Ever since Prime Minister Narendra Modi announced demonetisation on that fateful day in November 2016, the digital payments ecosystem surely got a shot in the arm. One of the best things to come out of demonetisation has to be unified payments interface (UPI) which had just 30 banks supporting in with Rs 100.5 cr in transaction amount in November 2016. Fast forward to April 2019, and UPI is now supported by 144 banks and the amount transacted is Rs 1,42,034 cr. PhonePe, the Bengaluru headquartered financial technology company which is owned by Flipkart, has been one of the prominent players in the digital payments ecosystem. Launched in 2015, PhonePe has also been one of the first to offer UPI outside of the banking apps. The app has added many more features since such as an increasing number of merchant partners, support for other wallets and wealth management and much more. According to Rahul Chari, the co-founder and CTO of PhonePe, India is still at a nascent stage when it comes to taking full advantage of the fintech revolution and there’s a lot of scope to do more in the space. Chari, who started his career in the US in networking and embedded software moved back to India in 2009 to work in the consumer internet space with Sameer Nigam, the co-founder of PhonePe. Together they created Flipkart’s now discontinued online music store Flyte before quitting and starting PhonePe in 2015. In an exclusive phone interview to tech2, Chari spoke about the early days of PhonePe, its current challengers, UPI frauds on its platform, its ambition to become a super app and much more. Edited excerpts from the interview follow. [caption id=“attachment_6676631” align=“alignnone” width=“1024”] Rahul Chari, Co-founder and CTO, PhonePe[/caption] tech2: PhonePe has been one of the earliest non-govt and non-bank-associated financial technology company. Could you give us a brief background on the journey of PhonePe from its inception to the acquisition by Flipkart Rahul Chari (RC): We got acquired by Flipkart in 2010 to create Flyte which was its ebooks and music download platform. So it became a digital content platform on Flipkart and it was the first native app out of Flipkart, much before the retail Flipkart app. From there, I went on to head the engineering and product supply chain at Flipkart. Post that Sameer (Nigam) and I quit and started PhonePe. One of the reasons Flyte shutdown in my view was because it was ahead of its time. Micropayments were one very critical reason that Flyte didn’t take off. Now we are seeing recurring payments having made some progress in the country and though there is scope for improvement, micropayments are a lot better. You still have the subscription models, pay as you go models with Hotstar, etc. Back then, we were selling content at Rs 5 a track and it was clearly meant to be an impulse purchase and it had to be quick. This was at a time when digital wallets weren’t there (2012-13) and paying through card was such a nightmare for purchasing something for as low as Rs 5. The whole excitement of making that impulse purchase would fizzle out the moment you had to checkout using a card payment method. Apart from this learning, another learning that we had during the first Big Billion Days sale was that the digital payment infrastructure in the country was not yet created. In 2014, we realised that digital payments aren’t scaling as well as they should within the first 10-20 mins of the sale. The next option was cash on delivery (CoD) and there is a cost to cash. With CoD at scale, that cost increases significantly. The amount of cash management, pilferage, reconciliation, counterfeit notes, it just wasn’t worth it. That kind of led us to believe that there is an opportunity and a problem to be solved, eventually leading to the formation of PhonePe. Something like UPI is a more natural way to make a payment in a more seamless manner. tech2: How important was Unified Payments Interface (UPI) for the current digital landscape to evolve? RC: Very important. For a largely direct debit country like India where cash is the major means to transact, and where the credit card penetration is much lower than bank cards, no other form of payment being as simple as UPI, it has been a game changer. If it wasn’t for UPI, we wouldn’t be where we are right now with digital payments. tech2: What are your thoughts on the digital payments landscape in India? RC: If you look at it from an adoption and penetration perspective, it is still a long way to go. Our market is still a cash-heavy. We are at the tip of the tip of the iceberg and have to convert a cash economy to a digital economy. UPI plays a very big role there. UPI has created an infrastructure in the payments space and there can be further innovations by building upon this infrastructure, through application programming interfaces (APIs). UPI 2.0 is a step in that direction. tech2: How critical are merchant partners on PhonePe? RC: We believe in broadening our base. Money transfer is important for us and we are probably the biggest trial drivers for our user base. Merchant transactions fall into three buckets — online merchants where we have a payment option; offline merchants where you can pay by scanning the QR code which is at more than 3 million offline stores and then there are partners who offer in-app payment through PhonePe. We are extremely bullish on in-app payments. There are around 30-35 apps on PhonePe. By the end of the year, we want to cross the 100-mark on that front. Our whole model is based on building a technology platform on which our partners can innovate as I believe that is the most scalable and sustainable business model. Ours is an open platform model and we have open APIs which can be used by businesses to build their apps. [caption id=“attachment_6682541” align=“alignnone” width=“1280”]

