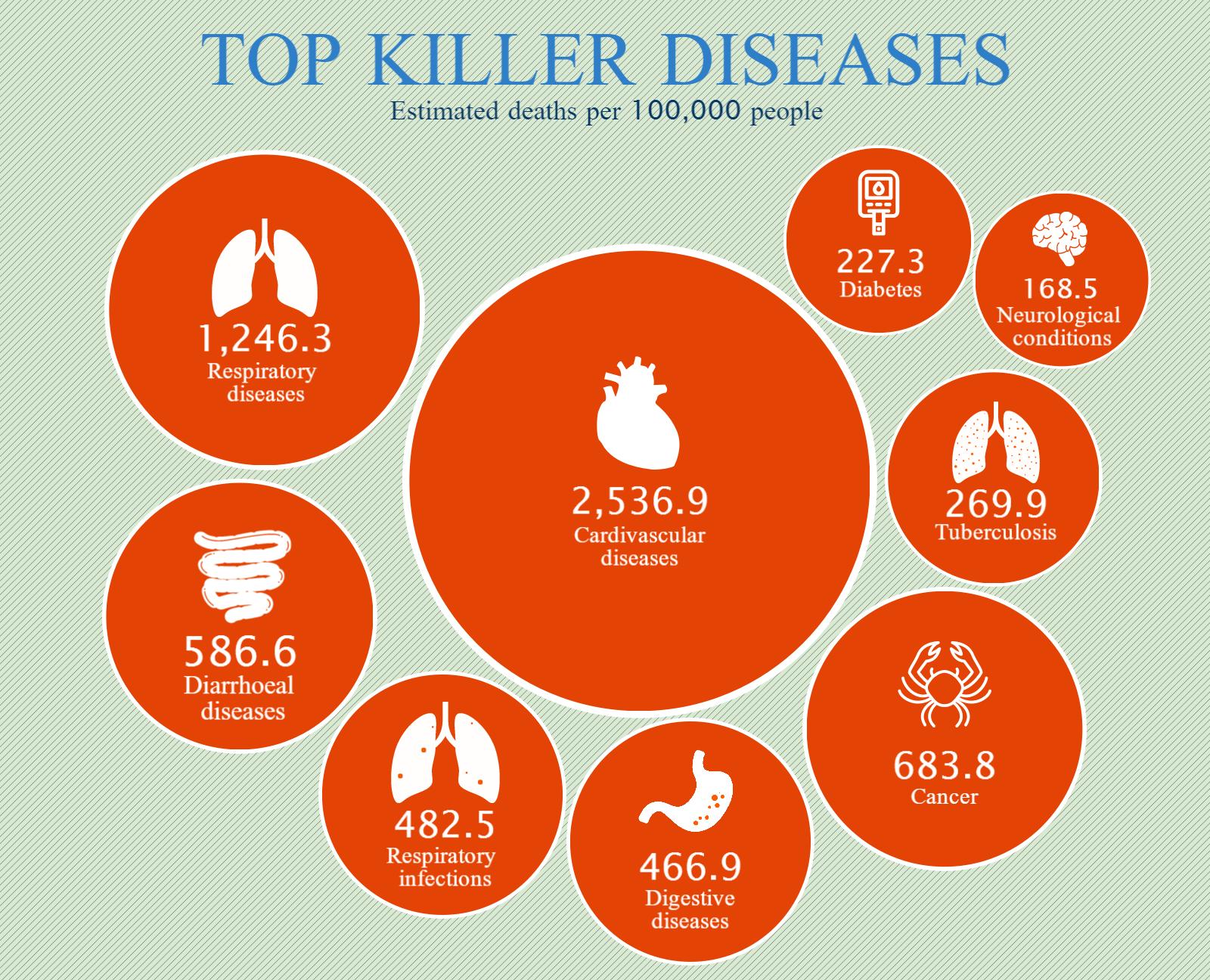

After spending the morning in the gym, 34-year-old Mehul Desai, a resident of Ahmedabad, was ready for a regular day in office. Unfortunately, given recent layoffs and increased work pressure, stress had become part and parcel of his daily schedule. He was about to go in for a meeting with his boss when he felt a severe pain in his chest. He was rushed to a nearby hospital by his colleagues, where it was revealed that he had suffered a heart attack. However, it was too late by then, and Mr. Desai couldn’t be saved. Like him, many people around the world lose their lives to heart diseases and other critical illnesses. Major Killers in India As per a WHO report published in 2014, heart disease was the biggest killer of people around the globe and in India too, where it killed more than 12 