Ride-hailing company Lyft Inc blew past Wall Street estimates for third-quarter revenue on Wednesday, as promotions attracted more active users who also spent more per ride. Shares of Lyft were up six percent in after-market trading. The company also estimated current-quarter revenue well ahead of expectations and raised its 2019 forecast. Lyft has partnered with several companies as it battles larger rival Uber Technologies Inc for a bigger share of the ride-hailing market. Uber’s shares were up nearly 1 percent. The company has partnered with Delta Airlines Inc, Airbnb and Slack Technologies Inc among others, according to Lyft’s website. [caption id=“attachment_7578141” align=“alignnone” width=“1024”] Lyft has partnered with Delta Airlines Inc, Airbnb and Slack Technologies Inc among othersImage: Reuters[/caption] Lyft said it expects revenue in the range of $975 million (£756.69 million) and $985 million for the fourth quarter. Analysts on average were expecting revenue of $942.6 million, according to IBES data from Refinitiv. The company on average got $42.82 in revenue from each of its 22.3 million active riders in its third quarter as a public company, an about 27 percent jump in revenue per rider and a 28 percent increase in riders over the same period in 2018. [caption id=“attachment_7578081” align=“alignnone” width=“1280”]

graphic on Lyft rider numbers grow post-IPO. Image: Reuters[/caption] The company had earlier promised that its ride-hailing services would be profitable without giving any timeline. But it had also warned that as a company it might continue posting losses as it invests heavily in self-driving cars, renting scooters and other ventures. Lyft expects fourth-quarter adjusted core losses to be between $160 million and $170 million, compared with its prior forecast of between $240 million and $245 million. [caption id=“attachment_7578061” align=“alignnone” width=“1280”]

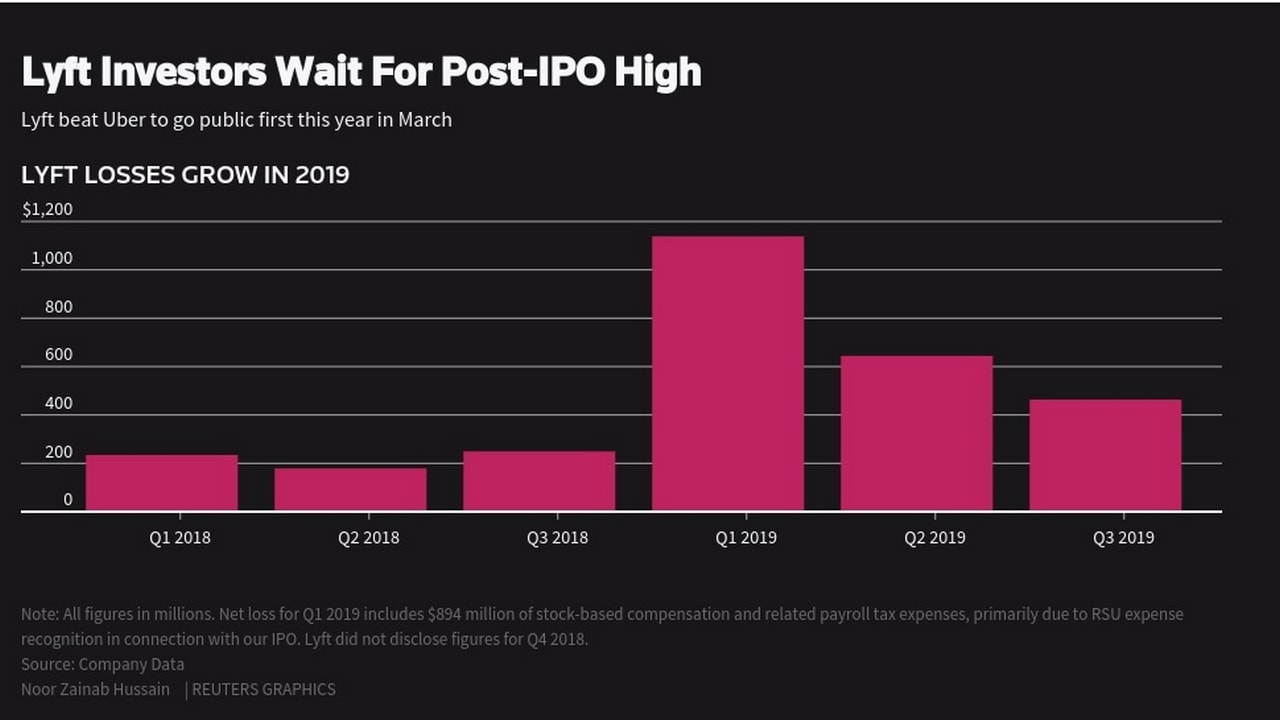

graphic on Lyft rider numbers grow post-IPO. Image: Reuters[/caption] The company had earlier promised that its ride-hailing services would be profitable without giving any timeline. But it had also warned that as a company it might continue posting losses as it invests heavily in self-driving cars, renting scooters and other ventures. Lyft expects fourth-quarter adjusted core losses to be between $160 million and $170 million, compared with its prior forecast of between $240 million and $245 million. [caption id=“attachment_7578061” align=“alignnone” width=“1280”] Graphic on Lyft loss before and after its March IPO. Image: Reuters[/caption] Revenue surged about 63 percent to $955.6 million in the third quarter ended 30 September, beating the average analyst estimate of $915.04 million, according to IBES data from Refinitiv. Net loss widened to $463.5 million from $249.2 million a year earlier, with costs rising nearly 70 percent. The company had a loss of $1.57 per share compared with a loss of $11.58 per share in the third quarter of 2018, as the number of outstanding shares rose from a year earlier.

Graphic on Lyft loss before and after its March IPO. Image: Reuters[/caption] Revenue surged about 63 percent to $955.6 million in the third quarter ended 30 September, beating the average analyst estimate of $915.04 million, according to IBES data from Refinitiv. Net loss widened to $463.5 million from $249.2 million a year earlier, with costs rising nearly 70 percent. The company had a loss of $1.57 per share compared with a loss of $11.58 per share in the third quarter of 2018, as the number of outstanding shares rose from a year earlier.

Lyft has partnered with several companies as it battles Uber Technologies Inc in the ride-hailing market.

Advertisement

End of Article

)

)

)

)

)

)

)

)

)