Sometimes agreements made some years ago come to life. The UAE raised its relationship with China to a strategic level in 2018, and two-way trade has certainly seen a fillip since. The UAE is and has traditionally been the gateway to trade throughout the Gulf, presently sanction-crippled Iran, and North Africa.

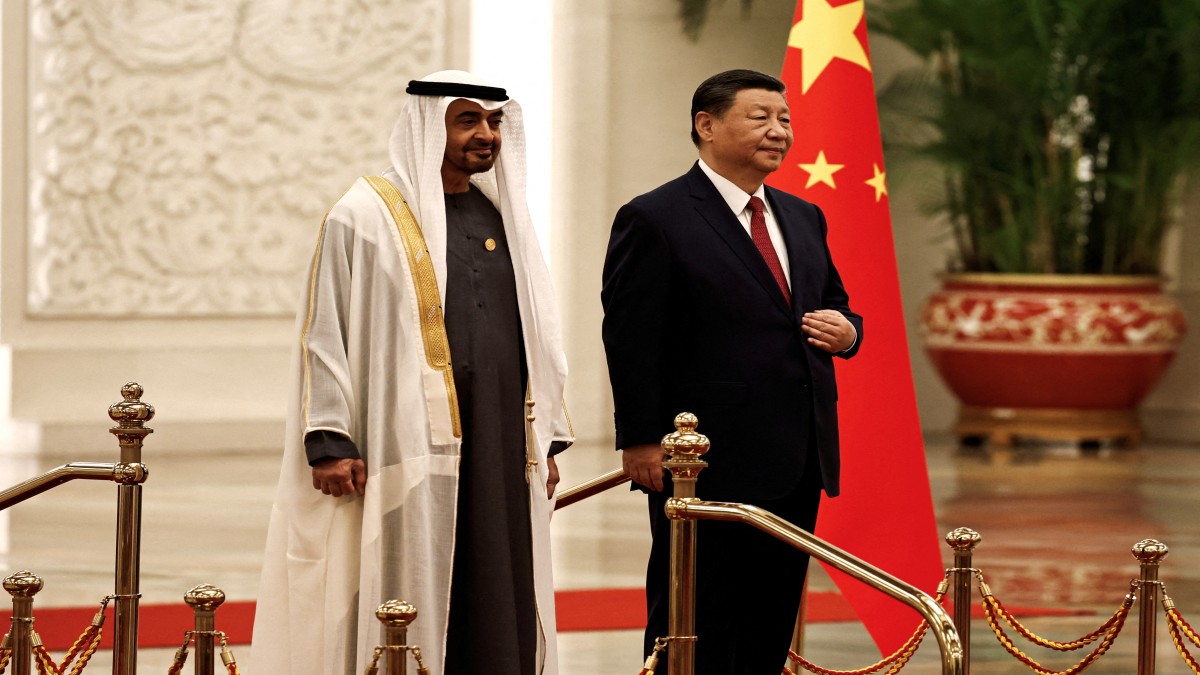

In July 2018, President Xi Jinping visited Abu Dhabi. As many as 13 financial and trade agreements were signed among almost 150 over the years since 1984, when diplomatic relations were established. Xi Jinping met with the then-Crown Prince Sheikh Mohammed bin Zayed al-Nahyan of Abu Dhabi and the ruler of Dubai. Xi was the first Chinese supreme leader to visit the UAE in 29 years.

There has been a persistent attempt on the part of China to establish a free-trade agreement with the entire Gulf Cooperation Council (GCC) area, with the help of the UAE and Saudi Arabia, but a few wrinkles, such as concern over its propensity to dump cheap exports, need to be ironed out yet.

China is currently seen as a power that may be able to prod the ‘two-state solution’ in Palestine into being, given its influence and leverage. The leader of the Palestinian Authority also recently paid a state visit to Beijing. And this Chinese influence extends not only to all the oil-exporting countries of West Asia but also to Iran and its proxies, the Hezbollah, the Hamas, the Houthis, and elements in Syria and Iraq. China cannot be ignored by Israel and its all-weather ally, the US.

For the Arabs, this is a balance they seek between pressures from America and those from China. Work on this is proceeding apace. The UAE and Chinese central banks have recently renewed a $4.9 billion currency swap agreement. There is a cooperation agreement between the Dubai and Shanghai stock exchanges, and the UAE sovereign fund Mubadala has opened a Beijing office.

Impact Shorts

More ShortsNow there is not only a state visit to Beijing from May 29 to May 31, 2024, from the president of the UAE, but a conference of Arab nations, the China-Arab States Cooperation Forum, formed 10 years ago.