lakh people. It was followed by Lung Disease and Stroke which killed 1,061,863 and 881,702 people, respectively. Cancer too is quickly emerging as a major cause of death among Indians with 548,015 cancer deaths reported in 2014. Among the different types of cancers, Oral Cancer is the biggest threat, followed by Breast Cancer. Diabetes, Liver diseases, and Kidney diseases took more than 6 lakh lives in the country in 2014. [caption id=“attachment_2566694” align=“alignleft” width=“600”]  Source: Department of Health Statistics & Information system and WHO[/caption]

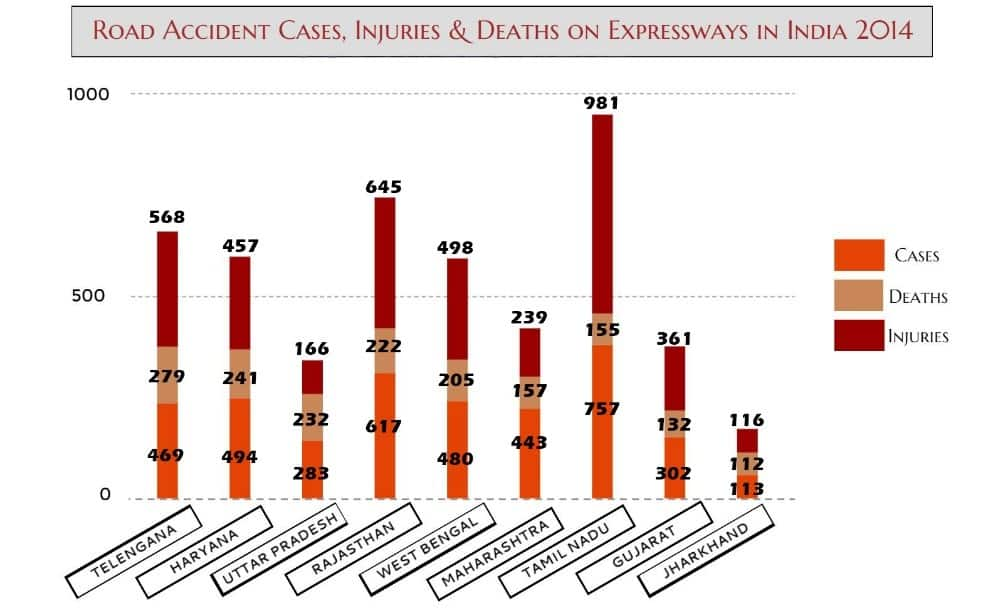

Apart from these diseases, road accidents are also a leading reason for deaths in India. India has the “dubious distinction” of leading nations having maximum road accidents, clearly indicating how unsafe Indian roads are.

