Special to Firstpost

S&P CNX Nifty (4,754.10): The index was in a consolidation mode during the week ended 6 January. The recent price action indicates scope for a short-term rally and a move to the immediate resistance at 4,860-4,900 appears likely.

[caption id=“attachment_175093” align=“alignleft” width=“380” caption=“While there is a case for a minor upward move, the index has to move past the 7 December swing high of 5,100 to indicate a reversal of the medium-term downtrend. Reuters”]

[/caption]

[/caption]

While there is a case for a minor upward move, the index has to move past the 7 December swing high of 5,100 to indicate a reversal of the medium-term downtrend. Until the index moves above 5,100, it would not be advisable to park money in equity assets from a long-term portfolio perspective.

Considering that preservation of capital is of paramount importance, there is no compelling technical reason to increase allocation to equity assets. There will be a lot of short-term trading opportunities in either direction and those adept at it may capitalise on it.

CNX Bank Index (8,488.25): Contrary to expectations, the index ruled firm and played a key role in shoring up the benchmark indices such as the Nifty and the Sensex. The recovery process witnessed last week appears incomplete and a rally to the short-term resistance at 8,900 appears likely.

The index, however, has to move past the bullish trigger level of 9,300 to indicate a reversal of the medium-term downtrend. A fall below the short-term support at 7,850 would not only negate the bullish trend but also confirm the resumption of the medium-term downtrend.

Arvind Ltd (Rs74): After a major downward correction off the 31 October high of Rs 111.15, the price action in the past few days indicates that the stock is in a short-term uptrend. A rally to the short-term resistance at Rs 82 appears likely.

[caption id=“attachment_175089” align=“alignleft” width=“600” caption=“Long positions may be considered on weakness, with a stop-loss at Rs 68”]

[/caption]

[/caption]

Long positions may be considered on weakness, with a stop-loss at Rs 68, for a target of Rs 82. A breakout above Rs 82 may trigger a rally to the major resistance at Rs 90.

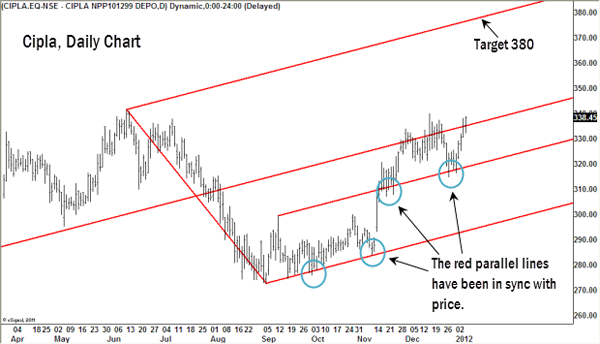

Cipla Ltd (Rs 338.45): The stock is in an uptrend since the 6 September low of Rs 276.20. The recent uptrend is likely to extend up to the short-term resistance at Rs 382.

[caption id=“attachment_175090” align=“alignleft” width=“600” caption=“Cipa”]

[/caption]

[/caption]

Any minor downward correction may be used to buy the stock, with a stop-loss at Rs 305, for a target of Rs 382. A breakout past Rs 382 would be a major sign of strength and could trigger a rally to the major resistance at Rs 420.

(The views and recommendations featured in this column are based on a technical analysis of historical price action. There is a risk of loss in trading. The author may have positions and trading interest in the instruments featured in the column.)

)