The Chinese economy grew 4.6 per cent year on year, as per the official data released on Friday. The economic growth figure is the lowest in 18 years, even less than the 4.7 per cent (YoY) recorded in the previous quarter. Sluggish consumption, the real estate debacle, and declining household spending have marred the world’s second largest economy. The stock markets are plunging, unemployment is rising, and deflation remains an urgent issue.

On October 8, the news came that Hong Kong’s Hang Seng index closed at 9.4 per cent lower—its heaviest fall since 2008—as the stimulus announced failed to inspire confidence. The similar pattern followed next week as, on October 15, Chinese stock slumped after the weekend announcement of packages as Shanghai Composite index tumbled 2.53 per cent and Hang Seng index plummeted 3.67 per cent dragged down by tech and real estate stocks.

However, Chinese markets rallied over three per cent, on Friday, after the central bank kicked off two funding schemes urging swift adoption of financial policies to support capital markets, while the pressure on policymakers for more stimulus continues. China kicked off funding schemes worth $112 billion to support the stock market.

On Monday, China’s central bank said it had cut two benchmark interest rates.

Many economists have been saying that Beijing is shy of extending the kind of massive stimulus packages that it yielded to overcome the global financial crisis of 2008. Whereas ‘outspoken’ Chinese economist Yu Yongding suggests that Beijing should be ready to spend bigger than the 4 trillion yuan package that it rolled out to overcome the 2008 crisis.

Impact Shorts

More ShortsAs per experts, there are heavy chances that China could enter into a ‘peak recession period’ if its target 5 per cent GDP growth is not met by the end of the year. But Goldman Sachs and Citigroup have cut their projections for the growth of the Chinese economy this year to 4.7 per cent; Morgan Stanley expects it to be only 4.6 per cent.

As per a recent World Bank report released on August 1, it might take China more than 10 years just to reach a quarter of US per capita income, and the chances of the Chinese economy getting caught in the middle income trap are also significant.

The job market also appears depressive, as the urban unemployment rate came up to 5.3 per cent in August, which was the highest in six months. After the youth unemployment data went up considerably last year, China stopped publishing it for a while, and despite Beijing releasing it with more favourable metrics now, youth unemployment in the urban areas touched 17 per cent in July.

Added to all these, China is facing a severe demographic challenge as the Chinese population is ageing and shrinking. Being one of the fastest-ageing economies, by 2050, the United Nations projects that 26 per cent of China’s adults will be 65 or older. Even though Beijing is mulling to increase the retirement ages, the shrinking workforce and the growing numbers of dependents might not be allayed.