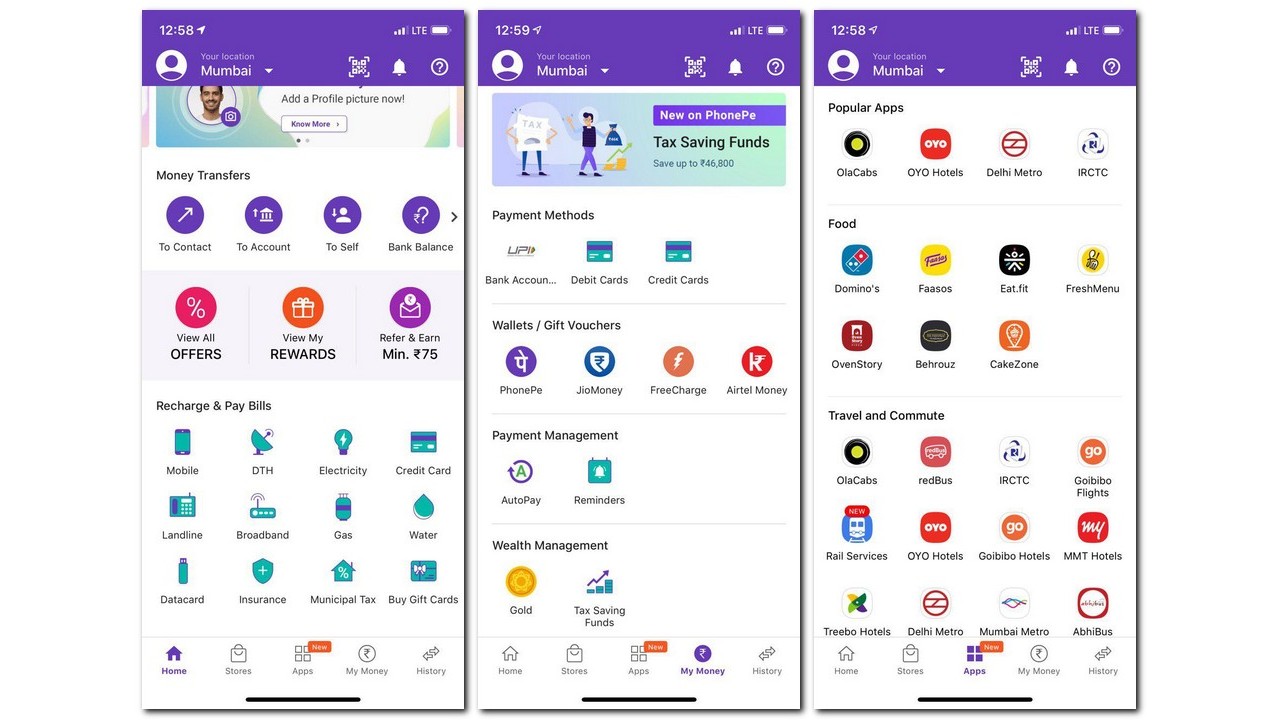

PhonePe interface[/caption] tech2: A lot of the times, when making in-app payments, one has to get out of that app, make the payment through the PhonePe interface and then return to the original app. Isn’t there a way to make it seamless? Or are there regulatory restrictions preventing that? RC: It is not a regulatory restriction. We do have models where we can completely integrate the process on the merchant app. The reason to take the person into the PhonePe app is to not just ensure security, but also to enable all the specialisations the user has done on the PhonePe app. It also helps in applying better fraud detection rules. tech2: There have been cases of UPI fraud on PhonePe. What are you doing to avoid these kinds of frauds as digital literacy regarding these things is still low in most parts of India? RC: Detecting fraud in India is a big problem. No PhonePe customer care representative will ever ask you for details such as transaction ID, virtual ID, MPIN and so on. Eighty percent of the tickets raised are crawled using technology and bots, so there is no agent involved. We continue to educate our customers about the fact that no one from our company will call you to take your details, through SMSes, through the website, etc. Education is a very large part of this. The second part is working with platforms. Now, Twitter, Facebook, etc., are being used by fraudsters who are also on PhonePe and we are working them to ensure that these accounts are automatically taken down. Also, when there are fraudsters acting as PhonePe support, then we can verify those accounts and have them shut down. The problem is we get throttled by the platforms who think that we are spamming them with requests of fraud accounts posing as PhonePe support. We just want these platforms to understand that this is a large problem in India. Apart from this, we take a lot of efforts in profiling our users and ensuring that any kind of fraudsters in the network are blocked. A lot of the times users complain of getting a message that their accounts are blocked for security reasons. We actively do this to ensure that there is no misuse. We use data signals effectively on our machine learning models and if that throws up any issues we block those accounts. tech2: So you mean you are monitoring different data points of users and looking for anomalies during transactions? RC: Yes, we do that. Location is a very large factor and we build affinity models based on your location. So a transaction limit check happens on a well-known location versus on a new location. If there is an anomaly, transactions will be blocked. That’s