NVIDIA has been riding a wave of extraordinary success this year, with its stock value nearly quadrupling in 2023 and growing more than ninefold over the last two years. However, its latest earnings report revealed signs of slowing growth in AI chip sales, raising concerns among investors. While the company remains a leader in AI hardware, its forecast for the slowest revenue growth in seven quarters has tempered the market’s enthusiasm.

The Santa Clara-based firm reported third-quarter revenue growth of 94 per cent year-on-year, but its fourth-quarter forecast indicates a slowdown to 69.5 per cent. Although still impressive, this marks a clear step back from its previous record-breaking momentum. Shares fell as much as 5 per cent in after-hours trading following the announcement but quickly regained some ground.

NVIDIA’s Blackwell chips and supply chain challenges

NVIDIA’s future hinges heavily on its new Blackwell family of AI chips, which are expected to drive significant sales growth. Chief Financial Officer Colette Kress noted that the company will exceed its initial fourth-quarter sales projections for the processors. However, the chips’ rollout has weighed on margins, initially in the low 70 per cent range, although they are expected to climb to the mid-70 per cent range as production ramps up.

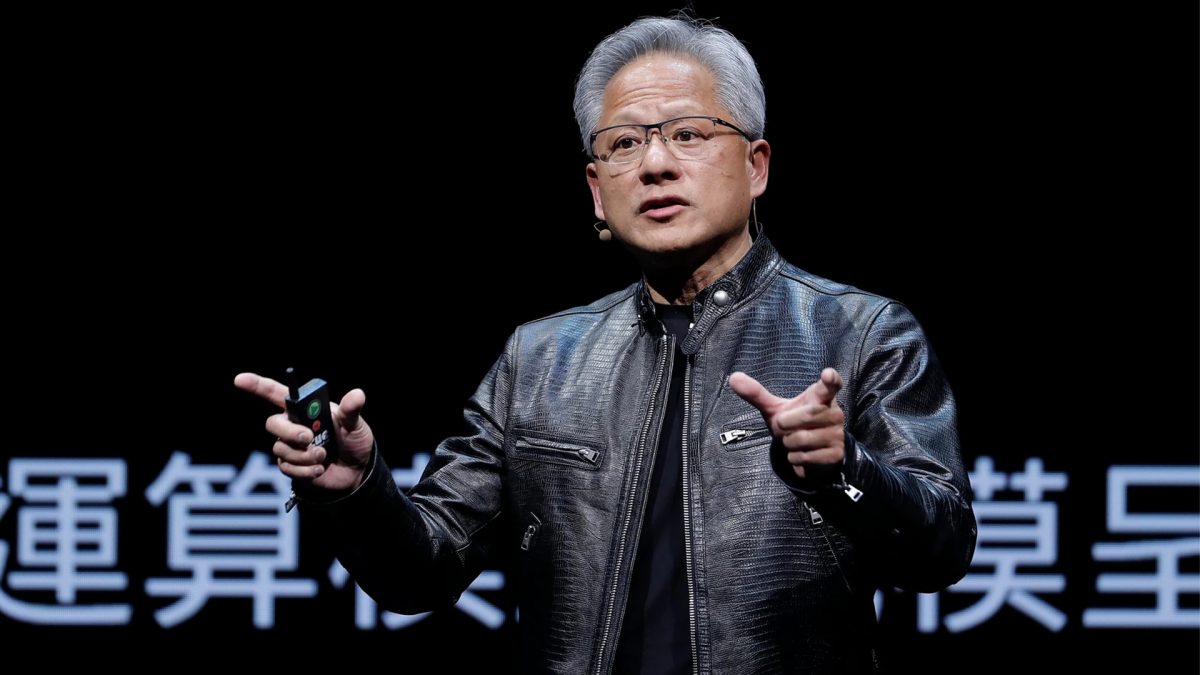

Concerns over overheating issues in Blackwell-powered servers have been reported, although they were were dismissed by CEO Jensen Huang, who assured investors that the systems were performing well in customer environments, including at Microsoft and Oracle.

Still, supply chain constraints, particularly limited advanced manufacturing capacity at TSMC, have slowed NVIDIA’s ability to meet surging demand. Huang indicated that production challenges are being addressed, with improved designs and expanded manufacturing lines in the works.

NVIDIA’s soaring year dampened by slowing AI chip sales growth

While NVIDIA’s fourth-quarter revenue forecast of $37.5 billion surpassed analysts’ estimates, the slowing pace of growth has caught investors’ attention. The company’s ability to consistently outpace Wall Street expectations has been a major factor in its meteoric rise. However, with supply bottlenecks and soaring expectations, maintaining that momentum has become increasingly challenging.

Experts like Ryan Detrick of Carson Group pointed out that even strong performance may appear underwhelming when expectations are sky-high. Despite the slowdown, demand for NVIDIA’s AI chips remains robust, driven by cloud companies expanding data centres to support generative AI.

Data centre growth and long-term prospects

NVIDIA’s data centre segment, which makes up the bulk of its revenue, grew by 112 per cent in the last quarter to $30.77 billion, although this was down from the 154 per cent growth recorded in the prior quarter. Adjusted earnings for the third quarter reached 81 cents per share, surpassing estimates of 75 cents per share.

Looking ahead, NVIDIA’s ability to address supply chain constraints and achieve higher margins will be critical. Analysts like Brandon Hoff from IDC suggest that growth could accelerate again if the company’s margins surpass 75 per cent. For now, while NVIDIA remains a Wall Street favourite, its slowing growth signals a potential shift in how investors view its future trajectory.

)