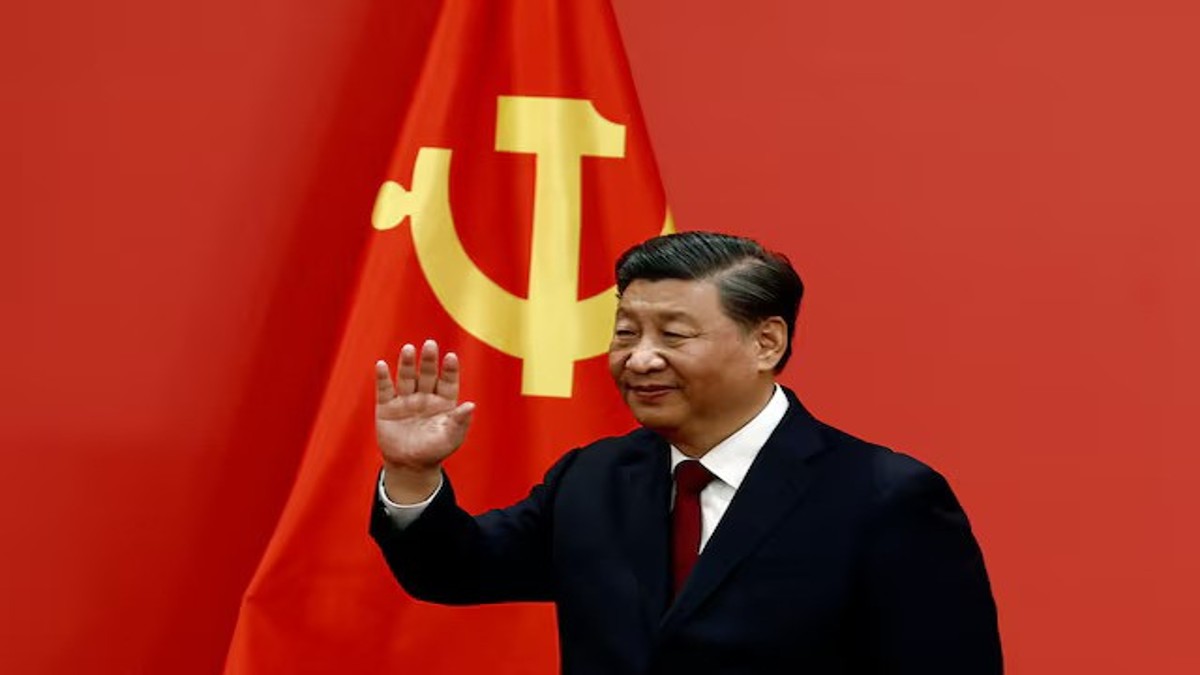

It seems like China is collectively facing the consequences of its Zero-Covid and One-Child policies. All of them were high-handed and authoritarian and have had severe consequences for society and the economy. But what’s also here to be seen is that China, indeed an economic miracle hitherto unseen in the anthropocene, is an economic promise as well—a promise of prosperity, development, and socio-economic security. Perhaps this promise is the basis on which the red aristocracy of China commands legitimacy.

China tanks down the likes of Tiananmen, exploits Tibetans and Uighurs, and the Communist Party rules with an iron fist, yet if the people bear this authoritarianism, there is a hope for a good future in them; they might think economic development may precede political reforms.

However, one wonders what if this promise dwindles, and it’s not just the China-watchers who question this; the same question baffles those who rule China as well and, as such, has its implications on China’s strategic choices.

Chinese growing assertions over the South China Sea region, or the drills to threaten Taiwan, are in line with the tactics to distract attention from a faltering economy and rally domestic support for the party. This is the reason we find Chinese and Filipino vessels scuffling, whether near Sabina Shoal or Second Thomas Shoal. Or, find China launching new drills off the coast of Taiwan, reacting to the Taiwanese president’s remarks made on Taiwan’s national day asserting the sovereignty of the island.

On the economic front, demands were for bolstering welfare measures; instead, China focused on critical technologies, and admittedly, this will bear fruit for Beijing, but again, the legitimacy rests on the ‘grand economic promise’. If these technologies will help China retain the lead and maintain its hold over the supply chains, they are beneficial in the long term, but household sentiments also need to be addressed.

The Chinese government continues its focus on advanced manufacturing and export-led growth. But the escalating trade tensions with the West, led by the US, followed by Europe, have marred the Chinese sales overseas. In this context, we find Jake Sullivan’s, the US National Security Advisor, Beijing visit last August being even more important for China.

Perhaps because of the same reason we find China mending its tone towards India in a bid to harness Indian markets; Chinese top diplomat Wang Yi meeting foreign minister S Jaishankar or NSA Ajit Doval; or China asking for India to keep border issues separate from trade ones. Yet these things did not deter China from demanding ‘unreasonable’ patrolling rights at two Line of Actual Control (LAC) spots along Arunachal Pradesh last September.

The Chinese economy indeed needs fresh breath to overcome cyclical and structural issues it is facing, that demands Beijing to shun its wolf-warrior diplomacy and be more cooperative and less assertive towards its fellow members of the global economy.

Views expressed in the above piece are personal and solely those of the author. They do not necessarily reflect Firstpost’s views.

)

)

)

)

)

)

)

)

)