when you see the ‘Transactions blocked for security reasons’ error. Another flag is to do with merchant transactions. If we notice that you have never transacted with a merchant and suddenly there are multiple transactions to that merchant of high-value amount, then that’s flagged for our systems to automatically block that transaction. We prefer to take an approach where we don’t allow a transaction to happen. Of course, there are false positives and that helps us improve our ML models. So there’s a score associated with a user, the device, the location and the transaction. The context for the transaction is merchant and amount, but apart from that we also have an affinity for the time of day. By that we mean, there are certain times in the day when you don’t interact with the app and don’t do a payment — so we use that in our affinity model as well to determine whether it’s a rhythmic pattern or a non-rhythmic pattern. So these are the real-time models that we apply. tech2: Malicious actors also use QR codes or digital payments. So is there a way to identify people who are making use of your platform for illegal purposes? RC: It is difficult to identify the legality, but we can call it suspicious transactions. These suspicious transactions are flagged in our system. For instance, if there is an account which is only receiving huge quantities of money and never transacts then that’s a suspicious model and automatically gets flagged. Sometimes they could be legit businesses. We do have anomaly detectors in the system that flag suspicious transactions. But if the party comes back with legit reasons, we enable these accounts. tech2: How do you see this space evolving in the next five years? RC: I think in the next five years, we will see the unbundling a lot of banking services. We will see a lot of partnerships across the board. Fintech is used very crudely nowadays, but true fintech is yet to happen in India and we will see that happening in the next five years. We will see a lot of financial institutes like banks, home loan companies, etc., partnering with true consumer tech companies like us. tech2: What are your thoughts on Cryptocurrency and will we see a PhonePe coin? RC: Blockchain as a technology has a much wider use case and I am more bullish about it starting to become a platform where various use cases in the fintech space can play out. Cryptocurrency by itself, I am not sure how the regulatory discussions will go on it. Given the lack of education in this space and the potential for fraud, I don’t think the country is ready for cryptocurrency yet. [caption id=“attachment_4809021” align=“alignnone” width=“1280”]

