Thanks to the Supreme Court’s decision to cancel 122 licences issued by A Raja in 2008, India is now on the threshold of a third unravelling of telecom policy. It is going to take all of this year and even early next year to clean up this third mess of our own making.

The first unravelling happened in the first half of the 1990s, when the Narasimha Rao government opened up the sector and received hugely inflated and rigged bids for telecom circles. The government had to cancel many of them through various dubious means, including by placing a limit on the number of circles one could bid for.

The second unravelling happened in 1999-2001, after the old high bids were found to be inhibiting the industry’s growth and reducing mobile telephony to a rich man’s indulgence. To complete the mess, it only needed an Ambani to enter the mobile sector through the backdoor (the government allowed him to offer fixed line telephony which had lower licensing costs) by relabelling his mobile plans as wireless in local loop (WLL).

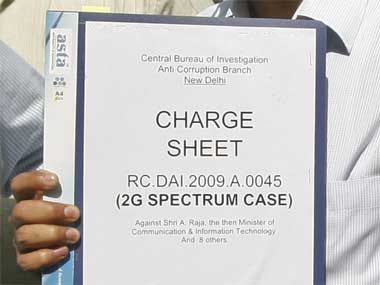

[caption id=“attachment_221663” align=“alignleft” width=“380” caption=“Reuters”]

[/caption]

[/caption]

When the rest of the industry threatened to lock up the industry in court cases, Communications Minister Arun Shourie guided the industry away from the rocks using Jaswant Singh’s New Telecom Policy (1999) as a broad guiding principle. In the process, we got the first-come-first-served (FCFS) spectrum policy at a time when businessmen were not rushing to enter the telecom sector, given its high licensing costs.

The seeds of the third unravelling were sowed in 2007-08, when Manmohan Singh and P Chidambaram allowed Andimuthu Raja to implement his flawed version of the FCFS policy to favour some parties.

It is Raja’s policy, willy-nilly approved by the PM and Chidambaram, that the Supreme Court has now junked. However, this time it is going to be even tougher to untangle the wires. And unlike last time, when Shourie managed to keep the matter away from the courts, this time the courts will have to be in the picture.

Consider what is already happening:

• Kumar Mangalam Birla’s Idea Cellular has already filed a clarificatory plea in the Supreme Court, says Business Standard.

• Videocon has also filed a similar petition with the court.

• Tata Teleservices has indicated that it has “been advised” to file a “review petition in the Supreme Court seeking redressal on this point.”

• Though Communications Minister Kapil Sibal has said the government itself won’t move court (he will keep a saintly distance from it), his ministry has indicated what when companies go to court, the government will automatically enter the picture, reports The Economic Times.

But even as companies reach for their lawyers, another slew of court cases could result from the corporate divorces precipitated by the verdict.

The only one to exit quietly is Batelco, which opted out of S Tel as soon as the Supreme Court pronounced its decision earlier this month. This has forced S Tel’s hand. It is asking all its customers to migrate to other operators - which could lead to battles with unhappy customers. S Tel’s boss C Sivasankaran is quoted by Business Standard as saying: “We are following the Supreme Court order and helping out our customers to port out.”

However, there is no guarantee Siva himself will not end up in court, for he is still sitting on 3G licences for which he had paid Rs 337 crore in July 2010. He wants the government to return the money, but even that will depend on what terms and conditions are specified. He may be back for the new 2G auction resulting from the licence cancellations. But if the terms of that auction are dicey, one can expect more court cases from those left holding the sack.

[caption id=“attachment_221675” align=“alignright” width=“380” caption=“the most godawful corporate divorce will be that between Telenor and Unitech - partners in Uninor. Reuters”]

[/caption]

[/caption]

But the most godawful corporate divorce will be that between Telenor and Unitech - partners in Uninor. Even since Unitech chief Sanjay Chandra went to jail, Telenor has been itching to ditch his partner and return on its own terms.

On Tuesday, the Norway-based Telenor Group said it would form a new company to run its existing business and also bid for spectrum, and it wants no part of Unitech in the new entity.

But like any jilted lover, Unitech is not planning to make things easy for Telenor to start a new life with another partner.

Unitech has already hit back. “Telenor cannot transfer any assets of Uninor without the consent of Unitech because we have veto right in the shareholders’ agreement as well as in the articles of association for such matters,” Unitech said in a statement.

The path from “I do” to “I don’t” is always messy. But even if the two agree to kiss and break up, the act itself won’t be easy. Reason: the valuation. Recently, Telenor valued Uninor at Rs 400 crore while planning a rights issue of equity. A bit earlier, BNP Paribas valued the company at Rs 800 crore. Unitech says the valuation should be in the region of Rs 11,000-12,000 crore.

Telenor acquired a 67.25 percent stake in Uninor in early 2010 at a total cost of around Rs 6,120 crore .

So is the company worth Rs 400 crore, or Rs 800 crore, or Rs 9,000 crore or Rs 11,000-12,000 crore? Don’t expect that argument to be settled over a couple of drinks at the club.

If Rs 6,120 crore was the bride-price for entering into a marriage of convenience, Telenor can be sure that exiting the marriage will have its high attendant costs too. The chances are this matter too will end in court.

With nearly 37 million subscribers, Uninor is the biggest loser in the licence cancellation - and at least one of its promoters could lose once more in the valuations.

Since the courts will be choc-a-bloc with companies seeking clarifications and redressals and divorces, one thing is certain: unravelling the third telecom mess in less than two decades will take more than the four months the Supreme Court specified for cancellation of old licences and moving to a new auction-based system.

The government has said the entire process of changeover from the old to the new will take 13 months . This means we will be well into 2013 before the train-wreck caused by Andimuthu Raja’s machinations will be cleaned up.

)