“Satta” sells in India and the success of the MCX IPO is a thumbs-up to the average Indian punter who is willing to gamble small amounts of money to satisfy his or her urge to engage in “satta”.

Satta can be defined as a bet on anything- a cricket match, a horse race, a card game. It can even be a bet on commodity, currency and equity derivative markets.

The “satta” Indian sits on the opposite end of the spectrum compared with the risk-averse “Indian,” who parks his or her money in fixed deposits and government-run savings schemes.

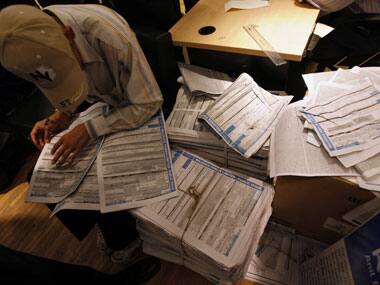

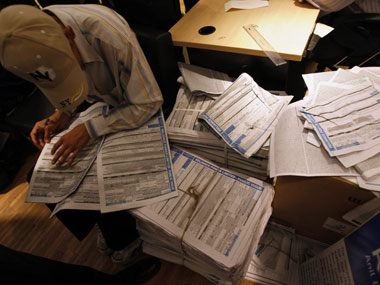

[caption id=“attachment_226585” align=“alignleft” width=“380” caption=“The lack of a middle ground is highlighted in the anemic participation of retail investors in equity - less than 5 percent of savings go into equity investments. Reuters”]

[/caption]

[/caption]

The lack of a middle ground is highlighted in the anemic participation of retail investors in equity - less than 5 percent of savings go into equity investments. The “satta” mentality also gives rise to numerous pyramid scheme scams that often leave a trail of households penniless.

The best part of “satta” is that one does not have to understand the fundamentals at all. There are numerous ways to trade, including using technical analysis, numerology and astrophysics, as well as “gut feel”. The trade lasts for an hour or a day or a few days at most, so there is no need to learn the fundamentals.

The biggest gainers of the “satta” are the intermediaries. Stock exchanges, brokers and the quacks who give out trading tips make merry at the wagering mentality of India.

The average punter knows that punting is a zero-sum game-you win some, you lose some, but, nevertheless, he or she will still punt just for the sake of punting.

Should we be proud of the retail investor driving MCX valuations or should we lament that money is not flowing into value-creating resources?

MCX (Multi Commodity Exchange) saw its IPO (Initial Public Offering) oversubscribed by 54 times. The IPO opened on 22 February and closed on 24 February. In that time, it received bids for Rs 35,000 crore and the retail portion of the issue was oversubscribed by 24 times, the highest-ever retail participation in an IPO in the country.

MCX is the fifth-largest commodity exchange in the world in terms of volumes of contracts traded.

The exchange is behind one American exchange, two Chinese exchanges and one global exchange.

The participants in the MCX exchange are exclusively Indians and predominantly retail rather than institutional. Participation in well established American, UK and Chinese exchanges have retail and institutional participation. The success of the MCX IPO is in fact driven by an average man or woman on the street wanting to do a “satta”.

MCX was ranked the world number 1 in silver, world number 2 in gold, copper and natural gas and number 3 in crude oil as per the ranking put up on its website.

India, apart from being the largest consumer of gold in the world and a significant importer of silver, does not figure high in consumption of the other top traded commodities in the MCX compared with countries like the US or China. However, the retail punter has embraced commodity trading like never before and that is giving a huge boost to commodity exchanges in the country.

Silver is the hottest commodity that is traded on the commodity exchanges at present. Silver accounted for 38 percent of the total turnover of MCX between April and December, up from 23 percent seen in the financial year ending March 2011.

The rise in silver volumes is driven purely by retail speculators and traders, who have embraced the precious metal wholeheartedly.

Silver prices more than doubled in 2010-11 (it hit $45 an ounce) before tumbling to$22 an ounce. Silver is now on an upward trend again and is trading above $27 an ounce and the average retail silver speculator is anticipating levels $44 an ounce again.

Indeed, the retail speculator has not only embraced commodity trading but also currency futures and equity options.

The National Stock Exchange (NSE) derivatives market is the fifth-largest in the world in terms of traded volumes of contracts, while the NSE options market is the second-largest in the world.

The rise of the NSE in the global pecking order of derivative exchanges is thanks to the retail trader who trades in small lots, contributing to the high volumes in the exchange.

Arjun Parthasarathy is the editor of www.investorsareidiots.com , a web site for investors.

Arjun Parthasarathy has spent 20 years in the financial markets, having worked with Indian and multinational organisations. His last job was as head of fixed income at a mutual fund. An MBA from the University of Hull, he has managed portfolios independently and is currently the editor of www.investorsareidiots.com </a>. The website is for investors who want to invest in the right financial products at the right time.

)