Special to Firstpost

S&P CNX Nifty (4,866.70): The pull-back rally fizzled out just 30-points shy of the target of 5,130 that was mentioned last week. As highlighted in recent weeks, the index is in a medium-term downtrend and has to move past 5,400 to indicate a reversal.

The index now is poised right at a crucial support zone of 4,830-4,860. A bounce from these levels may face resistance at 4,990. The downtrend would gather momentum on a fall below the immediate support at 4,800.

As long as the index trades below the major bullish trigger level of 5,400, there would be a strong case for a slide to the major support at 4,600.

[caption id=“attachment_152699” align=“alignleft” width=“380” caption=“Photo:moneycontrol.com”]

[/caption]

[/caption]

The failure of frontline index stocks to complete their pull-back rally potential is indicative of the dominance of bearish forces. Investors may use any upward move to pare exposures.

As highlighted last week, it would be advisable to avoid long positions, on a portfolio basis, until the index moves past 5,400. It, however, does not mean that you rush to bet your entire capital on a breakout past 5,400.

A move past 5,400 gives the licence to hunt for long positions but buying may be considered on a subsequent correction or pull-backs. The trigger level of 5,400 would get revised to lower levels when the downtrend matures.

CNX Bank Index (8,811.10): Along with the Nifty, the Bank Index too was under pressure over the past couple of trading sessions. Though there is a possibility of a minor pull-back rally, the underlying trend remains bearish until the index moves past 10,100.

A fall below 8,200 would not only indicate that the index has completed its counter-trend rally but would confirm that the journey towards the major support at 7,700 has begun.

Arvind Limited (Rs 82.60): After a sharp downward correction, the stock has been consolidating in a trading range in the past few weeks, which is a positive sign. A breakout past Rs 85 would confirm that a fresh uptrend is underway.

Long positions may be considered on a move past Rs 85, with a stop-loss at Rs 81, for a target of Rs 93.

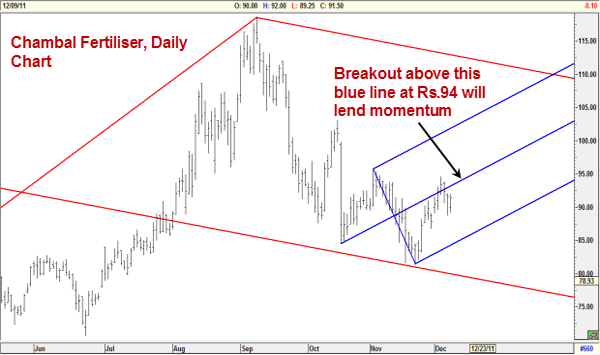

Chambal Fertiliser (Rs 91.50): The price action in the past few days indicates that the stock is in a short-term uptrend. A breakout past Rs 94 would impart momentum to the uptrend.

[caption id=“attachment_152696” align=“alignleft” width=“600” caption=“A breakout past Rs 94 would impart momentum to the uptrend.”]

[/caption]

[/caption]

Long position may be considered on a breakout past Rs 94, with a stop-loss at Rs 87, for a target of Rs 110.

(The views and recommendations featured in this column are based on a technical analysis of historical price action. There is a risk of loss in trading. The author may have positions and trading interest in the instruments featured in the column.)

)