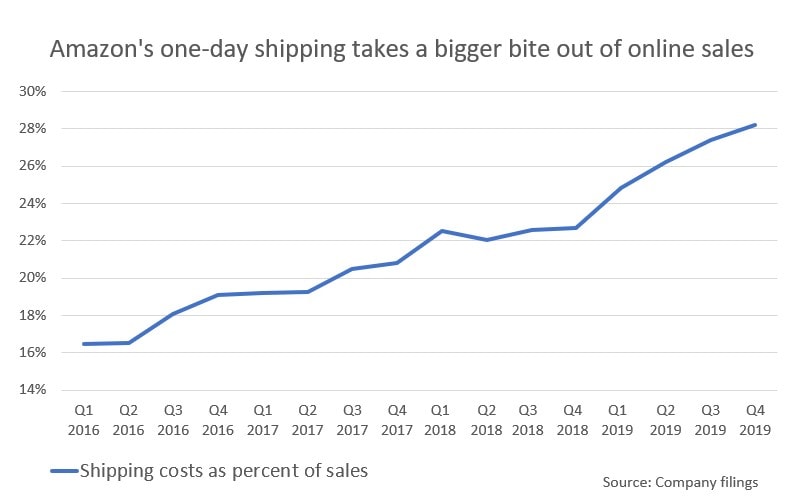

Amazon.com Inc on Thursday posted holiday quarter results well above expectations as the expansion of its one-day shipping program came under budget and membership in its Prime loyalty club notched a 50 percent rise in two years. Shares soared 13 percent in after-hours trade, putting the online retailer back in the $1 trillion market capitalization club. If the share gain holds on Friday, it will be the biggest daily jump for Amazon since October 2017. Amazon also forecast operating income of up to $4.2 billion (3.2 billion pounds) in the current quarter. That may assuage investor concerns that Amazon was continuing to invest heavily in its fast delivery effort that could have erased its windfalls in e-commerce, advertising and its cloud computing business, Amazon Web Services (AWS). “These results and Q1 forecast suggest we’re past the worst in terms of the margin pressure from the one-day shipping initiative, and that competitive concerns surrounding AWS have been massively overstated, removing two of the main bear arguments on the stock,” said Atlantic Equities analyst James Cordwell. [caption id=“attachment_7464001” align=“alignnone” width=“1024”]  A view of the new Amazon logistic center with the company’s logo in Dortmund, Germany November 14, 2017. REUTERS/Thilo Schmuelgen - RC1962CE0BF0[/caption] Amazon Chief Financial Officer Brian Olsavsky told reporters that additional investment in one-day shipping came slightly under the $1.5 billion it had forecast for the fourth quarter, and that the company would no longer have a year-over-year cost penalty from its one-day delivery program in the second quarter. Olsavsky added that spending on video would rise going forward, but the company was still determining its overall level of investment for 2020. Jeff Bezos, Amazon’s chief executive, said in a statement that the company now has more than 150 million paid members in its loyalty club Prime, a 50 percent increase from the retailer’s last disclosure in April 2018. Subscribers keep returning to Amazon to benefit from perks like fast delivery and television, and its purchase of U.S. grocer Whole Foods Market and popular suite of voice-controlled Echo speakers are prompting still more customers to transact with the Seattle-based company. This formula has helped make Bezos the richest person in the world. Now, Amazon is hoping that cutting delivery times to one day for Prime members will spark further demand, aiming to outmanoeuvre rivals such as Walmart Inc that have marketed two-day shipping without subscription fees. Amazon made progress in the holiday season, reporting that it quadrupled one-day and same-day deliveries over the year-ago period. Revenue from subscription fees grew 32 percent to $5.2 billion, Amazon said.

Costs Jump; Watching Coronavirus

Total net sales rose 21 percent to $87.44 billion in the fourth quarter ended 31 December, beating estimates of $86.02 billion. This has helped offset spending for Amazon, a company that has long been happy to forgo short-term results on a bold bet that could reap its future profit. Amazon’s total operating expenses rose 21.8 percent during the quarter to $83.56 billion. More online shopping and the bet on faster delivery has meant a surge in hiring and related costs. The company said its full-time and part-time worker headcount rose 23 percent to 798,000 in the quarter, as it expanded both fulfillment and corporate software roles. [caption id=“attachment_7981621” align=“alignnone” width=“798”]  Image: Thomson Reuters/Company Filings[/caption] Expenses similarly have grown as the company placed inventory closer to customers and built out its last-mile shipping network, now carrying the biggest share of US Amazon-ordered packages. Its Amazon Logistics unit delivered more than 3.5 billion boxes globally in 2019. Online grocery orders from Whole Foods grew a lot, too, Olsavsky said. Worldwide shipping costs rose 43 percent to $12.9 billion, Amazon said. Amazon Web Services also has seen infrastructure and marketing costs rise. The unit responsible for selling data storage and computing power in the cloud lost out to Microsoft Corp in a high-profile deal last quarter to sell technology to the US Department of Defense, in what could have netted the company $10 billion over a decade. Amazon is contesting the contract decision. AWS increased revenue 34 percent to $9.95 billion, the third quarter in a row in which its rate of growth was under 40 percent. Amazon’s international business narrowed losses to $617 million in the fourth quarter, from a loss of $642 million a year prior. Amazon has less exposure to China than Apple Inc and other technology industry peers, which may help it weather economic uncertainty surrounding the outbreak of the coronavirus. Olsavsky said the company is watching the situation very carefully and is starting to put China travel restrictions in place for employees. Amazon lets customers in China buy foreign goods through its global store; businesses in China can sell abroad via Amazon and use Amazon’s cloud computing technology as well. However, Amazon considers China to be a far less strategic market than India, which Bezos visited earlier this month partly to announce a new $1 billion investment in the country. “Amazon’s increased profits during this quarter in the face of increased costs and competitive pressure in AWS was the real surprise,” said eMarketer Principal Analyst, Andrew Lipsman. “Amazon blew all expectations out of the water.”

)

)

)

)

)

)

)

)

)