PhonePe interface[/caption] tech2: A lot of the times, when making in-app payments, one has to get out of that app, make the payment through the PhonePe interface and then return to the original app. Isn’t there a way to make it seamless? Or are there regulatory restrictions preventing that? RC: It is not a regulatory restriction. We do have models where we can completely integrate the process on the merchant app. The reason to take the person into the PhonePe app is to not just ensure security, but also to enable all the specialisations the user has done on the PhonePe app. It also helps in applying better fraud detection rules. tech2: There have been cases of UPI fraud on PhonePe. What are you doing to avoid these kinds of frauds as digital literacy regarding these things is still low in most parts of India? RC: Detecting fraud in India is a big problem. No PhonePe customer care representative will ever ask you for details such as transaction ID, virtual ID, MPIN and so on. Eighty percent of the tickets raised are crawled using technology and bots, so there is no agent involved. We continue to educate our customers about the fact that no one from our company will call you to take your details, through SMSes, through the website, etc. Education is a very large part of this. The second part is working with platforms. Now, Twitter, Facebook, etc., are being used by fraudsters who are also on PhonePe and we are working them to ensure that these accounts are automatically taken down. Also, when there are fraudsters acting as PhonePe support, then we can verify those accounts and have them shut down. The problem is we get throttled by the platforms who think that we are spamming them with requests of fraud accounts posing as PhonePe support. We just want these platforms to understand that this is a large problem in India. Apart from this, we take a lot of efforts in profiling our users and ensuring that any kind of fraudsters in the network are blocked. A lot of the times users complain of getting a message that their accounts are blocked for security reasons. We actively do this to ensure that there is no misuse. We use data signals effectively on our machine learning models and if that throws up any issues we block those accounts. tech2: So you mean you are monitoring different data points of users and looking for anomalies during transactions? RC: Yes, we do that. Location is a very large factor and we build affinity models based on your location. So a transaction limit check happens on a well-known location versus on a new location. If there is an anomaly, transactions will be blocked. That’s when you see the ‘Transactions blocked for security reasons’ error. Another flag is to do with merchant transactions. If we notice that you have never transacted with a merchant and suddenly there are multiple transactions to that merchant of high-value amount, then that’s flagged for our systems to automatically block that transaction. We prefer to take an approach where we don’t allow a transaction to happen. Of course, there are false positives and that helps us improve our ML models. So there’s a score associated with a user, the device, the location and the transaction. The context for the transaction is merchant and amount, but apart from that we also have an affinity for the time of day. By that we mean, there are certain times in the day when you don’t interact with the app and don’t do a payment — so we use that in our affinity model as well to determine whether it’s a rhythmic pattern or a non-rhythmic pattern. So these are the real-time models that we apply. tech2: Malicious actors also use QR codes or digital payments. So is there a way to identify people who are making use of your platform for illegal purposes? RC: It is difficult to identify the legality, but we can call it suspicious transactions. These suspicious transactions are flagged in our system. For instance, if there is an account which is only receiving huge quantities of money and never transacts then that’s a suspicious model and automatically gets flagged. Sometimes they could be legit businesses. We do have anomaly detectors in the system that flag suspicious transactions. But if the party comes back with legit reasons, we enable these accounts. tech2: How do you see this space evolving in the next five years? RC: