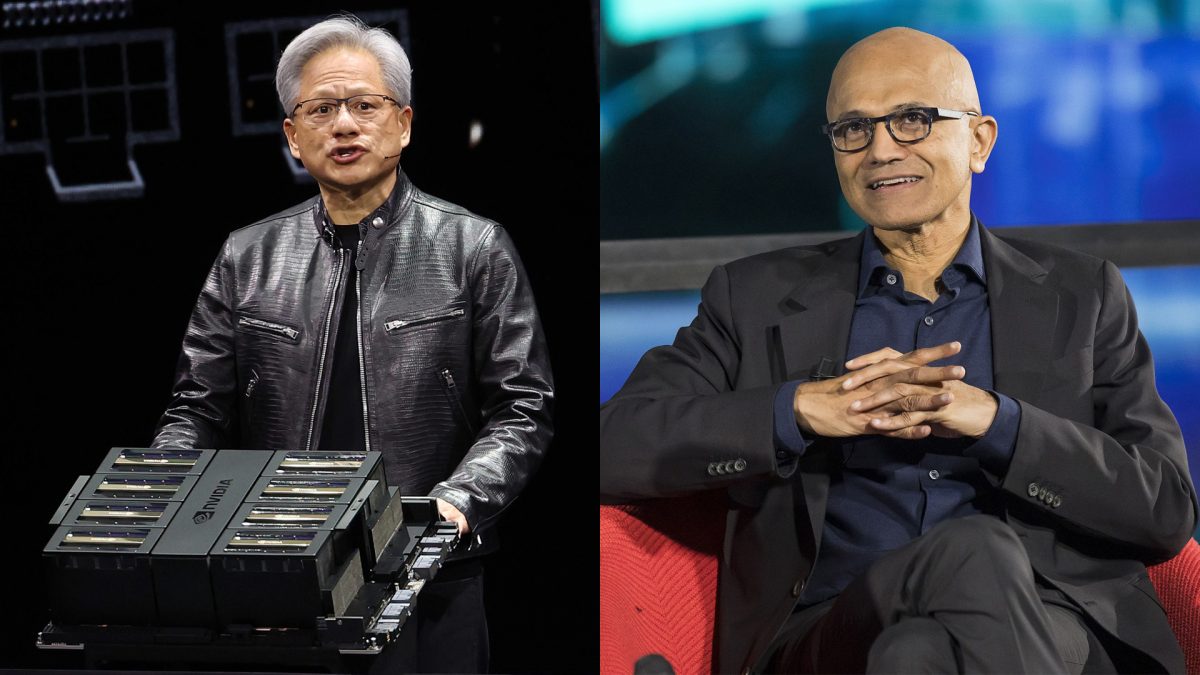

NVIDIA, for a brief moment had overtaken Apple in market capitalisation and was the second-most valuable public company behind Microsoft, driven by the ongoing artificial intelligence (AI) surge.

On Wednesday, NVIDIA’s market cap soared past the $3 trillion mark, closing at $3.019 trillion after a more than 5 per cent increase in its share price. This surpassed Apple’s market value of $2.99 trillion. However, as of Thursday, NVIDIA saw its shares fall by just over 1 per cent. With this Apple, and NVIDIA are tied neck and neck.

As of the latest figures, Microsoft remains the most valuable publicly traded company with a market cap of $3.15 trillion, with Apple and NVIDIA tied neck and neck at $2.98 trillion

Market Dynamics and Analyst Projections

Market analysts now predict that NVIDIA could soon surpass Apple again, this time for good, and soon, even surpass Microsoft in market cap, positioning itself as a potential leader in the tech industry. Some analysts are particularly bullish, suggesting NVIDIA could become the first company to reach a $5 trillion market cap within the next few years.

This projected $5 trillion market cap would translate to a stock price of approximately $2032, which is a 66 per cent increase from current levels. Post its upcoming 10-for-1 stock split, this would equate to about $203 per share, potentially making NVIDIA eligible for inclusion in the Dow Jones Industrial Average.

Impact Shorts

More ShortsDriving Factors Behind NVIDIA’s Surge

NVIDIA’s rise has been fueled by its dominance in the AI chip market, particularly for data centres. The company’s strong execution and AI prospects have made it a favorite among investors. On Wednesday, BofA Securities analysts reiterated NVIDIA as their top sector pick, with a street-high price target of $1500. They emphasized NVIDIA’s significant lead in performance, pipeline, incumbency, scale, and developer support.

NVIDIA has seen its shares rise by more than 24 per cent since reporting its first-quarter earnings in May. Over the past five years, the stock has surged more than 3,290 per cent. NVIDIA holds an estimated 80 per cent market share in AI chips for data centres, which has attracted substantial investment from major cloud vendors.

For the most recent quarter, NVIDIA’s revenue from its data centre business, including GPU sales, skyrocketed by 427 per cent year-over-year to $22.6 billion, constituting about 86 per cent of the company’s overall sales.

Comparison with Apple

In contrast, Apple has experienced more modest growth this year, with shares up only about 5 per cent. The iPhone maker’s sales growth has slowed, with overall sales dropping 4 per cent and iPhone sales falling 10 per cent in the most recent quarter compared to the previous year. Apple faces strategic challenges, including demand issues in China, manufacturing concerns, and mixed reactions to its new Vision Pro virtual reality headset.

However, with WWDC just around the corner, Apple can expect its stock to rally upward as it announces some major AI features for its product lineup.

Apple, which was the first company to reach both $1 trillion and $2 trillion market caps, has recently ceded its position as the most valuable US company to Microsoft. Microsoft has similarly benefited from investor interest in AI infrastructure, contributing to its leading market cap position.

)