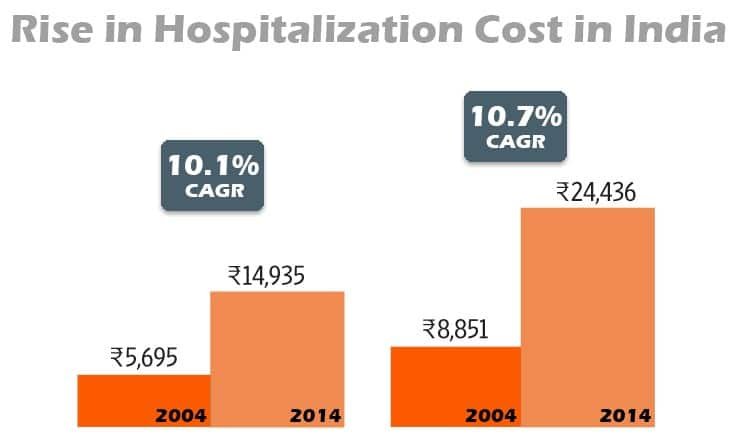

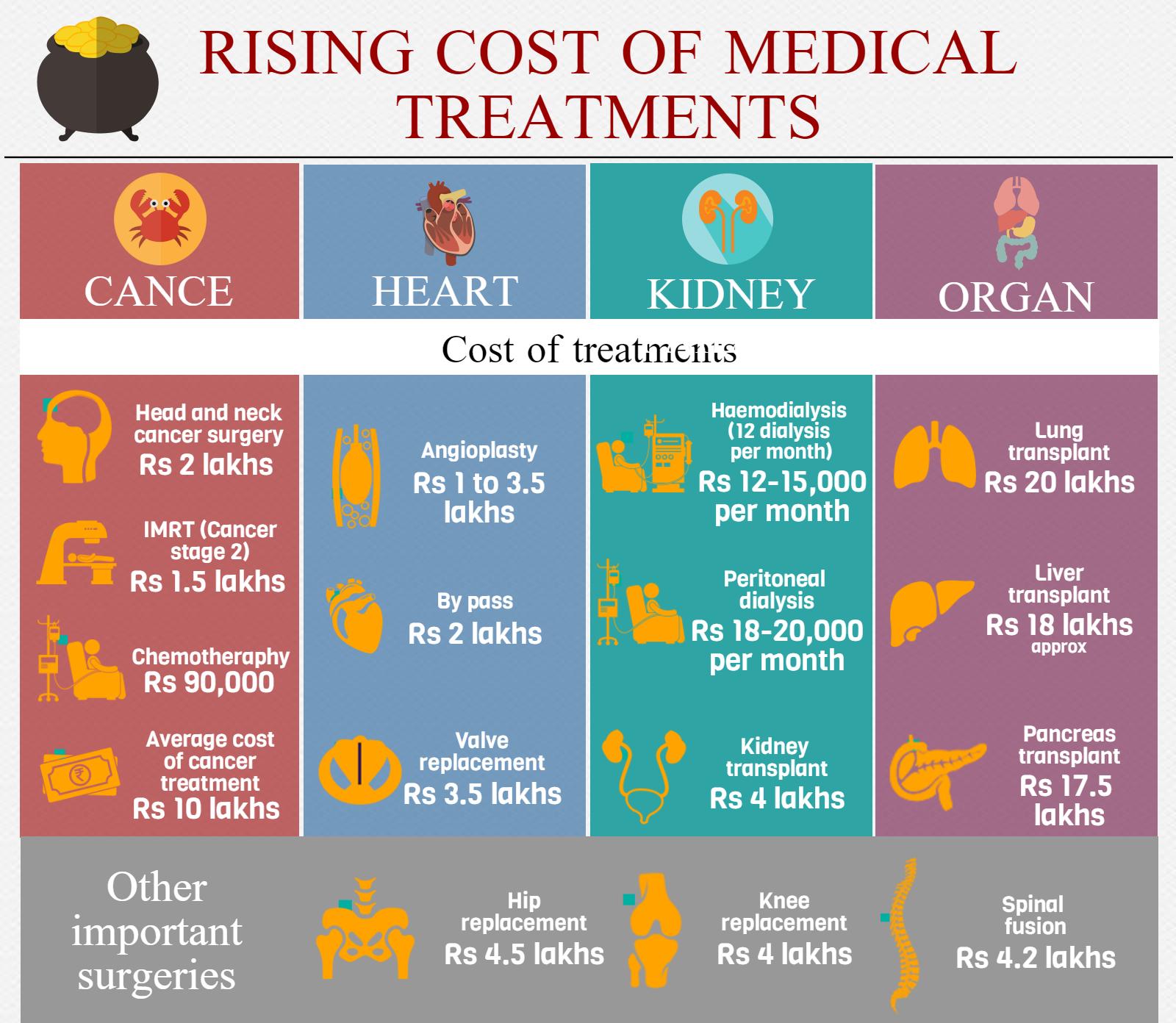

[caption id=“attachment_2566696” align=“alignleft” width=“600”]  Source: Road Accident report by the Ministry of Road Transport & Highways[/caption] Rising Un-affordability of Health Care Thanks to modern health care facilities, most of these life-threatening health conditions are curable, at least if detected at early stages. However, a major problem with availing treatments for these diseases is affordability. Over the last decade, the cost of medical treatment has grown at a rate of 10 percent. [caption id=“attachment_2566698” align=“alignleft” width=“600”]  Source:http://www.livemint.com[/caption] Medical bills for treatments of cancer, heart diseases, and other critical illnesses run into multiple lakhs with just a single vial of drugs or a medical procedure costing up to a few lakhs. For e.g. 50 tablets of the drug Sprycel, which is prescribed for Blood cancer, cost around Rs 1,65,000. Similarly**,** a valve replacement surgery cost somewhere around Rs 3.5 Lakhs, Angioplasty cost between Rs1 to 3.5 Lakhs, and a By Pass surgery cost around Rs 2 Lakhs. [caption id=“attachment_2566700” align=“alignleft” width=“600”]  Source: https://www.tomorrowmakers.com[/caption] The Under-insured Indian- A Major Cause of Concern While we Indians go to great lengths to ensure the safety and security of our families, we underestimate the role insurance plays towards the achievement of that goal. As per a report in 2013, only 25% Indians have a life insurance cover. On the contrary, our western counterparts, such as the Americans, understand the importance of insurance very well and hence almost 90% of the total American population have insurance. As Indians, we are also not serious about health insurance, which is one of the primary reasons why affording treatment of these critical diseases becomes even more difficult for us. According to a report by the Insurance Regulatory Development Authority of India, only 17% of Indians have a health insurance cover. Even in urban areas, as many as 82% of patients don’t have any insurance cover for their health**.** Secure Yourself with a Term Insurance Plan We often hear about families that go through immense financial stress after paying for the costly treatment of Cancer, Heart Diseases, Kidney Ailments, etc. Things become even worse when the breadwinner of the family succumbs to one of these diseases. It is therefore, essential to buy a term insurance plan which not just takes care of your family’s finances after you are no more, but also pays for the high cost of treatment of these