The Maldives-China Free Trade Agreement (FTA) is set to come into effect in 2025 after a delay of more than a decade.

The Maldivian government has said the FTA would take the bilateral trade to $1 billion. Maldives’ Minister of Economic Development and Trade Mohamed Saeed said the FTA will offer significant benefits, such as enhanced opportunities for exporting various goods and providing additional services, according to PTI.

Here are five things about China-Maldives trade treaty:

1. Political differences delayed FTA’s implementation

Maldives and China signed the FTA in 2014 and the Maldivian parliament approved it in 2017, but it could not be implemented due to the change of government.

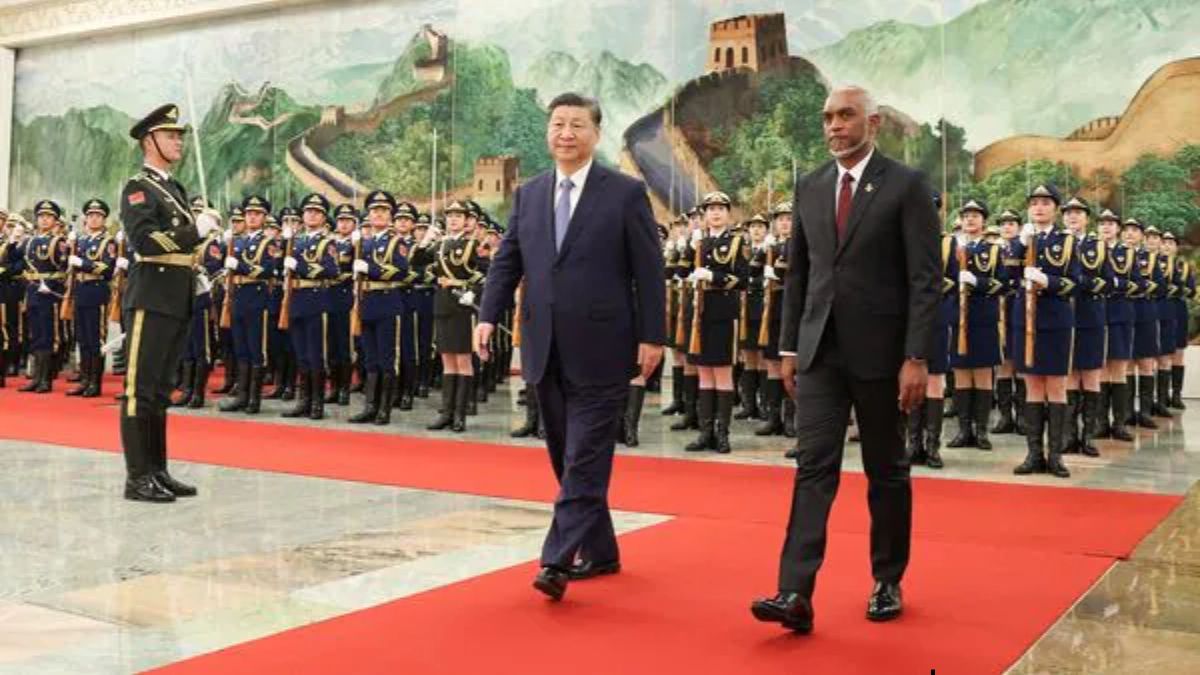

Former Maldivian President Ibrahim Solih, who was deemed friendly to India, held back the implementation of the FTA. It was only after pro-China Mohamed Muizzu came to power that things started moving. The Muizzu government on Tuesday announced the FTA will come into effect from January 1, 2025.

Muizzu came to power on the back of the ‘India Out’ campaign. While he initially plunged the India-Maldives relationship to a new low, he dragged Maldives into China’s orbit. The FTA’s implementation’s announcement came within days of the two countries signing a memorandum of understanding (MoU) to set up a framework for current account transactions and direct investments in their own currencies —Maldivian Rufiyaa and Chinese Yuan— instead of US Dollar.

2. Chinese imports to flood Maldives, trade imbalance to rise

The China-Maldives trade is around $700 million and the Maldivian government has said the FTA will take it to $1 billion.

Impact Shorts

More ShortsWhat the Maldivian government did not say is that the trade surge would be led by Chinese imports. China is already the third-largest source of imports for the Maldives after Oman and the United Arab Emirates (UAE). While the UAE and Oman’s imports are energy-based, China already dominates non-energy imports, including in the critical agricultural and food sectors.

Amitendu Palit, a researcher at the Singapore-based Institute of South Asian Studies (ISAS), said the end-result will be that Maldives’ trade imbalance and overall trade deficit will increase.

“The implementation of the FTA by the Maldives will result in a surge in imports from China. Imports of machinery and machinery-related products are specifically expected to increase. This is because demand for these imports will increase as ongoing and new Chinese projects on the island, especially those that are part of China’s Belt and Road Initiative, gather renewed momentum. These projects are in various stages of construction and the FTA will facilitate their import requirements,” noted Palit in an article for ISAS.

3. Foreign exchange crisis

The custom-free Chinese imports will not flood the Maldivian economy at the cost of domestic industry but will also contribute to a foreign exchange crisis.

While the imports will consume Maldivian foreign currency reserves, the custom-free nature of imports as a result of the FTA would mean that the Maldives would also be deprived of receiving foreign currency. The Maldives could lose as much as 3 per cent of all revenue, as per Palit.

“The FTA will enable almost half of the Maldives’ current imports from China to enter the country without being charged customs duties immediately upon its coming into effect. Foregoing customs revenue has implications for the public finances of the Maldivian economy. Imports from China are one of the largest sources of customs revenues for the Maldives. If most of these imports now enter the country duty-free, the Maldives will lose foreign exchange earnings. These losses can amount to around three per cent of total government revenues,” noted Palit.

4. FTA not a solution to food & economic crisis

The FTA will not be a solution for the crisis-laden Maldivian economy. As Maldives remain dependent on food imports and thus vulnerable to supply chain disruptions, the solution to the problem has to be an inward-looking one and not an outward one, noted Arya Roy Bardhan and Soumya Bhowmick of the Observer Research Foundation (ORF) in an article.

Instead, the FTA with China will further exacerbate the balance of payments deficit and plunge the country into a borrowing spiral, note Bardhan and Bhowmick.

5. More trouble if India pulls the plug

China, which has a track-record of plunging vulnerable countries into debt traps, now has its eyes on Maldives and the FTA can just be the medium for it.

The silver lining is the Indian support that keeps Maldivian economy afloat, but as pro-China Muizzu’s actions have worsened the relations, it would be understandable if India would be not very enthusiastic about supporting Maldives and may scale back support — spelling trouble for the island nation.

The China-Maldives FTA along with the worsening India-Maldives ties can significantly dampen prospects of industrial resurgence, note Bardhan and Bhowmick of ORF.

“With a large decline in import duty collection and imposition of high levels of debt, Maldives can soon find itself in a precarious position. The simultaneous withdrawal of Indian economic support will further compromise their prosperity, especially in terms of food security — where India is a major global supplier,” note Bardhan and Bhowmick.

)