Sheikh Mohamed has visited China several times before. Starting in 1990, he accompanied his father, the first president of the UAE, and then again in 2009, 2012, 2015, 2019, and 2022. This time, Sheikh Mohamed said he wants to ‘enhance Arab-Chinese cooperation’. Reports say he wants to ‘finesse’ the relationship, particularly after considerable progress with the UAE relationship with India and its geopolitical implications.

This is the 40th year of diplomatic relations between China and the UAE, and Sheikh Mohamed is in Beijing to celebrate it. Formal ties were established in 1984. In 2023, the UAE’s non-oil trade with China reached $81 billion, accounting for 12 per cent of all UAE trade. The UAE’s investments in China reached $11.9 billion across sectors like telecommunications, renewable energy, transportation, hospitality, and rubber. There is a resident Chinese community in the UAE of about 350,000 people.

For the 10th China-Arab Summit between May 28 and June 1, there will be as many as four heads of state from the UAE, Egypt, Bahrain, and Tunisia present in Beijing.

This, while NATO foreign ministers are meeting in Prague to discuss the fraught idea of Ukraine being allowed to hit targets inside Russia. NATO is coincidentally celebrating 25 years of its existence, but there is no unanimity of agreement on further provoking Russia.

The UAE and Saudi Arabia, as the biggest middle powers in the GCC and the Gulf, though strategically close to the US for its military needs, want to settle the Palestine question perennially troubling their region. The state visit of the President of the UAE to Beijing, the first since he assumed power, can be partially seen in this light.

Besides, China has a GDP of $17.7 trillion, even in its much-weakened economy. It has had upwardly revised GDP forecasts of 5 per cent per year. This was done by international lending agencies such as the World Bank and the IMF after China undertook strenuous efforts to right things lately. Stock investors around the globe are returning to China to take advantage of attractive, beaten-down valuations.

This economic heft in China, despite its aggressive trade practices and erstwhile, pre-Covid, ‘wolf warrior diplomacy’, is only second to that of the United States. The tension with Taiwan and all countries around the East and South China Seas are additional friction points. India has its own tense standoff with China all along its long border alongside Tibet and proxy problems with Pakistan as well. Still, most countries are forced to deal with China until more effective geopolitical shifts take place. It remains a formidable trading partner with every country and is still the factory for the world.

Aware of all this, leading countries in the Gulf and Arab North Africa did sign up years ago, when China’s star was higher in the sky, for its predatory Belt and Road Initiative. Ironically, no work has been done on it in the region, better than the usual ‘beneficiary’, so far.

Nearly bankrupt Pakistan’s CPEC has been and is struggling, and India has refused to be part of it altogether from the very start.

So perhaps the UAE, Saudi Arabia, Egypt, Tunisia, and Bahrain are not missing much, given the programme’s debt trap propensities and erratic progress. Countries such as Cambodia, Sri Lanka, Malaysia, Thailand, Myanmar, Nepal, and Bangladesh, along with some in Central Africa, probably rue the day they got involved. Some countries in Europe, such as Italy, have actually withdrawn from the Belt and Road initiative.

While China has a vast military establishment, it is an unknown quantity when it comes to its effectiveness. Though it has not been involved in a shooting war of any size, it is not considered to be really up to scratch compared to the US, either technologically or in terms of its manpower under arms. Though the size and extent of its blue-water navy and submarines are indeed impressive, likewise, its progress with hypersonic missiles and drones is underpinned by its nuclear weapons prowess.

However, Russia, with a mere $1 trillion economy and a huge nuclear weapons arsenal, is considered to be a much more fearful military power.

The Gulf-based GCC sells 80 per cent of its oil to China. The UAE alone exports over $30 billion ($32.5 billion) of its petroleum to China and is its biggest trading partner in the Gulf, importing over $50 billion worth ($57.7 billion) of machinery, electrical equipment, and broadcast equipment. It is lately making preparations to import its cheaper and very good electrical cars.

China also offers, along with India, an increasing opportunity to conduct much of the mainstay petroleum business in local currencies to reduce dependence on a very strong US dollar. Despite the gargantuan debt America carries, China, too, carries a lot of external and internal debt. The difference is that the US dollar remains the main global currency for international trade.

To make the export-import trade more attractive, China is now steadily devaluing the Yuan, which it had kept artificially strong for many years.

What can come out of a closeness with Beijing beyond the obvious bully-boy arrangements is hard to say. But as a matter of hedging one’s bets in an increasingly unstable multipolar world, an actualised China of today, and an emerging India of tomorrow, are definitely important to consider.

The writer is a Delhi-based political commentator. Views expressed in the above piece are personal and solely those of the author. They do not necessarily reflect Firstpost’s views.

)