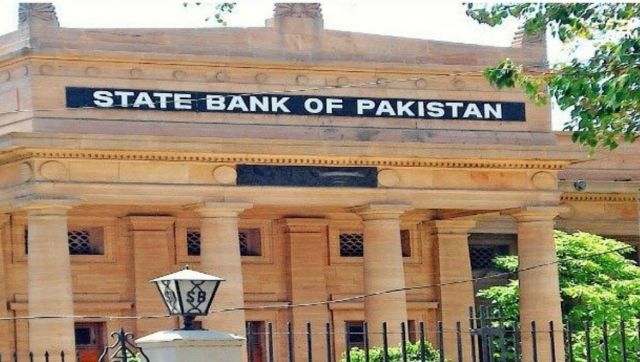

Islamabad: The economic situation of Pakistan is turning bad to worse. People of the south Asian nation barely have employment, savings for food and other essentials, amid this Pakistan’s central bank has hiked the policy rate by 100 basis points. The key rates of the State Bank of Pakistan (SBP) is now at 21 per cent, its highest level ever. The SBP’s monetary policy committee (MPC) noted that consumer price inflation in March 2023 rose further to 35.4 per cent and is expected to remain high in the near term. “However, there are early indications of inflation expectations plateauing, albeit at an elevated level,” Pakistan central bank’s MPC said in a released issued on Tuesday. On 2 March, the SBP raised rate by 300 basis points to 20 per cent. The SBP’s MPC noted three important developments that had implications on the macroeconomic outlook. 1 - The current account deficit has narrowed considerably, more than previously anticipated, mainly on the back of sizable import containment. Nonetheless, the overall balance of payments position continues to remain under stress, with foreign exchange reserves still at low levels. 2 - Significant progress has been made towards completion of the ninth review under the International Monetary Fund’s (IMF) Extended Fund Facility (EFF) programme. 3- Recent strains in the global banking system have led to further tightening of global liquidity and financial conditions. These have added to the difficulties of the emerging market economies like Pakistan to access international capital markets. The committee also observed that Pakistan’s financial sector “remains broadly resilient, while economic activity continues to be moderate.” Pakistan rupee falls to a new low As Pakistan struggles to unlock critical IMF funding its currency - Pakistani rupee - touched to a record low on Tuesday. The PKR, in the interbank market, closed at 287.29 against the US dollar, 0.78 per cent, or Rs 2.25, down from Monday’s close of 285.04. The country’s foreign exchange reserves have also been dwindling which is adding more woes to people as well as investors. Pakistan’s loan programme has not yet materialise months even after the country raised taxes and energy prices and allowed the currency to depreciate to meet IMF’s conditions. The country has missed several deadlines to resume its bailout. In 2019, Pakistan secured a $6 billion IMF bailout. In 2022, the country got another $1 billion to cope up with the devastating floods. However, in November, the IMF suspended disbursements after Pakistan failed to make more progress on fiscal consolidation. Read all the Latest News , Trending News , Cricket News , Bollywood News , India News and Entertainment News here. Follow us on Facebook , Twitter and Instagram .

Umang Sharma is a media professional with over 12 years of experience. Crafting compelling content and using storytelling techniques are his strengths. His interest lies in national, global, political news and events.

)