I think in the next five years, we will see the unbundling a lot of banking services. We will see a lot of partnerships across the board. Fintech is used very crudely nowadays, but true fintech is yet to happen in India and we will see that happening in the next five years. We will see a lot of financial institutes like banks, home loan companies, etc., partnering with true consumer tech companies like us. tech2: What are your thoughts on Cryptocurrency and will we see a PhonePe coin? RC: Blockchain as a technology has a much wider use case and I am more bullish about it starting to become a platform where various use cases in the fintech space can play out. Cryptocurrency by itself, I am not sure how the regulatory discussions will go on it. Given the lack of education in this space and the potential for fraud, I don’t think the country is ready for cryptocurrency yet. [caption id=“attachment_4809021” align=“alignnone” width=“1280”] Paytm. Reuters.[/caption] tech2: This space has a lot of competition such as Google Pay, Paytm and others. What differentiates PhonePe from the others? RC: Yes, it’s a fairly competitive space. But we have realised that players who relied a lot on the digital wallet aspect of digital payments have not really seen much success. Google Pay is banking on UPI alone and Paytm is transitioning from a wallet to a bank. PhonePe has actually taken up the role of being a local container when it comes to currency and a local platform when it comes to your transactions. So that is our biggest differentiator. In the app, you will notice that there is an option to direct debit using UPI. So in the ‘My Money’ section, you can actually link your debit and credit cards to your PhonePe account without the need to actually load money in your wallets. At the same time, you can link your PhonePe wallet or other wallets to the PhonePe account and use the balance in those wallets. So we really are payments container whose objective is to allow you to use a digital wallet of your choice so far as you are dealing in digital currency. So PhonePe, JioMoney, Airtel Money, Freecharge, share the same level of importance on our platform. At the same time, it is not mandatory to load money on these wallets to do transactions. Our goal is to mirror your physical wallet (which may have all your cards and cash) so that you don’t have to carry your physical wallet. tech2: With UPI becoming so popular, is it making digital wallets redundant? RC: I think there is space for both. Especially with micro-transactions or refunds, digital wallets are the best. Today if you pay by a card and have to get a refund, it can take anywhere from 5-7 days. With digital wallets, it’s an immediate transaction. I think there is still a case for digital wallets. tech2: The Right to Privacy ruling is expected to come out soon. Will your digital transactions and data usage around it be affected by it? RC: We are still in discussion with the authorities as to how the act will come into play. The privacy act will have to take into consideration how India operates, what are the kind of issues we are seeing today. It can’t be an exact mirror of the General Data Protection Regulation (GDPR). We have to work with policymakers to define what works. This works in the banking sector as well where innovation doesn’t stop. So it’s early days to predict what the changes will be. Yes, we need it. But in what form it will come, we will only know later in the year. tech2: There has recently been a Rs 450 cr infusion from Flipkart on PhonePe. By when will PhonePe break even or is that not of immediate concern at the moment? RC: Looking at the hyper-growth we are experiencing, there will be a lot of spending on brand marketing and consumer cash back. Putting a date to an immediate breaking even is not the goal at the moment. Give the opportunity to connect with the market is huge and the growth we are seeing, we are being intelligent about how we market. The IPL partnership is important as it gives us a vast reach. I think this will continue as Flipkart is quite bullish about the product. We think now is the right time to amplify the brand and to actually take in national at all possible touchpoints, especially events like the Indian Premier League (IPL). [caption id=“attachment_6682581” align=“alignnone” width=“640”]

