technology, follow Canada’s lead, Washington’s military-industrial influence could wane.

Long-term outlook for Canada’s defence policy

Canada’s advanced talks with the EU to join its defence industry initiative highlight a significant geopolitical shift. As traditional alliances are tested under Trump’s leadership, Canada is seeking greater security autonomy by expanding its military partnerships with Europe.

The implications of this move could redefine Canada’s role in Nato, impact global arms markets, and reduce the dominance of US defence manufacturers. Whether this strategic realignment succeeds will depend on Canada’s ability to wade through the complexities of defence procurement, economic constraints and evolving global threats.

)