diseases. In addition, it should also protect your family in the event of an unforeseen tragedy like a road accident. One such insurance plan that completely fits the bill is the ICICI Pru iProtect Smart. It is unlike other regular term plans available in the market. It not only protects your family in the event of your unexpected death but also offers multiple benefits that aren’t available with any other plan. Benefits of ICICI Pru iProtect Smart 1. Apart from lifelong protection for your family, it allows you to choose your critical illness cover for an amount of up to Rs 1 crore. For example, if you take a life cover of Rs 1 crore with critical illness benefit of Rs 30 Lakhs, and some years later you are diagnosed with Cancer, then you will be paid Rs 30 Lakhs without even being asked for the hospital’s bills. Your policy will continue with a sum assured of Rs 70 Lakhs and your premium amount too will reduce accordingly. Unlike health insurance plans offered by other insurers, its premium doesn’t increase with age or with the renewal of critical illness benefit. This means your premium amount will not increase even after you utilize your critical illness cover. 2. Since critical illnesses might render you unemployed for some time, this plan can double up as your Income replacement option during that duration. E.g. if you are diagnosed with cancer and you cannot go to work for a year, owing to your treatment and convalescence, the lump sum payout you receive can replace the sum you would have otherwise earned as monthly income. 3. The policy covers 34 critical illnesses- more than any other plan- including heart diseases, cancer, kidney failure, etc. Additionally, it covers major critical illnesses for women such as Breast Cancer and Cervical Cancer. 4. It provides double your life insurance cover of up to Rs 2 crores in case of a road accident. This means that if your life insurance cover is Rs 50 lakhs, then your nominee will get Rs 1 crore, in case you die in a road accident. To combat the increasing prevalence of lifestyle diseases, one must make positive changes in their daily routines. Exercising regularly, eating healthy and minimizing alcohol/tobacco consumption are some steps that will put you on the right path. In addition to this, you must also provide a safety net for your family by buying a term insurance plan such as ICICI Pru iProtect Smart, which will not just protect your family in the event of your unforeseen death, but will also ease your financial burden and stress in case you are diagnosed with any of these ‘biggest killers’. This is a sponsored post.

)

)

)

)

)

)

)

)

)