Paytm. Reuters.[/caption] tech2: This space has a lot of competition such as Google Pay, Paytm and others. What differentiates PhonePe from the others? RC: Yes, it’s a fairly competitive space. But we have realised that players who relied a lot on the digital wallet aspect of digital payments have not really seen much success. Google Pay is banking on UPI alone and Paytm is transitioning from a wallet to a bank. PhonePe has actually taken up the role of being a local container when it comes to currency and a local platform when it comes to your transactions. So that is our biggest differentiator. In the app, you will notice that there is an option to direct debit using UPI. So in the ‘My Money’ section, you can actually link your debit and credit cards to your PhonePe account without the need to actually load money in your wallets. At the same time, you can link your PhonePe wallet or other wallets to the PhonePe account and use the balance in those wallets. So we really are payments container whose objective is to allow you to use a digital wallet of your choice so far as you are dealing in digital currency. So PhonePe, JioMoney, Airtel Money, Freecharge, share the same level of importance on our platform. At the same time, it is not mandatory to load money on these wallets to do transactions. Our goal is to mirror your physical wallet (which may have all your cards and cash) so that you don’t have to carry your physical wallet. tech2: With UPI becoming so popular, is it making digital wallets redundant? RC: I think there is space for both. Especially with micro-transactions or refunds, digital wallets are the best. Today if you pay by a card and have to get a refund, it can take anywhere from 5-7 days. With digital wallets, it’s an immediate transaction. I think there is still a case for digital wallets. tech2: The Right to Privacy ruling is expected to come out soon. Will your digital transactions and data usage around it be affected by it? RC: We are still in discussion with the authorities as to how the act will come into play. The privacy act will have to take into consideration how India operates, what are the kind of issues we are seeing today. It can’t be an exact mirror of the General Data Protection Regulation (GDPR). We have to work with policymakers to define what works. This works in the banking sector as well where innovation doesn’t stop. So it’s early days to predict what the changes will be. Yes, we need it. But in what form it will come, we will only know later in the year. tech2: There has recently been a Rs 450 cr infusion from Flipkart on PhonePe. By when will PhonePe break even or is that not of immediate concern at the moment? RC: Looking at the hyper-growth we are experiencing, there will be a lot of spending on brand marketing and consumer cash back. Putting a date to an immediate breaking even is not the goal at the moment. Give the opportunity to connect with the market is huge and the growth we are seeing, we are being intelligent about how we market. The IPL partnership is important as it gives us a vast reach. I think this will continue as Flipkart is quite bullish about the product. We think now is the right time to amplify the brand and to actually take in national at all possible touchpoints, especially events like the Indian Premier League (IPL). [caption id=“attachment_6682581” align=“alignnone” width=“640”] Aamir Khan has been roped in as the brand ambassador for PhonePe. Image: PhonePe[/caption] tech2: What are the challenges that PhonePe is facing in the current market scenario. In the cities, it is well-oiled machinery, but in tier 2 and tier 3 towns there are challenges such as network being patchy, more feature phones than smartphones and so on, so how does PhonePe plan to grow there? RC: We are less worried about the feature phone segment, as we feel the transition (to smartphones) is happening at a rapid pace. The price points at which Android phones are selling and a lot of people in tier 2 and tier 3 towns are much more aspirational. Data is also becoming cheap. But yes, the choppy connectivity bit is an issue. Since we have more than a billion transactions every month on the app, we want to ensure that the app works on even 2G-like networks. From a technology standpoint that is a challenge and we are continuously working on improving that. We are looking at seeing how we can make offline payments happen. Such that even if you don’t have a network at a given point, can you actually complete a payment? We are working on some solutions in that direction. It is not just about making payments happen, but also consolidating the payments at the merchant’s end for him to hand over the goods. So instead of optimising for the patchy network, we are also looking at making possible offline payments. The other challenge is educating the consumers about digital payments. Demonetisation was a strong way of getting people to learn about digital payments. Now metros and tier 1 cities are adopting it fine. But we need to be able to educate people about the advantages of digital transactions over cash payment. The challenge is how we can build use cases that are much more local. That’s where the partnership model works. We will be doubling down on finding partnerships which are relevant to those tier 2 and tier 3 towns where we want to grow. Identifying that one use case can help in the easy adoption of the app. tech2: Google Pay offers significantly higher chances of cashbacks. Do you think that’s a problem area that needs to be addressed on PhonePe? RC: I think we have a different approach. We are extremely competitive on the number of transactions that we are driving on our platform. Also, from a merchant use case perspective we are way ahead, because the acceptance among merchants being significantly larger and also the number of use cases on the app being way ahead of Google, we are relying more on the prospect of being a habit creating app. We are working towards that, so we don’t have to rely as much on the cashback aspect. tech2: How long before India reaches the level of China, when it comes to digital payments. Do you see cash being eliminated in a large way as it is in China? RC: I don’t see it going to the level that cash is eliminated in India in the next 3-4 years. However, I see a lot of day to day spends adopting digital payments. If you look at our economy, money changes hands at multiple levels, so it is difficult to eliminate cash from the equation. But at the retail side, I believe there will be a quantum shift over the next three years, because of the kind of partnerships that will evolve between banks, fintech players, etc. There are a number of kirana stores who are accepting digital payments now, that wasn’t the case a few years back. [caption id=“attachment_4220177” align=“alignnone” width=“1280”]

Aamir Khan has been roped in as the brand ambassador for PhonePe. Image: PhonePe[/caption] tech2: What are the challenges that PhonePe is facing in the current market scenario. In the cities, it is well-oiled machinery, but in tier 2 and tier 3 towns there are challenges such as network being patchy, more feature phones than smartphones and so on, so how does PhonePe plan to grow there? RC: We are less worried about the feature phone segment, as we feel the transition (to smartphones) is happening at a rapid pace. The price points at which Android phones are selling and a lot of people in tier 2 and tier 3 towns are much more aspirational. Data is also becoming cheap. But yes, the choppy connectivity bit is an issue. Since we have more than a billion transactions every month on the app, we want to ensure that the app works on even 2G-like networks. From a technology standpoint that is a challenge and we are continuously working on improving that. We are looking at seeing how we can make offline payments happen. Such that even if you don’t have a network at a given point, can you actually complete a payment? We are working on some solutions in that direction. It is not just about making payments happen, but also consolidating the payments at the merchant’s end for him to hand over the goods. So instead of optimising for the patchy network, we are also looking at making possible offline payments. The other challenge is educating the consumers about digital payments. Demonetisation was a strong way of getting people to learn about digital payments. Now metros and tier 1 cities are adopting it fine. But we need to be able to educate people about the advantages of digital transactions over cash payment. The challenge is how we can build use cases that are much more local. That’s where the partnership model works. We will be doubling down on finding partnerships which are relevant to those tier 2 and tier 3 towns where we want to grow. Identifying that one use case can help in the easy adoption of the app. tech2: Google Pay offers significantly higher chances of cashbacks. Do you think that’s a problem area that needs to be addressed on PhonePe? RC: I think we have a different approach. We are extremely competitive on the number of transactions that we are driving on our platform. Also, from a merchant use case perspective we are way ahead, because the acceptance among merchants being significantly larger and also the number of use cases on the app being way ahead of Google, we are relying more on the prospect of being a habit creating app. We are working towards that, so we don’t have to rely as much on the cashback aspect. tech2: How long before India reaches the level of China, when it comes to digital payments. Do you see cash being eliminated in a large way as it is in China? RC: I don’t see it going to the level that cash is eliminated in India in the next 3-4 years. However, I see a lot of day to day spends adopting digital payments. If you look at our economy, money changes hands at multiple levels, so it is difficult to eliminate cash from the equation. But at the retail side, I believe there will be a quantum shift over the next three years, because of the kind of partnerships that will evolve between banks, fintech players, etc. There are a number of kirana stores who are accepting digital payments now, that wasn’t the case a few years back. [caption id=“attachment_4220177” align=“alignnone” width=“1280”] A WeChat Pay system is demonstrated at a canteen as part of Tencent office inside TIT Creativity Industry Zone in Guangzhou, China May 9, 2017. Picture taken May 9, 2017. REUTERS/Bobby Yip - RC171C3E03B0[/caption] tech2: Any plans to expand to other geographies outside India? RC: The opportunity is there and it won’t be difficult for us to transition the product when that happens. But right now, the focus is on India. tech2: Is there a plan to have international partners in your app. RC: We have to ensure that whichever partner we bring onboard comes with a network that is beneficial to both of us. So it’s not just about adding an international partner. If we do that, we will go all the way using our platform approach of bringing in the merchants, BFSI partners, digital currency together. tech2: Do you see consolidation happening in this space? I don’t see a lot of consolidation happening now among the big players. I do see a lot of partnerships getting forged between fintech apps. Disclaimer: Jio Money belongs to Reliance Industries which is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd, the publisher of Firstpost and tech2

A WeChat Pay system is demonstrated at a canteen as part of Tencent office inside TIT Creativity Industry Zone in Guangzhou, China May 9, 2017. Picture taken May 9, 2017. REUTERS/Bobby Yip - RC171C3E03B0[/caption] tech2: Any plans to expand to other geographies outside India? RC: The opportunity is there and it won’t be difficult for us to transition the product when that happens. But right now, the focus is on India. tech2: Is there a plan to have international partners in your app. RC: We have to ensure that whichever partner we bring onboard comes with a network that is beneficial to both of us. So it’s not just about adding an international partner. If we do that, we will go all the way using our platform approach of bringing in the merchants, BFSI partners, digital currency together. tech2: Do you see consolidation happening in this space? I don’t see a lot of consolidation happening now among the big players. I do see a lot of partnerships getting forged between fintech apps. Disclaimer: Jio Money belongs to Reliance Industries which is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd, the publisher of Firstpost and tech2

“If it wasn’t for UPI, we wouldn’t be where we are right now with digital payments.”

Advertisement

End of Article

)

)

)

)

)

)

)

)

)